19.07.2023 – There’s life in the old dog yet: Not so long ago, the European single currency fell below parity with the dollar. That was last fall. And now the euro is enjoying its longest rally in almost two decades. We take a look at the background.

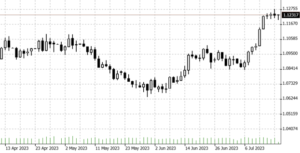

According to the Bloomberg news agency, the euro has just achieved its longest winning streak since 2004. The EURUSD was last as strong as it was in February 2022. Here is the daily chart.

Soruce: Bernstein Bank GmbH

The strength of the euro is actually a dip in the U.S. currency – namely, it has recently lost value against some major currencies.

Yellen talks down inflation

Recently, U.S. Treasury Secretary Janet Yellen created a bearish mood for the dollar. In an interview with Bloomberg TV, she explained that the U.S. is making good progress in reducing inflation. Speaking from the G20 meeting in India, she said, “the most recent inflation data were quite encouraging.” And the U.S. economy will not slip into a recession, she added.

Thus, the main reason for dollar weakness still lies in data from about a week ago. That’s when the U.S. had reported a Consumer Price Index for June that had climbed weaker than expected. Specifically, the CPI rose 0.2 percent month-over-month and 3.0 percent year-over-year. Ergo, hopes rose for an end to the tightening cycle – after all, the Federal Reserve now has fewer arguments to raise interest rates.

Interest rate differential with Euroland

In Europe, on the other hand, the end of interest rate hikes is probably still a long way off. According to Eurostat, the statistics authority, inflation in the euro area fell to 5.5 percent in June 2023, down from 6.1 percent in May. You can see that inflation is still far above that in the United States. In addition, the European Central Bank still has room for improvement in the key interest rate, which stands at 4.0 percent in the euro zone. In the U.S., it is between 5.0 and 5.25 percent.

The development of EURUSD is indeed astonishing, because apart from monetary policy, there are some factors that speak more in favor of an investment in the U.S. than in Europe. As there would be a solid energy policy, where the economy is not threatened with migration. Or the abundant natural resources in the USA, such as oil or natural gas. In addition, the greenback is always in demand as a safe haven when crises rage. Ukraine and Taiwan are just two of them. We keep an eye on the development for you and wish successful trades and investments!

_______________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.