08.06.2020 – Special Report. The Brexit negotiations between London and Brussels are about to end. We had seen it coming: After the Tories’ resounding victory in the December 2019 general election, Prime Minister Boris Johnson is bursting with strength. And he doesn’t have to make any concessions to the EU – he has the support of the people and a solid majority in the House of Commons. Now an important deadline of 30 June is approaching. We look at the possible consequences for the pound sterling.

London wants a lot

Michel Barnier sounded “not amused” last Friday: The EU Commission representative for the negotiations on the UK’s withdrawal from the EU made no secret of his pessimism. He said there was “no significant progress” in the negotiations on future relations with Great Britain. Since March, four rounds of talks had ended largely without results. Now Barnier accused the British of “blockade”.

Johnson wants to collect one promise after the other – for example, the ongoing dispute over the “level playing field”. The British would only have wanted to maintain a similar standard of environmental protection, labour law and social standards as the EU after the Brexit. Now they did not want to know anything more about it, complained Barnier. The situation was similar regarding cooperation in the civil use of nuclear energy and the fight against money laundering and terrorist financing.

Deadline June 30

The next step is now a meeting of Commission President Ursula von der Leyen and Council President Charles Michel with Johnson. But whether this will be done by videoconference or in person is still as open as the date. Presumably, the EU side will wait until the EU video summit on 19 June to coordinate their actions. However, a decision must be made by 30 June on an extension of the transitional phase during which the EU rules will continue to apply in Great Britain. At present it ends on 31 December.

Prime Minister Johnson has repeatedly rejected an extension. Perhaps the British economy is now so battered by Corona that the possible consequences of a hard Brexit no longer make any difference. Perhaps he does not expect trade to collapse.

Warning from the Bank of England

In the currency market, there has recently been intense discussion about whether the Bank of England (BoE) will follow the European Central Bank and the Swiss National Bank on the path to negative interest rates. The BoE is currently focusing on containing the economic damage from Corona. Now, a hard Brexit could possibly be added. As the “Financial Times” reported a few days ago, Andrew Bailey, the governor of the Bank of England, in a telephone conversation urged the heads of commercial banks to prepare for a no-deal Brexit. However, given the long smouldering topic, most institutions have probably already taken into account possible interruptions in currency flows anyway.

Pound traders hope for strong integration

So it all looks like hard Brexit at the moment – which should push the British Pound down against the Dollar and Euro. Because an analysis by the CME Group has found exactly that for the past five years: “Despite all the developments during this time, one element has remained constant: If the UK moves towards greater integration within Europe, the British pound (GBP) will rise – if it’s a no deal Brexit, it will fall,” said recently Erik Norland, Executive Director and Senior Economist of the CME Group. The US-based CME Group is one of the world’s largest options exchanges and the world’s largest futures and options exchange, based in Chicago, Illinois.

Pound falls on prospect of hard Brexit

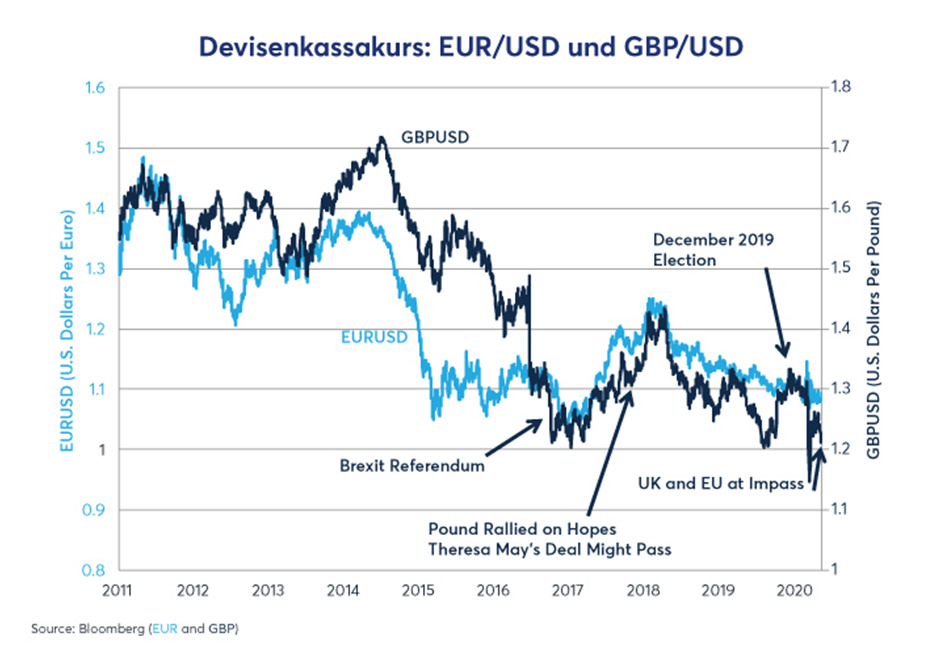

According to the CME Group, this is the chronological development in the long-term issue: in the period between the passing of the law on the EU referendum on 9 June 2015 and the referendum itself on 23 June 2016, the British pound lost 4 per cent against the euro and 3 percent against the US dollar. In the months following the referendum, the pound slipped 17 percent against the euro and 21 percent against the greenback. Since the referendum, a clear trend has become apparent: As soon as an agreement seemed not far away, the British pound tended to strengthen, according to the CME. For example, it rose by 21 percent against the US dollar until early 2018, when Prime Minister Theresa May led the negotiations. And when Great Britain then again moved towards a no deal scenario, Sterling devalued. For example, minus 16 percent when deals by the unlucky May were repeatedly rejected.

According to the CME Group, investors felt the impact of this once again in early May when negotiations between the UK and the EU reached an impasse and both sides complained about a lack of progress on issues ranging from fishing rights to competition regulation. Since then, the pound has fallen by 3 percent against the euro and by 4.5 percent against the US dollar (USD).

The bears are waiting

And what happens next? Norland pointed out an interesting indicator: Recently, the GBP options markets have shown a more pronounced than usual downward trend: “Out-of-the-money (OTM) put options are much more expensive than usual compared to OTM call options”. Reuters just hit the same mark with a survey of around 50 forex experts: GBP/USD could fall to 1.23 by the end of June if the talks between London and Brussels fail.

Our conclusion: If the experts are right with their observations and forecasts, the pound will fall when we head for a hard exit. If there is an agreement, Cable will go up. We are curious to see how things will continue and will keep you informed.

The Bernstein Bank wishes successful trades and good investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.