31.08.2020 – Special Report. New records on Wall Street. But you already suspect it: The warnings of the bursting bubble are multiplying. We list the most important requests to speak for you. Perhaps the stock market is really facing an unhealthy high fever.

New Records

Was there something? Corona, perhaps? Anyway: The Dow Jones erased its previous annual losses on Friday. And both the S&P 500 and the indices on the Nasdaq set new closing records. The financial blog Marketwatch referred to encouraging economic news: private spending and incomes were surprising. Just like the fact that the Federal Reserve announced a policy shift: employment and inflation are now more in focus. In other words: more and more fresh money. Interest rate hike postponed indefinitely.

US-Tech more expensive than all of Europe

But be careful: The many bullish signals could eventually lead to a crash. Especially because of the misallocation of cheap money. The Bank of America, for example, has just warned that American high-tech stocks, with a valuation of $9.1 trillion, are now more expensive than all the stocks in Europe, which are valued at $8.9 trillion. In 2007, European shares were valued four times higher than US tech.

Correction Watch

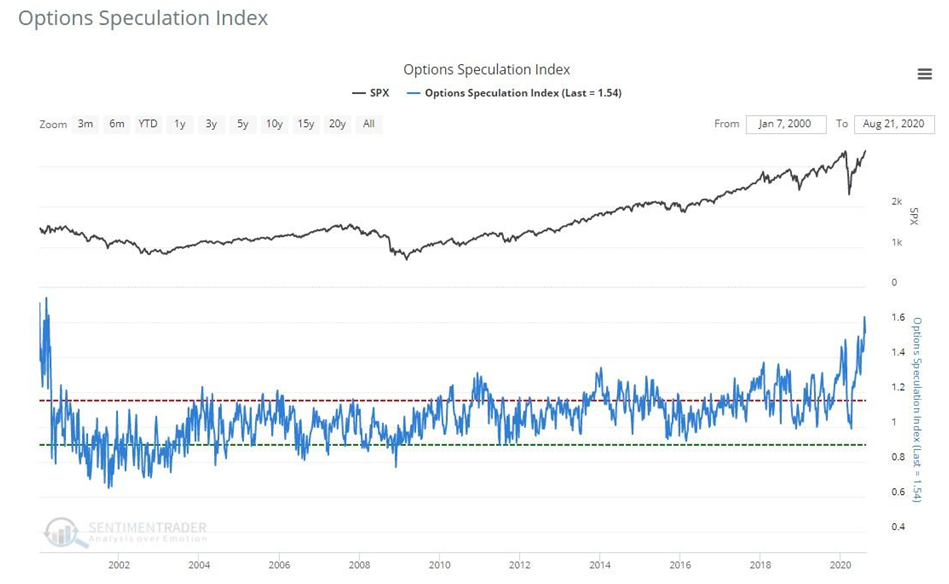

The Knowledge Leaders Capital Blog reported seven warning signals for the bulls. The fear indicator VIX is rising, although the stock market is also rising. In the S&P 500, the breadth of the market is dwindling – fewer and fewer shares are supporting the upswing. Small stocks continue to fall, while the big ones continue to rise. The dollar is no longer weakening against emerging market currencies – apparently there are liquidity problems. Yields on corporate bonds are no longer keeping pace with the equity market. The same applies to consumer confidence. And last, but not least, the Option Speculation Index shows an enormously bullish picture, measuring call purchases and put sales. This was already the case during the dotcom bubble at the turn of the millennium, see the blue curve below.

Hedge fund billionaire Leon Cooperman warned of a Fed bubble on Bloomberg TV. The founder of Omega Advisors reported that Apple shares have gained 17 percent since the 4:1 stock split on July 30. On Friday a week ago, 2.1 million calls were traded, three times the 20-day average. Tesla has gained almost 50 percent since the announcement of its split. Michael Wilson of Morgan Stanley recently used similar arguments to warn of an imminent correction. Apple alone is often responsible for the daily gains in the major indices.

The alarm sirens are also going off the mainstream financial market. For example, the price of the construction timber future in the USA has just reached a new all-time high of 887.30 dollars. On the one hand, house builders are more optimistic again. On the other hand, this niche market illustrates what can soon happen under Corona with other assets: Because of the pandemic, the sawmills had drastically reduced production. When there is new demand, they can no longer keep up with output. And prices are rising. Which, similarly, could quickly stifle an upswing in other goods.

State crisis ahead

Unser Fazit: Auch diesmal können wir die diversen Warnungen vor einem Platzen der Blase nicht ignorieren. Der wahrscheinlichste Zeitpunkt für einen Crash wäre Anfang November zur Präsidentschaftswahl. Es ist gut möglich, dass wir ein wochenlanges Chaos bei der finalen Auszählung erleben werden, da die US-Post – die übrigens den Bundesstaaten gehört und nicht dem Weißen Haus – bei einer massiven Briefwahl überfordert ist. Was in einer nie zuvor gesehenen Staatskrise munden könnte. Vermutlich wird die Antifa dann wieder losschlagen und die Bundestruppen sowie die Nationalgarde massiver als zuvor eingreifen. Die Anleger an der Wall Street dürften bei heftigen landesweiten Unruhen auf Tauchstation gehen, bis der Kulturkampf ausgefochten und die Linksradikalen vernichtet sind. Merke: In den USA gibt es auf Bundesebene keine Kuscheljustiz, sondern mindestens fünf Jahre Haft bei Brandstiftung gegen föderale Einrichtungen. Amerika, du hast es besser.

Focus on Big Tech

Many investors are also likely to make profits on megacaps, as these could be crushed if Trump wins the election. Who can remind us that Apple, Amazon, Google and Microsoft are politically on the Democratic side, permanently disadvantage the Republicans and could be crushed as monopolies if Trump is re-elected. We will keep an eye on the matter for you – the Bernstein Bank wishes successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.