12.02.2020 – Special Report. What a catch-up in the market for crude oil: after the incredible dive into negative territory in oil futures last April, the price of WTI in the spot market is once again scraping the $60 per barrel mark. Some analysts believe this will continue as the global economy picks up. Others warn of new Corona stoppers. We analyse the situation.

Falling supply in the USA…

In the meantime, the oil price has pretty much reached the pre-Covid level. One factor for this is the cap on oil production in the US market. According to the Energy Information Agency (EIA), inventories fell to the five-year average at this time of year in the week ending 29 January. Normalisation, then. US producers are currently pumping 2.4 million barrels per day less than a year ago, according to Oilprice.com.

… and at OPEC+

And OPEC+ is also cutting supply. Last week, OPEC announced that a further 2.1 million barrels would be withheld since the peak of the Covid crisis in April 2020. This means that currently around 9.7 million barrels per day less is being pumped by the expanded cartel than pre-Covid. On top of that, there is a small gift of 1 million barrels per day on top from Saudi Arabia. This has consequences: Martin Rats, analyst at Morgan Stanley, told the Wall Street Journal this: “the amount of crude oil and petroleum products stored around the world down by about 5% since its peak in 2020.”

Bulls refer to the cold snap

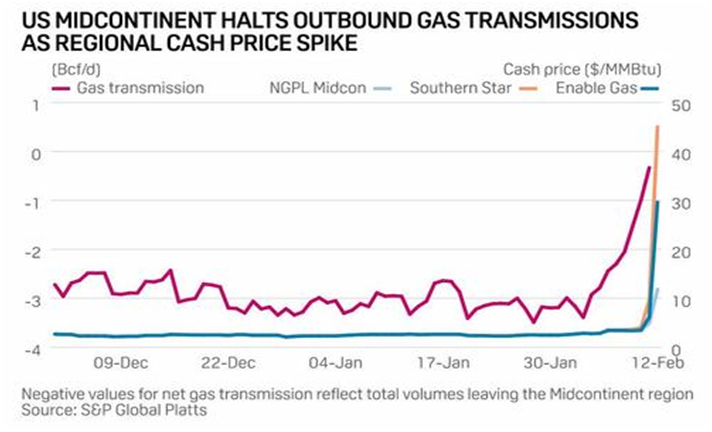

Goldman Sachs sees a price of 65 dollars by the end of the year. Analyst Damien Courvalin recently pointed out that the cold spell is boosting demand for oil by at least 1 million barrels per day. This is because more diesel is being burned in generators. The cold snap in the midst of the global warming hysterically conjured up by the Green Left is also quickly showing up in another market: according to S&P Global Platts, spot prices for natural gas at some regional gas suppliers and pipeline operators in Kansas, Oklahoma and Arkansas just shot up – from around 2 dollars per mmBTU (million British thermal units) to almost 50 dollars. This is because increased demand for propane burners was met with supply shortages due to icing in the Midwest.

Why is this important? Because you can assume that this trend on a small scale will soon be observed on a large scale. Heating and power plants are likely to have burned an enormous amount of oil – and will be buying up massive amounts of crude oil and products like diesel in the coming weeks to refill the tanks.

Hoping for the travel season

Some oil bulls are also hugely optimistic for the summer. It all depends on whether the US and other major countries achieve Corona herd immunity by the summer – and then whether demand for gasoline and jet fuel picks up in the travel season. “By the summer, the vaccine should be widely provided and just in time for summer travel and I think things are going to go gangbusters,” hedge fund manager David D. Tawil of Maglan Capital told Reuters news agency.

Flood of money pushes up commodities

In addition, most players believe in continued stimulus in the US and elsewhere. Which boosts the economy and guts purchasing power – in inflation, commodities are in demand. Because of the various stimuli, Amrita Sen of Energy Aspects sees an oil price of 100 dollars and more. “We’ve always called for $80 plus oil in 2022. Maybe that is $100 now given how much liquidity there is in the system. I wouldn’t rule that out,” Sen said in an interview with Bloomberg. “Oil companies, for the first time in a long time, are likely to make a big comeback,” Jean-Louis Le Mee, head of hedge fund Westback Capital Management, also said in an interview with Reuters. “We have all the ingredients for an extraordinary bull market in oil for the next few years.”

Will OPEC+ continue to throttle?

But the higher price and the hope of more demand awakens greed. The coffers of many oil producers are empty. So OPEC+’s resolve on production restraint is likely to crumble in the face of rising prices. The question is whether this status quo can be maintained at the next meeting on 4 March. Then there is Iran. Tehran is also not taking seriously Joe Biden, who has signalled his willingness to reinstate the 2015 nuclear deal in new appeasement. Therefore, several million barrels of oil could be back on the market in quite a short time.

Corona is what counts

There is also a lot of hope in the prices for Corona in the future. Should the world’s governments decide on new lockdowns because of mutations in Brazil, South Africa or elsewhere, the recovery will get a bump. For example, according to Reuters, tens of millions of people in China are currently being kept at home and subjected to mass testing. The government is afraid that a new wave of infections will roll over the country in the course of the New Year. Should this effect intensify, demand from the Middle Kingdom will collapse. This is compounded by an inability to mass vaccinate as in the European Union.

Backwardation in the market

So the picture is mixed. And how does the market see the whole mixed situation? We recently saw backwardation, which means that the price for the futures contract is lower than the spot price. This usually happens when the demand for immediate delivery of the product is significantly higher than the demand for future futures contracts. So the market assumes a future higher supply or weaker demand. We are keeping an eye on this exciting topic for you – Bernstein Bank wishes you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.