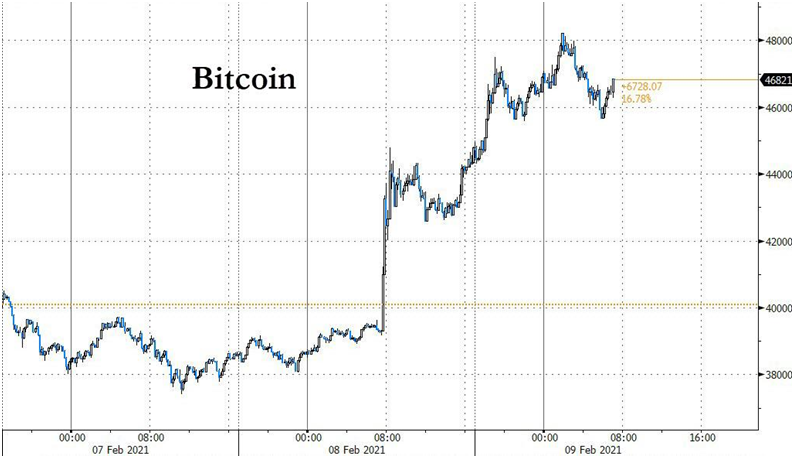

09.02.2020 – Special Report. Bitcoin bulls are popping the champagne corks: News that Tesla has bought into BTC is pushing the price away towards $50,000. Soon there could be another, far more violent push for the e-devise: An analyst at the Royal Bank of Canada muses that soon Apple should get in even bigger. Simply by establishing a gigantic Bitcoin exchange for its customers’ army via smartphone.

Next stop $50,000

And off it goes: Bitcoin fizzled away at its high on Tuesday to a good 48,000 dollars. The day before, the market had been enraptured by the news that the e-car manufacturer had invested 1.5 billion dollars in Bitcoin, according to a document for the US Securities and Exchange Commission. It got even better: “We expect to accept Bitcoin as a means of payment for our products in the near future, subject to applicable laws and initially on a limited basis,” the SEC document reads. So the self-driving e-car for the smartphone customer with a wallet – a perfect match.

Hedge fund bull sees $100,000

And where do we go from here? Perhaps this is the dam breaking for the mass suitability of the cyber currency. The Financial Times does not believe that many more companies will now use BTC. But a cyber cop like Mike Novogratz sees it differently, of course. He is aiming for a price target of $100,000. The head of Galaxy Investment Partners believes that the whole herd will now pounce on Bitcoin – that after Tesla, every company will buy the e-currency, he said on Bloomberg TV.

RBC recommends “Apple Exchange

And analyst Mitch Steves of RBC Capital Markets also sees golden times for the e-device. The expert from the Royal Bank of Canada recommends that the iPhone champion should focus on an “Apple Wallet”. In other words, Apple should offer a closed payment system for BTC. The company could thus combine its approximately 1.5 billion customers into a gigantic exchange – this “Apple Exchange” would resemble Coinbase, the largest marketplace for BTC, right off the bat. Should Apple then buy BTC for only 1 billion dollars – or “4 days of cash flow” – this would attract even more customers to the “Apple Exchange” and push things forward.

Apple to compete with Coinbase and co. Competition

And, along the way, boost Apple’s value substantially. The analyst literally: “Taking a big picture view of this, if we look at recent articles from The Block, which suggest Coinbase will be valued at ~$50B (at $200/share), this means Apple could potentially generate a similar or higher amount of value. Why? The firm already has a robust software ecosystem and install base to take significant and sudden market share from crypto currency exchanges (others include Binance, Kraken, and Gemini – all private companies but would be competitors in this situation). ” In other words: this marketplace would bring around 50 billion dollars in additional value. Which would, of course, help the Apple share in particular, whose price target Steves sees at 171 dollars.

So: Apple should become a BTC exchange. And open up an interesting new business field with Bitcoin trading. Steves points to PayPal: the payment service provider “does not allow for crypto assets to be sent off the system to a hardware wallet (individual custody). “A closed system, in other words, from which Apple could collect hefty fees.

At 5 billion in BTC, the thing pays for itself

The costs for this Apple exchange would virtually finance themselves. Steves continues: “Looking at it from another angle, if we assume that the cost of developing a crypto wallet/exchange on the Apple ecosystem would cost $500M, they could synthetically pay for the development cost by acquiring the underlying asset. For example, if the firm purchased $5B of Bitcoin (20-25 days of cash flow), the price of the underlying asset would need to rise by 10% for the firm to fully fund the entire project in the first place! This is a solid value proposition in our view as the business would be funded without diluting any other projects at the firm (iPhones, potential cars, etc.)”. So: a small purchase of BTC for 5 billion dollars and the thing carries itself.

A brilliant business idea

We think: A clever idea indeed – and too good to be wrong. It should be noted that analysts do not float in a vacuum. These experts are fed information by the companies. Through such test balloons, manufacturers can prepare their customers and shareholders for things to come without breaking the stock market rules on insider trading. Perhaps Apple has long since bought into BTC and is quietly working on the payment system so that at some point it can explode the price of BTC towards the sun with a confirmation. Technically and as a business idea, the Apple Exchange would be quite brilliant: Apple has the customers and the electronics – and with the delivery of its I-Phones, it can offer the payment system for the tech-savvy world of millennials, who rely more than others on BTC and co. Why leave the business to the many other small exchanges? A completely new business segment that would make the smartphones even more interesting. So let’s wait and see. So you see: The BTC world remains fascinating – Bernstein Bank wishes successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.