09.02.2023 – Unbelievable, but true: the DAX has just marked a twelve-month high. And it is not far from the all-time high. All this despite the Ukraine war, the threat of recession and rising interest rates. We take a look at the background.

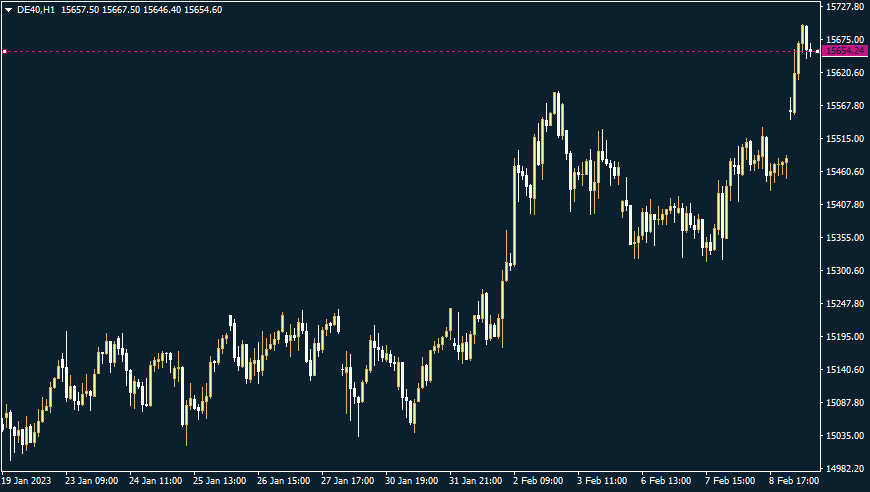

A few hours ago, the time had come: On Thursday, the German benchmark index broke through the 15,600 mark – the highest level not only in this still young year, but also in twelve months. The all-time high at 16,290 is thus within reach. Here is the hourly chart of the DAX.

Source: Bernstein Bank GmbH

Initially, the firm U.S. futures provided a boost. Prices are also rising because of a short squeeze. Large addresses are running after the market, which has decided to see the world rosier again.

Hopes for the interest rate turnaround

Consumer prices in Germany, for example, climbed 8.7 percent in January compared to the same month last year. A fabulous value… However, most analysts had expected an increase of 8.9 percent. Admittedly, this enormous inflation is still enough to choke off consumption, because people have to keep household money together. The ongoing construction crash will also still keep the German economy busy.

But few people care about that at the moment, because now hopes are rising for an end to interest rate hikes by the European Central Bank. The cautionary voices are somewhat drowned out. NordLB, for example, just warned that the ECB will remain on a tightening course.

Ukraine war ticked off for now

Interestingly, the price barometer is now holding as high as before the Russian invasion of Ukraine. And this despite the fact that Germany, after months of dithering and the overdue departure of the incompetent defense minister, is now supplying Ukraine with battle tanks after all – and thus incurring the wrath of the Kremlin. The market is relaxed about this fact. Which suggests that hardly anyone believes in an escalation. This is an understandable reaction; after all, Russia has so far done little to counter Western intervention apart from threats.

It is not over yet

But what is not, may yet become. We certainly see smoldering risks: Vladimir Putin and his clique of siloviki urgently need a success. Otherwise they will be swept away. The imperialists in Moscow need to achieve respectable partial successes by the anniversary of the invasion on February 24, such as the complete occupation of the separatist areas of the dreamed-of Novorossia.

Conversely, however, if Ukraine takes the initiative again, the Putinists could escalate once more in their impending death throes. Perhaps even nuclear. Who knows, if Western tanks or even the first modern fighter jets from Poland and Great Britain arrive in Ukraine in time, anything is possible. But time is pressing: The Institute for the Study of War has just reported the start of a new Russian offensive between Kharkiv and Luhansk.

Conversely, the courses are likely to receive new impetus if the current Russian regime is forced to capitulate – who knows if the reluctant West will eventually send not just slivered and delayed weapons, but decisive aid on a grand scale. Be that as it may: We hope you are right on the stock market. Whether long or short – Bernstein Bank wishes you successful trades and investments!

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7