02.02.2023 – The price of natural gas has plummeted. And that despite the Ukraine war and the winter season. We analyze the reasons for this.

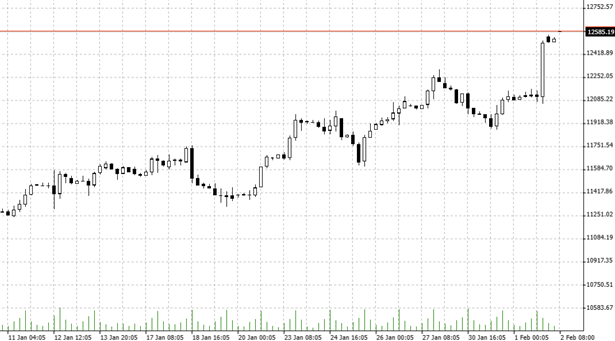

The Bottom Line: The U.S. federal funds rate is up 0.25 percentage points and is now in a range of 4.50 to 4.75 percent. This is thus the eighth consecutive rate hike. But the pace of tightening is slowing. In December, the Fed had still raised the interest rate by 0.50 points. Ergo, the interest rate-sensitive high-tech stocks in particular reacted positively. You can see the small jump of joy in the four-hour chart on the Nasdaq 100.

Source: Bernstein Bank GmbH

The mainstream media focused on this statement in the press conference: the Federal Reserve plans to continue raising its benchmark interest rate after the recent hike. Further tightening is appropriate to bring inflation back to the Fed target, he said. In December, inflation in the United States slipped to 6.5 percent. But the central bank wants inflation to be only 2.0 percent.

Subtle change in language

And now we’ll let the pros from the market niche have their say – as always, it was worth reading very carefully between the lines when it came to the Washington oracle. For example, the blog “Newsquawk” dissected Jerome Powell’s statements in great detail. And stated that the Fed chief had focused more on the question of when the interest rate hikes should end than on how high interest rates still had to rise.

Since he threw both hawks and doves a few lumps, observers saw this as a departure from the previous strict course. Especially since Powell indicated that a disinflationary process had begun. Inflation data over the past three months had shown a welcome slowdown in the rise, he said. While the Fed has not yet made a decision on the terminal rate, the target at the federal funds rate; discussions about it continue and there will be more rate hikes. However, the Fed is not far away from the actual target.

A – too? – good run

Our translation: inflation should continue to fall, interest rate hikes need not be as long and strict as previously feared. And the Fed is probably close to its actual interest rate target. So, all in all, a bullish impulse for stocks. However, the online service “SpotGamma”, for example, pointed out that growth stocks in particular had already anticipated such an interest rate decision in recent days. We remain on the ball for you – Bernstein Bank wishes successful trades and investments!

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7