24.08.2023 – Nvidia remains the high-flyer when it comes to artificial intelligence (AI): The chip manufacturer again exceeded all expectations in the second quarter. And spread even more optimism for the third quarter. Group CEO Jensen Huang spoke of nothing other than a turning point in the computer business.

The stock remains the ultimate AI bet. Whereby we ask ourselves whether the bulls are not already somewhat spoiled by now. A plus of around 9 percent overnight is not bad. Nevertheless, the current stock market reaction was relatively restrained. Three months ago, the stock shot up by a spectacular 24 percent – that’s how much Nvidia had exceeded analysts’ expectations. Here in the picture the hourly chart.

Source: Bernstein Bank GmbH

Presumably, some investors opted to Sell the News; many investors also cashed out in the days before. Of course, many traders also anticipated the numbers: Nvidia shares had already posted an 11 percent gain on Monday.

Expectations exceeded

To the facts. Sales in the past second quarter were $13.5 billion – the expectation was about $11 billion. Earnings per share came in at $2.70 versus estimates of $2.07. However, the market was completely off its rocker because of the raised forecasts for Q3: Nvidia now expects revenue of $16 billion – that’s $3.5 billion more than the analysts’ average. Moreover, the announced revenue is above the highest whisper estimate of $15 billion. Finally, the icing on the cake was the announcement of a $25 billion share buyback.

A new era

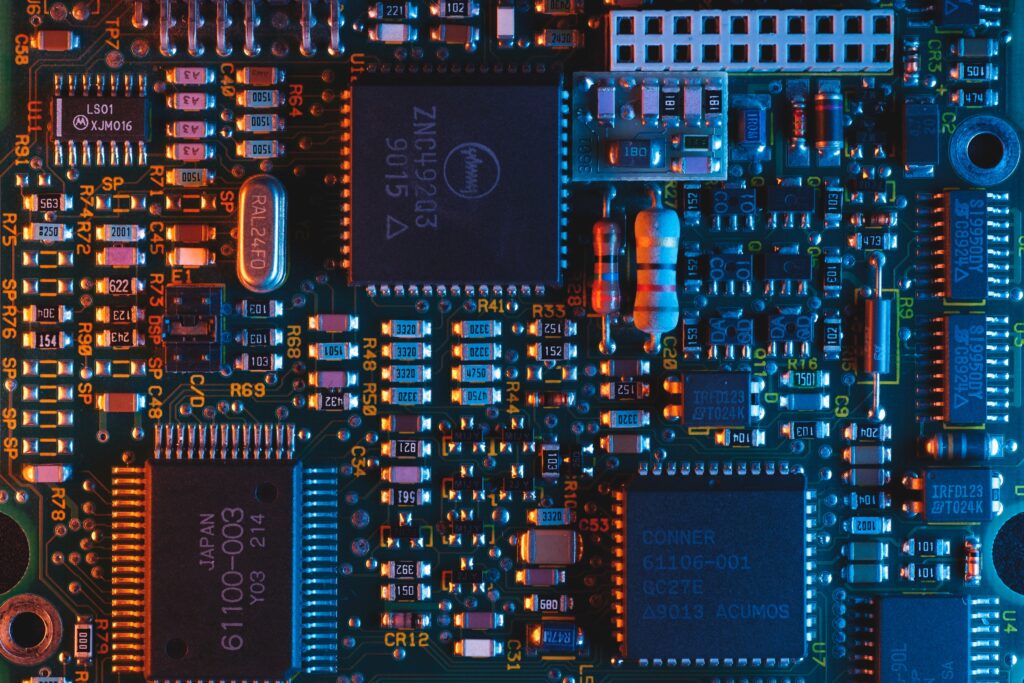

CEO Jensen Huang commented, “A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI. (…) Nvidia GPUs connected by our Mellanox networking and switch technologies and running our CUDA AI software stack make up the computing infrastructure of generative AI.”

We translate the techie-speak: The chipmaker supplies high-quality graphics components for laptops, smartphones and gaming – GPUs for short. De facto, the company is thus working on reinventing modern graphics and making its use in many high-end Artificial Intelligence (AI) applications possible in the first place. In other words, Nvidia is by far the largest supplier of special chips for applications in AI with high computing power.

The conclusion from all this: Nvidia remains the turbo call for all those who are betting on the success of AI. The major bank HSBC, for example, raised the price target to $780 only on Monday. So there’s still a lot of upside. Things will get exciting if a competitor appears at some point and challenges Nvidia’s business. Or an invasion from Taiwan will dry up the chip pipeline; there are already bottlenecks at the contract manufacturer Taiwan Semiconductor. We are curious to see what will happen next – Bernstein Bank wishes successful trades and investments!

___________________________________________________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7