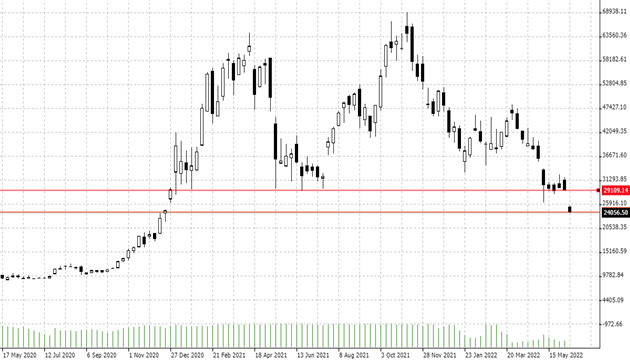

14.06.2022 – In Bitcoin, the battle for the $30,000 mark seems lost. This zone should have held better from the bulls’ point of view. Currently, a breakout to the downside is apparently underway – it is questionable whether the recovery will not come after all. However, we wonder where the impetus for this should come from in the current risk-off environment.

For about a month, the zone around 30,000 was fiercely contested. Now BTC – here the weekly chart – has slipped below the strongly pronounced support line. Below it, the abyss threatens.

Source: Bernstein Bank GmbH

Despite all this, just the analysis boutique Fundstrat spread a little hope. Co-founder Tom Lee said on CNBC that the bottom formation is now complete. Until the end of the year it will go rather sideways-upward. No crash thus.

Consolidation wave ahead

On the other hand, a star investor just provided a bearish note: Mike Novogratz believes that two-thirds of the roughly 1,900 hedge funds that invest in cryptos are doomed to fail in the wake of the current market slump. We add: Which would then likely trigger a wave of liquidations in Bitcoin and co. The founder and chief executive of Galaxy Digital Holdings said at the Piper Sandler Global Exchanges & Brokerage Conference in New York last Wednesday: “Volume will decline and hedge funds will have to restructure.” Novogratz saw the Federal Reserve’s Quantitative Tightening as the main reason for the bear market in BTC, which has been ongoing since November. The Terra blockchain crash last month was also a “catastrophic loss,” he said.

That leaves two other factlets: the U.S. state of New York is deliberating a ban on crypto mining. Russia, meanwhile, wants to allow cryptos as an investment but ban them as a means of payment. Mixed news, then, that is currently being discussed. We are curious to see whether Bitcoin will catch on – and will keep you up to date!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7