20.04.2022 – Now it’s down to the wire for oil: According to the investment bank JP Morgan, the price of a barrel of Brent will soon reach $185 in the worst case scenario. According to an insider source, the European Union will impose an embargo on Russia in the coming week.

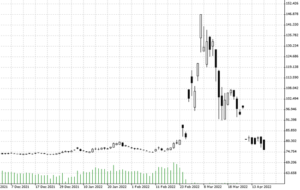

The oil bulls are slowly warming up. If a total embargo is in the offing, we should see a repeat of the reaction in Brent – shown here in the daily chart – as at the beginning of the war. Even if new punitive measures turn out to be more moderate, the long-term trend is set. Whatever the case, something is brewing.

Source: Bernstein Bank GmbH

According to Reuters, the EU wants to impose a boycott on Russian oil immediately after the second round of the French presidential election this weekend. Russian oil is still flowing unabated – so the West is financing the Russian state budget. JPMorgan noted that supplies from Russia in the seven days to April 16 were 7.3 million barrels a day – just below February’s pre-war average of 7.58 mbd.

Complete embargo

JPM Oil analyst Natasha Kaneva now examined three possible types of embargo, noting that “any immediate embargo measure taken by the European Commission will have a severe impact on the global oil market with risks to price entirely to the upside in the short-term.” Option one, he said, is the most extreme form: A full and immediate embargo. This would drive up the price of Brent to $185 per barrel, as 4 million barrels per day would immediately be lost.

Import tariffs and price caps

Variants Two and Three are more conservative – namely, higher import taxes or price curbs on Russian imports, he said. With a tariff surcharge of 90 percent or a price cap of $20 per barrel, the EU could save face, demonstrate strength, and continue to buy oil. The $20 difference from the market price could go into an escrow account to fund Ukraine’s reconstruction. With a slow embargo, extending over a four-month adjustment period, as with coal, the price would barely move in the short term.

JPM suspects European buyers will cut supplies from Russia by 2.0 to 2.5 barrels per day by year-end – and Moscow will only find substitutes for 1 mbd. China, India and Turkey in particular were now grabbing Russian oil at a discount. Already, major European refiners and traders had cut spot purchases to the tune of 2.1 mbd, he said. Soft embargoes would also definitely hit Russia, the report continued. This is because the margin for Russia is only $10 per barrel.

Possible Russian counter-reaction

We add: While Saudi oil is very easy to extract in the desert sands because it is lower in the ground and costs are low because ports are also close, it is different in Russia. In the Siberian permafrost, deep drilling is expensive, plus there are high transport costs due to long pipelines or trains. Presumably, however, even with the softer embargo variants, Moscow would stop deliveries of its own accord, since the money would then flow from the West to Kiev. The consequence would then be a delayed jump in prices.

Stalled offensive

Which brings us back to a possible startle reaction of the market. Still an escalation by a frustrated President Vladimir Putin is quite possible. Because if the U.S. think tank Institute for the Study of War is right, the current Russian major offensive in Ukraine is not going smoothly either. According to ISW in Washington, D.C., Putin desperately wants a success by Victory Day – we had already pointed out this important event on May 9. And that is why the Russian army continues to proceed too hastily, poorly organized and bumbling – despite the massive bombardments from the air, the Russians are hardly making any progress on the ground. So what comes next? A frustration nuclear strike? A victory for Ukraine? A coup in Moscow? An unexpected peace? All of this would have an impact on the energy market and the stock markets. Exactly the same would be the case if the EU chickened out on oil and did nothing at all – then a lot of long positions would be liquidated. Bernstein Bank keeps an eye on the situation for you.

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7