25.11.2020 – Special Report. Bitcoin scratches the old record of almost 20,000 dollars. Many market observers expect the e-foreign currency to make a breakthrough – and indeed there are good reasons for this. If it were not for an important warning signal from China, which has so far been lost in the media mainstream. We will shed some light on the background.

Up, up and away

The tension is rising. “Börse Online” judged: “Before the all-time high, there is now hardly any resistance on the charts. The probability is very high that the all-time high will be reached before the end of the year. The old coins have initially lagged far behind. There could be catch-up effects here, especially for Ethereum, Litecoin and Bitcoin Cash, which will soon be offered for trading by PayPal in addition to Bitcoin In Brief”.

Masses of paper money

There are plenty of reasons to buy e-foreign currency, even in the light of current monetary policy. The World Resources Institute pointed to the trillions that would be printed worldwide for stimuli in response to corona – in the USA, Europe, Japan and other major economies. Quantitative easing has reached undreamt-of dimensions. “For the first time U.S. debt is now about equal to GDP (Gross Domestic Product), like the sound barrier we once thought if we hit it we might explode. In fact, the Federal Reserve’s balance sheet has inflated to a record level of around $7.2 trillion. This does not bode well for the world’s currencies – many investors fear a gutting.

BTC beats gold

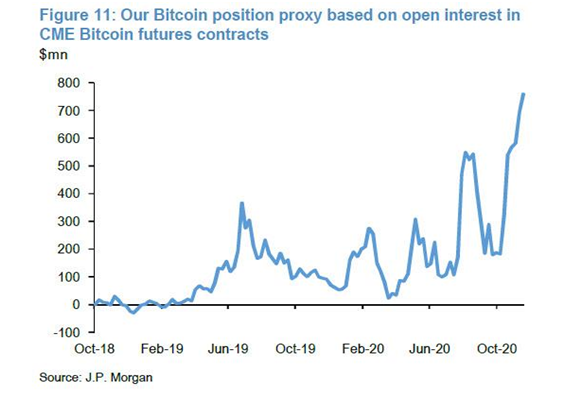

Against this background, many investors are betting on e-foreign currencies – and are giving gold, the usual store of value, the cold shoulder. Analyst Jim Reid of Deutsche Bank noted a rotation of gold into BTC: “there also seems to be an increasing demand to use Bitcoin where gold is used to be used to hedge dollar risk, inflation and other things. In fact, JPMorgan reported a record open interest in Bitcoin futures of nearly $800 million.

At the same time, the Bank of America registered the largest weekly outflow from gold funds ever, at $5 billion.

Expert sees BTC at $318,000

Bitcoin therefore becomes socially acceptable. The price expectations are correspondingly euphoric: “Today bitcoin has gotten to a place where institutional investors, banks, and family offices are legitimately pondering involvement as a defence against currency devaluation,” was the recent not entirely unselfish judgement of Alex Mashinsky, CEO of Celsius Network, the financial services provider specialising in BTC. And further: “This isn’t a gold rush anymore, it’s a good investment. BTC will climb to 30,000 dollars by the end of the year.

Tom Fitzpatrick, Managing Director at Citibank, took the cake. In an information to institutional clients, he predicted that BTC would cost more than $318,000 next year. In view of the uncertain economic situation, he said, there were similarities with the gold market in the 1970s.

A warning signal from China

Last but not least, a little-noticed but nevertheless important fact remains as a dissenting vote: China is intensifying the fight against Bitcoin. In October, the People’s Bank of China (PBOC) banned the private issue of digital currencies. As a result, the Malta-registered stock exchange OKEX had to block withdrawals of cryptos for a month because the company had to provide information to the Chinese authorities. The background: the Chinese central bank is preparing to launch its own digital currency.

As a result, Reuters recently reported that asset managers are looking to expand outside the People’s Republic and are looking for clients in Hong Kong and Singapore. Babel Finance, a financial services provider specialising in Cryptos, has applied for a licence for asset management in the former British Crown Colony. The company intends to raise around 1 trillion dollars in capital. Gordon Chen, former Bitcoin trader in Beijing, recently founded the company GMR in Singapore, as trading with digital currencies is increasingly regulated in China.

As we have often written at this point: China is only the forerunner; the world’s governments will not tolerate an uncontrollable secondary currency. They will use state-controlled e-currencies to eliminate competitors, to eliminate corruption, black money and tax evasion – and to retain power over monetary policy. Although it will be technically difficult to enforce this completely, sooner or later the blockade will come. We will keep an eye on the matter for you – and wish you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.