10.10.2022 – A few days ago, OPEC and allied countries such as Russia decided to cut production. Immediately, the bullish change of mood in the market intensified. We shed light on the background.

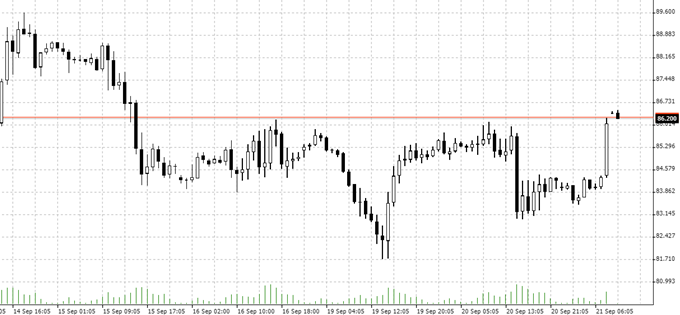

In the midst of the West’s conflict with Russia, Saudi Arabia jumped in to help the Kremlin. A real affront. Starting in November, the Riyadh-dominated cartel of 23 countries will produce two million barrels less oil per day. The aim is to stabilize the oil price, which has fallen sharply recently. In fact, the price – here the daily chart of Brent – picked up some time before the OPEC meeting in Vienna last Wednesday. The most important analysts had apparently been well informed in advance. Goldman Sachs, at any rate, predicted a price of $105 per barrel for Brent – in six months. This mark is already in sight.

Source: Bernstein Bank GmbH

While the U.S. may now be producing more oil after all – a turnaround away from the eco-course will take time. However, a global recession is looming and demand is suffering. Also, some countries are already producing less than their allocated quota allows them to. Nigeria, Angola and Russia, for example. This is due on the one hand to Western sanctions against Moscow; on the other hand to the dilapidated infrastructure – in some countries, state funds just keep ending up in the deep pockets of corrupt politicians.

Another question is what effect the Western embargo on crude oil from Russia, which will take effect in December, will have. Perhaps it will have no effect at all – because other countries will simply sell Russian oil on to the West as middlemen. Nevertheless, things could soon change in the market.

Tectonic shift

Michael Every of Rabobank claims to have observed a tectonic shift in geopolitics. The White House is raving about the Saudis’ decision – they are no longer the swing producer that has always helped the United States. In any case, America’s reaction is not convincing: tapping the Strategic Petroleum Reserve by another ten million barrels will not help for long – and at some point the reserves will be depleted. Once again, plans are whirring around in Congress to finally pass the NOPEC law that has been under discussion since 2007, according to which companies from OPEC countries could be sued for antitrust violations in the United States.

Warning of new supercycle

And Louise Dickson of Rystad Energy predicted a market tightening in December on Bloomberg TV – with a possible new supercycle in prices. One possible White House response is also an export ban on diesel and gasoline to keep prices low at the pump ahead of the midterms. Which in turn should boost the price of Brent in Europe. The lobby group American Petroleum Institute warned that an export ban would amount to a shortfall of 1.3 million barrels of oil per day.

Our conclusion: the cut announcement seems bullish. However, high inflation plus a recession could push demand further down. However, it is quite possible that OPEC+ will cut production even further if the current move does not have a lasting effect. Bernstein Bank is keeping an eye on the situation for you!

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7