31.08.2023 – Jerome Powell held out the prospect of higher interest rates and still kept the market calm. So the Jackson Hole feat was accomplished.

What if the world does slide into an economic crisis? A little-noticed indicator is sending out signs that it could indeed come to that: Zinc remains bearish.

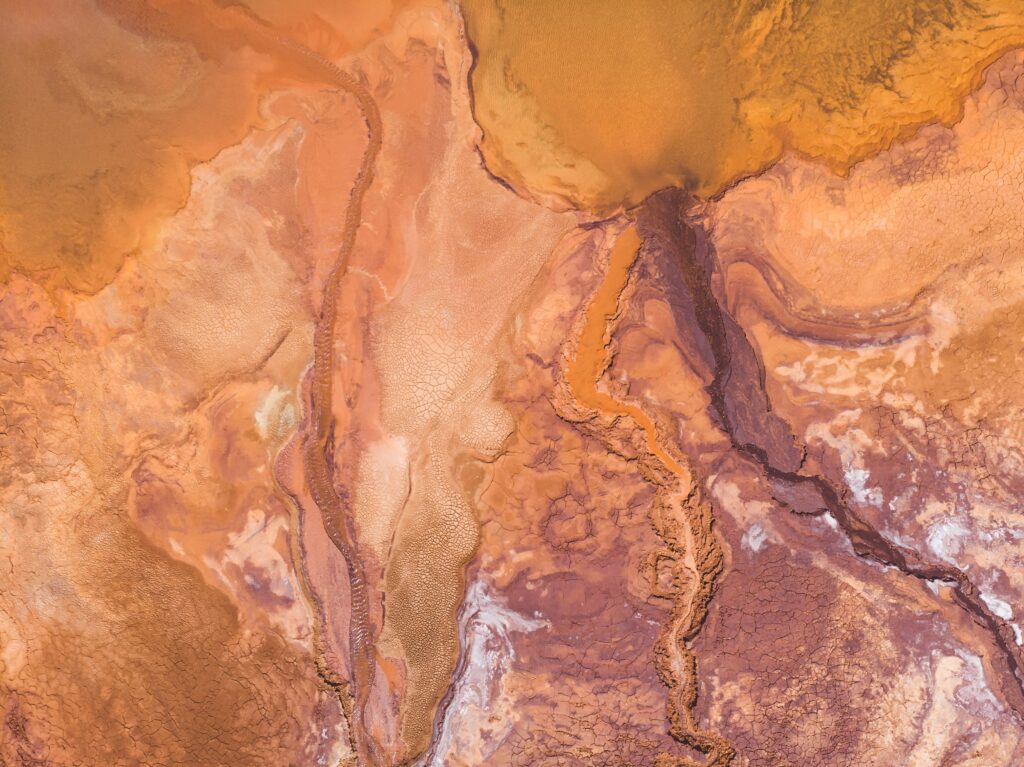

We see zinc as a leading indicator for the old economy: the low price certainly points to low global demand. Or is a bottom just forming here? Here is the weekly chart. The analysts at Trading Economics see the price at around $2,173 per ton on a one-year horizon.

Source: Bernstein Bank GmbH

Zinc is in demand in key sectors of industry. The blue-white, brittle metal is used, for example, in automobile manufacturing and mechanical engineering to protect steel against corrosion. The same applies in construction wherever iron and steel are exposed to wind and weather – for example as sheet metal in roofs or in rain gutters. About half of the production is used to protect against rust and weathering.

As zinc oxide, chloride or powder, the metal is used in the chemical and pharmaceutical industries. Further, zinc is found everywhere in the home: alloyed with copper as brass in fixtures, lamps, doorknobs and so on.

Tightening versus recession

The website “Tradingeconomics.com” stated that concerns about a continued thightening kept the price of zinc down. Higher interest rates could choke off demand in Europe and the US. We add: In Germany, we also see a bursting of the real estate bubble and falling corporate profits, triggered in part by high energy prices.

Indeed, recent data from the US also point to a slowdown. For example, the second estimate for US gross domestic product was revised downward. Namely, from 2.4 to 2.1 percent. In the labor market, the ADP National Employment index also signaled a contraction, with 177,000 versus the expected 195,000.

Weaker economic figures are still interpreted on the stock market to mean that the Federal Reserve will then have to scale back tightening. And so will the rest of the world’s central banks. But analyst Simon White of Bloomberg commented that there is a lot of catching up to do in the stock market on recession risks.

Construction crash in China

And then there’s China. The real estate market in the Middle Kingdom looks pretty bad: Vacancies, bankruptcies of project developers, half-finished building ruins. We have already discussed the ghost towns in the People’s Republic here on several occasions. The crisis has hit developers such as Evergrande Group, Country Garden, Kaisa Group, Fantasia Holdings, Sunac, Sinic Holdings, and Modern Land. Now “Tradingeconomics.com” hopes for rescue measures by Beijing.

After all, the website recently pointed to lower inventories on the LME commodity exchange in London. However, global demand for zinc will only increase by about 1.4 percent this year, according to S&P Global. And supply, meanwhile, will rise 1.9 percent, it said. After all, smelting in China remains rather constrained because of energy problems, he said.

The conclusion to be drawn from all this: We suspect that construction companies and auto groups will immediately buy larger quantities of galvanized steel if they expect demand to pick up. So keep an eye on the real-time news: When optimism increases, so does the price of the commodity. New recession worries are accompanied by a drop in the price of the blue-white metal. Zinc thus serves as a weather vane for all those involved in the stock market. Whether long or short – we keep an eye on the situation for you!

____________________________________________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7