13.02.2023 – WTI and Brent are slowly inching upwards. The market is tentatively shaking off recession fears. But why do they have different prices? And what differences are there between the two grades? We shed light on the background.

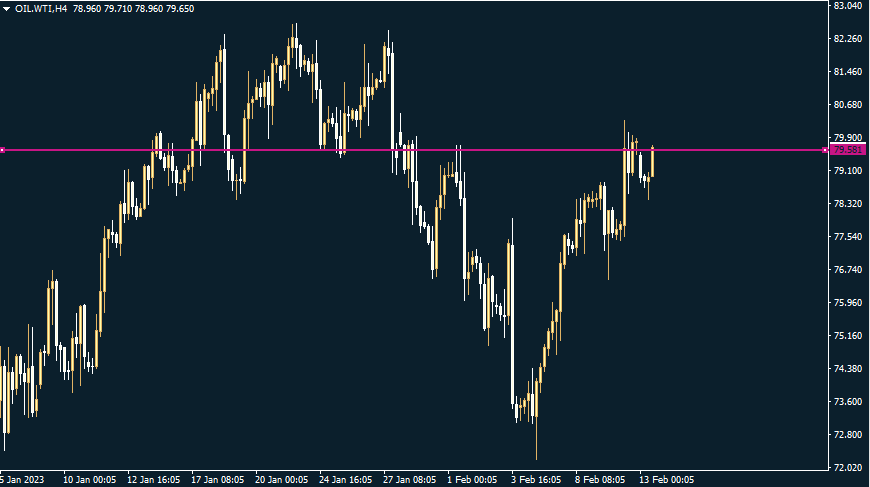

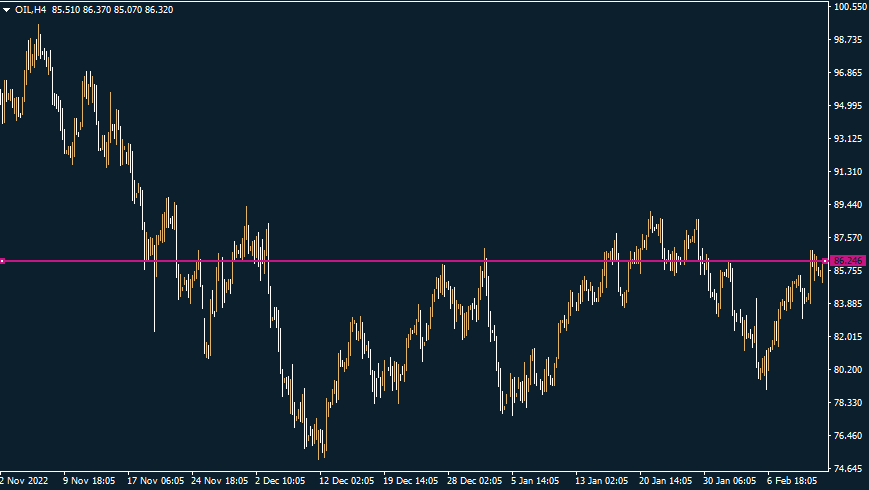

The oil price has recently reacted bullishly to the announcement from Moscow that Russia will reduce output by 500,000 barrels per day or 5 per cent from next month. This is intended to counter Western sanctions. Just over a week ago, Goldman Sachs had already caused a stir with its forecast that a real supply crisis was to be expected for crude oil into the coming year. In addition, the new demand from China will peak this year due to the reopening of the Chinese market. The oil price will therefore rise above 100 dollars. Above you see the four-hour chart of WTI, below Brent.

Source: Bernstein Bank GmbH

Source: Bernstein Bank GmbH

As you can see, both grades are running in unison, but Brent is costing more. But why is that? Especially since, until just over a decade ago, WTI was more expensive than North Sea oil because it is of a slightly higher quality than its European counterpart.

Sulphur and heaviness

While there are many more types of oil than just these two, these are the most important. WTI is mainly important for the US market, Brent for Europe and international trade. Brent comes from the North Sea and is traded on the London commodity futures exchange ICE Futures, which is the former International Petroleum Exchange, clarified the “Handelsblatt”. According to this, Brent has a low sulphur content of around 0.37 percent and is described as light, sweet crude oil. We add: Sulphur destroys engines and is therefore undesirable. The “Handelsblatt” continued: So-called sour grades have a sulphur content of up to six percent. The American light oil WTI (West Texas Intermediate) is also considered sweet crude oil. According to “Manager Magazin”, it has a sulphur content of 0.24 percent.

Mobeen Tahir of the asset manager Wisdom Tree, explained on the website of the Munich Stock Exchange that oil is called “light” in the sense of the measurement of the American Petroleum Institute (API) if it has an API gravity of more than 10 – then it floats on water; in contrast, an API gravity of less than 10 causes the crude oil to sink. Such super-heavy oils are used, among other things, as bitumen in road construction.

Transport costs count

Further, Tahir correctly noted that there are “contrasting characteristics in terms of where the oil is produced, how it is stored and transported, and how the type of oil is traded in international markets.” We add: WTI is mainly consumed in the US. When the supply of fracked oil increases there – which has increasingly been the case for about a decade since the revolutionisation of production by cross-drilling and by exploiting oil shales – the price falls. At the same time, there are transport costs as factors: While Brent is loaded directly onto tankers from the drilling rigs, WTI must first be transported overland in pipelines, trains or trucks. Buyers therefore deduct these costs from the purchase price.

Storage capacities and immediate delivery

The fact that prices also depend heavily on the capacities in the oil tanks was demonstrated on 20 April 2020, when the price of WTI experienced a historic crash – even into negative territory – shortly before the expiry of the active WTI futures contract on the Nymex. Oil inventories in the US were full, especially at the main hub in Cushing, Oklahoma. Corona had choked off demand.

This in turn made gamblers extremely nervous who did not need oil for production at all. When the futures contract expires on the NYMEX New York Mercantile Exchange (NYMEX), the holder of the contract immediately receives delivery of the barrels of oil purchased. In the case of Brent, however, the procedure on the Intercontinental Exchange (ICE) is different: there, the holder of the futures contract does not have to take delivery of the underlying asset at expiry, the Wisdom Tree expert explained further. Ergo, Brent did not collapse as much as WTI.

Practical trading tips:

The trading hours for the two types of oil are as follows:

OIL: 02:05-23:00 (Mon-Thu), 02:05-22:00 (Friday).

OIL.WTI 00:05-23:00 (Mon-Thu), 00:05-22:00 (Friday)

Contract size: USD 10 x price level

We hope we have helped you a little with this background – Bernstein Bank wishes you successful trades and investments!

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7