21.09.2022 – Red alert for traders and investors: Russia escalates the Ukraine war. Added to this is the Federal Reserve with its interest rate decision.

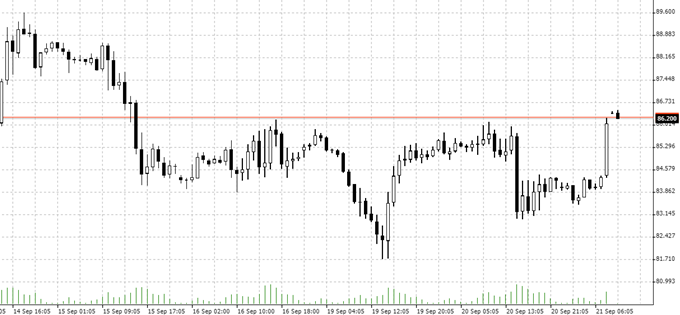

We cannot imagine a scenario more bearish for equities than the current one – and more bullish for energy and the dollar. Vladimir Putin is taking flight after the successful Ukrainian counter-offensive around Kharkiv. With this morning’s partial mobilisation and indirect threat of a nuclear strike, Putin has brought the world closer to nuclear war. What is clear is that the so-called Luhansk and Donetsk People’s Republics are to be incorporated into the Russian Federation through sham referendums. And thus a war against them would also be a war against Russia. The first reaction on the oil market to Putin’s speech can already be seen in the hourly chart of WTI oil.

Source: Bernstein Bank GmbH

Now the West has the choice between two extremely unpleasant options: Either it drops Ukraine, freezes arms deliveries and relies on appeasement. This line is likely to be favoured in Rome, Berlin or Madrid. But then there could be a change of government in Germany, for example. Or else Ukraine will finally be effectively supplied with large quantities of modern weapons and Russia will be brought to its knees. This is the line we see in Washington, Warsaw or London.

Possible panic over oil and gas

The situation is also precarious for Putin. In the event of a defeat in Ukraine, he and his siloviki are likely to be history. And an implosion of the Russian Federation will follow. At the end of February, we wrote here that Vladimir Putin had launched his Afghanistan with the invasion of Ukraine. The failure of the Soviets in the Hindu Kush was the harbinger of the end of the Soviet Union. The same could happen to Russia now. With consequences for the stock markets and also for the energy market. With around 5 million barrels per day, Russia is one of the largest exporters of crude oil. The market for natural gas would then also panic.

How stable is Russia?

In fact, the Kremlin’s power seems to be waning. In the course of the counter-offensive, for example, the Ukrainian leadership just reported the flight of some 13,000 Russian-born collaborators – mainly from the administration. The Russian Belgorod confirmed such a wave of refugees. Thus, the local stalwarts seem to have lost faith in a Russian victory. The neighbours are getting bolder. The recent invasion of Armenia by Azerbaijan is certainly no coincidence – after all, Yerevan is under Russian protection. The predominantly Islamic republics in the south of Russia could strive more strongly for independence, above all Chechnya.

The big danger is China

Kazakhstan has refused to recognise the pro-Russian separatist republics under international law and is putting out feelers to Beijing. China itself is in desperate need of farmland and could one day annex Siberia if chaos rages in Russia – with exactly the same justification Russia has just used in Ukraine. Namely, that millions of Chinese migrant workers are being oppressed in the Russian Far East.

Smouldering conflicts

Georgia might be tempted to wipe out the two Moscow-backed pseudo-republics on its territory. Moldova, with Ukraine’s help, could wipe out the Russian enclave of Transnistria. Belarus, the last Russian ally in Europe, is tottering – in the event of an overthrow, Moscow would have to intervene. The same applies if Ukraine, Kazakhstan or even the Baltic states expel the Russian minorities as troublemakers. The Kremlin has just reaffirmed the protection of Russians abroad under the concept of Russki Mir (Russian World). A wave of refugees would also put a heavy strain on the Russian economy.

The conclusion to be drawn from all this is that, if our observations are correct, we are in for some turmoil on the stock markets and on the oil and gas markets. So keep an eye on the situation – and prepare yourself. Bernstein Bank wishes you successful trades and investments!

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7