22.12.2020 – Special Report. There is a lot of rumbling in the Bitcoin market. On the one hand, JPMorgan has just issued a potential price target of $650,000 for BTC. On the other hand, there is a lot of trouble brewing in Washington. Bitcoin disciples fear regulation of the e-currency – a deadly embrace of politics.

JPM sees potential $650,000

Early New Year’s Eve firecracker from JPMorgan: In his last “Flows and Liquidity” report of the year, quantitative analyst Nikolaos Panigirtzoglou from JPMorgan has fired a truly remarkable price rocket: $650,000 for BTC could be it.

First, the analyst looks anxiously at the newly created debt – mainly via the issuance of $13 trillion in new US government bonds, the 2020 level has climbed to around $21 trillion. According to JPMorgan’s calculations, all financial assets in the world are now worth almost 300 trillion dollars. The creation of air money out of thin air naturally fuels demand for real assets.

Parity with gold

And here comes the interesting comparison with the usual inflation hedge gold: all mined gold in the world brings it to a market cap of 12 trillion, according to JPM – which is 27 times that of Bitcoin, which even at its all-time high only comes to around 443 billion dollars. If Bitcoin reaches parity with gold, BTC would have to rise to 650,000 dollars.

Life insurance buys BTC

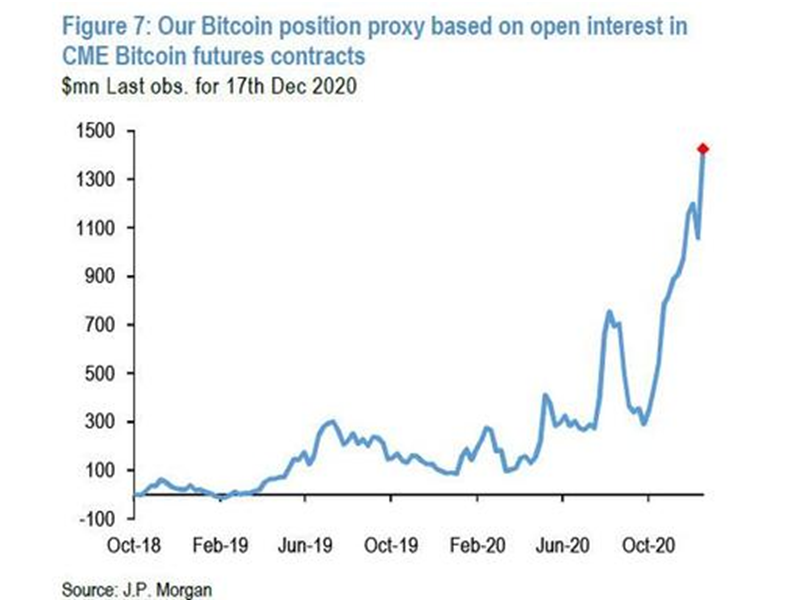

That could take a while. BTC is hedged on the downside, Panigirtzoglou says, pointing out that the momentum from institutional demand is simply too great at the moment “(to) allow any position unwinding by momentum traders to create sustained negative price dynamics”. In other words, he probably does not believe in falling prices. In fact, about a week ago, the life insurance company MassMutual reported investing 100 billion dollars in Bitcoin. So the e-currency is becoming increasingly accepted even in conservative circles. And retail traders believe in BTC anyway, as a look at the futures shows. Last Thursday, the open interest in futures reached a new record of 1.4 billion dollars.

JPM continues “difficult not to characterize bitcoin as overbought at the moment”. However: “the inflows into the Grayscale Bitcoin Trust, at $1bn per month currently are too big to allow any position unwinding by momentum traders”. This fund is also the canary in the mine for BTC traders, he said: “any signs of significant slowing in the flow trajectory for the Grayscale Bitcoin Trust 9 would raise the risk of a bitcoin correction similar to the one seen in the second half of 2019.” So much for the bulls’ party.

Fear of crypto-regulation

The bears also have arguments on their side. On Friday, the U.S. Treasury Department announced new rules for virtual currencies: Banks and other financial institutions are to keep records and verify the identity of customers for some transactions. Details are still pending. An unloved crypto-regulation, then. Joseph Young from CoinTelegraph calmed the nerves of the BTC bulls: The threat of regulation of the sector is credible and has also had a negative impact on crypto prices in the past; however, the matter is already priced in and a crash will therefore not happen.

Jeremy Allaire, CEO of the payment service provider Circle, said that a possible regulation would be harmful for the entire cryptocurrency sector. Then the all-clear was given again: rumours had recently been circulating in the scene that only transfers worth more than 10,000 dollars would have to be reported. Everything could be half as bad as feared – especially since conservative institutional investors who bring some lobbying power with them are also becoming increasingly involved.

We think: Whether and how the regulation will turn out is still completely open in view of the change of government in the USA. However, a fatal blow against the unloved digital currency competitor is possible by several central banks around the world. So you see: The situation in the crypto market remains exciting – the Bernstein Bank keeps you up to date and wishes you successful trades!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.