30.11.2023 – Too high too fast. Gold and silver are about to crash, believes a precious metal bear. But perhaps he hasn’t been paying attention to China.

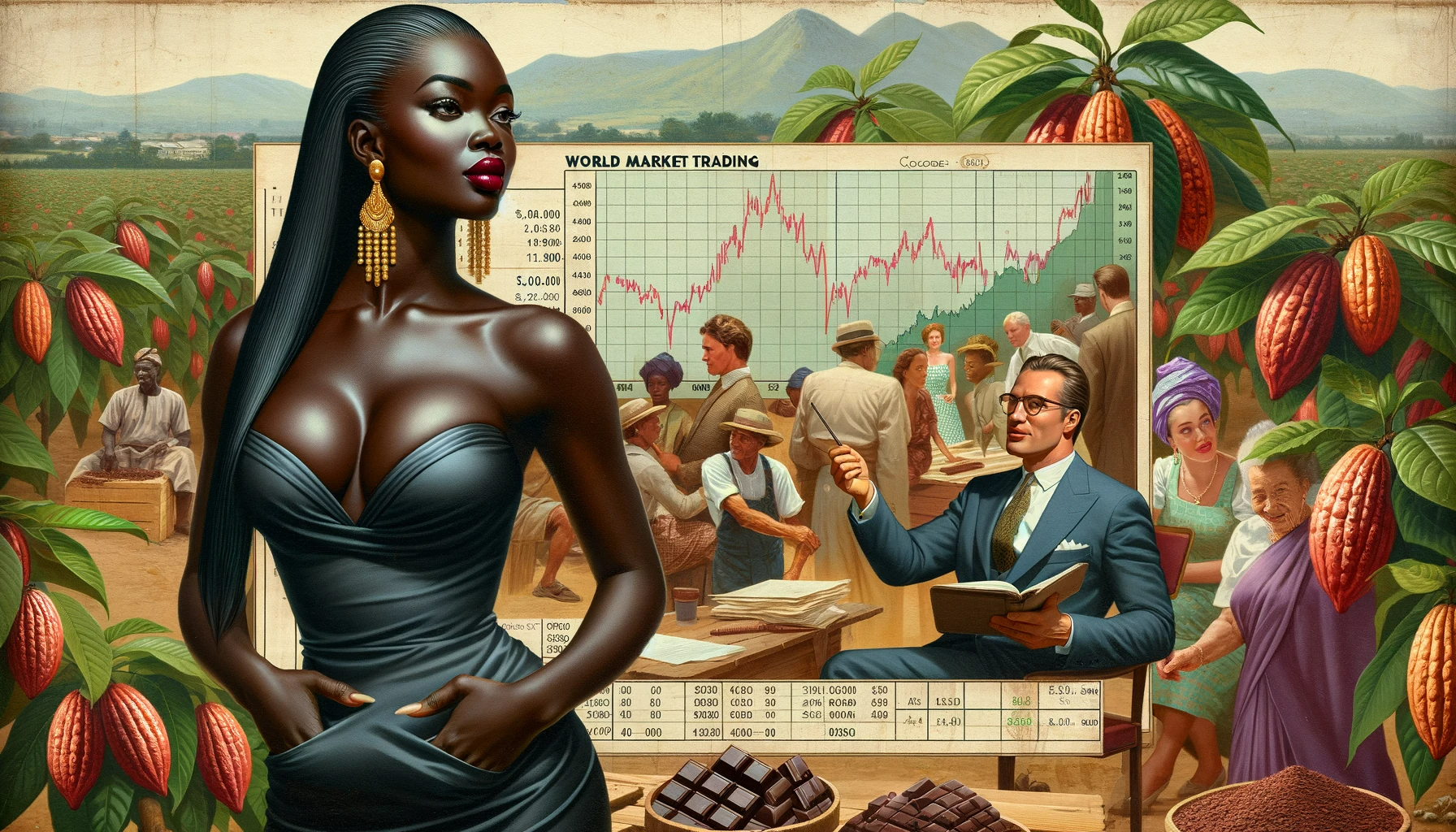

Let’s take a look at the gold price first. It has recently risen rapidly, as shown in the daily chart.

Source: Bernstein Bank GmbH

As loyal readers know, we also like to let the small and rather unknown players in the market have their say. Przemyslaw K. Radomski, for example, head of the investment boutique Sunshine Profits. He has just warned of several sell signals in gold and silver.

Signals in the greenback

Firstly, there is the strong stock market, which often correlates with the metal market. Then there is the weak dollar, which according to his chart analysis is on the verge of a turnaround: “We have a situation in the USD Index that is a screaming buy alert”. Here, the expert cited the overbought situation, visible in the RSI index, for example. His verdict: “Given the negative correlation between the USD Index and the precious metals sector, this very likely means that the tops in gold, silver, and mining stocks are either in or about to be in.” In fact, the Financial Times recently made a similar judgement: gold has reached a six-month high because the prospect of falling interest rates is weighing on the dollar.

Playground for small investors

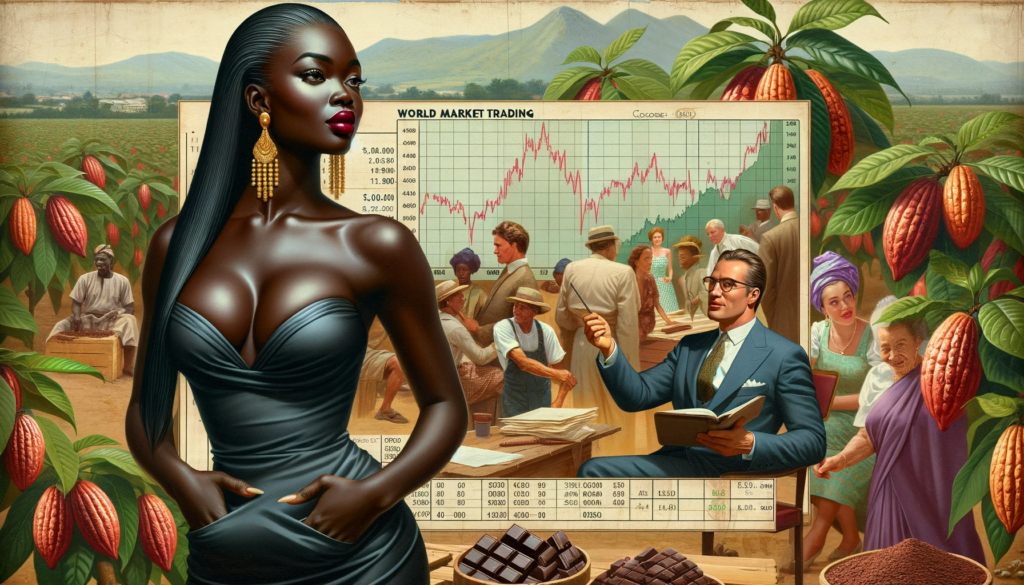

Sunshine Profits also referred to silver: if the white metal pulls up sharply compared to gold – which has recently been the case – then it is time to buckle up and prepare for a price collapse. Here is also the daily chart.

Source: Bernstein Bank GmbH

According to Sunshine Profits: “The silver market is considerably smaller than the gold market and it’s more popular among individual investors (compared to the interest from institutions), which means that as investment public gets excited, it’s likely to push the silver market more than the gold market. And when does the investment public get particularly excited? That’s right – at the tops, or very close to them.” In fact, small investors like to jump on the silver bandwagon when gold takes off – because the yellow metal is too expensive for them. But also because silver has a number of industrial applications, for example in electronics or solar energy systems.

China in a buying frenzy

But isn’t the perma-bear forgetting something? China, for example. According to the “China Daily”, experts expect demand to continue, “as economic and geopolitical uncertainties may drive up investors’ purchases of safe-haven assets.” Our interpretation: The Middle Kingdom is known for its inflationary policy; in view of the crash in the property market, new government money is the order of the day, increasing the money supply.

Demand for gold bars and coins rose to 82 tonnes in the third quarter – an increase of 16 per cent year-on-year and the strongest sales since 2018. In the first nine months, sales were 26 per cent higher than in the same period last year.

Wang Lixin, head of the China section of the World Gold Council lobby group, told the newspaper that after the Covid lockdown, there is now pent-up demand for weddings – and for jewellery. According to “China Daily”, demand for gold and silver jewellery climbed by 12.2 per cent in the first three quarters. According to the jewellery association, this increase was almost twice as much as the rise in the retail sector as a whole. However, it is not only retail investors who are buying, but also the central bank. Since the beginning of the year, the central bank has increased its reserves by 181 tonnes to 2,192 tonnes of gold. Investment funds are also buying: ETF holdings rose by 9.5 tonnes to 57 tonnes in the third quarter.

We are therefore curious to see how things will continue with precious metals – and wish you successful trades and investments!

________________________________________________________________________________________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7