25.06.2020 – Special Report. There’s life in the old dog yet. But lately, the prophecies that the Greenback is heading for his end have become more frequent. The arguments sound plausible: the reasons for the possible end are the excessive monetary policy in the US and the global corona shock. We shed light on the arguments of the bears.

Turning Point March 23

Those who do not believe in paper money bet on precious metals. Ergo, it is mainly the gold bugs that have been speaking out recently with warnings about the end of the dollar. Alasdair Macleod of GoldMoney.com, for example, sees 23 March as a decisive turning point in the fate of the US currency – and as the possible beginning of the end. On the 23rd, the Trade Weighted Dollar Index (TWI) reached its high for the time being, while the previously fallen stocks, gold, silver and copper moved up. On this day, something changed: Either the market decided that economic growth in the USA and the rest of the world would continue after the corona lockdown. Or that the purchasing power of the dollar would decline.

The new banking crisis

GoldMoney.com went on to say that it is unlikely that the US banking system will survive the current disruption to industry supply chains without damage. The banks are heavily in debt and fear of credit failure is growing – which is why financial institutions are reluctant to lend money to each other. Despite the massive interventions of the Fed, the liquidity situation of the financial institutions remains problematic, as is shown by the use of overnight repos in the amount of 20 to 100 billion dollars. Most systemically important banks around the world are currently worse off at the time of the Lehman crisis, according to GoldMoney.com.

End of 2020 the dollar is history

The dollar could fail completely by the end of the year. And this is how the end of the greenback will be: a long period of declining purchasing power, followed by a sudden collapse when people reject the currency completely. The second phase usually lasts six months. Then not only the domestic customers will be able to withdraw their money from their accounts. But also international investors, who hold around 25 trillion dollars in securities and accounts. And if foreign countries no longer buy US Treasuries, the Fed would no longer be able to finance the deficit, Macleod concluded.

Money supply kills purchasing power

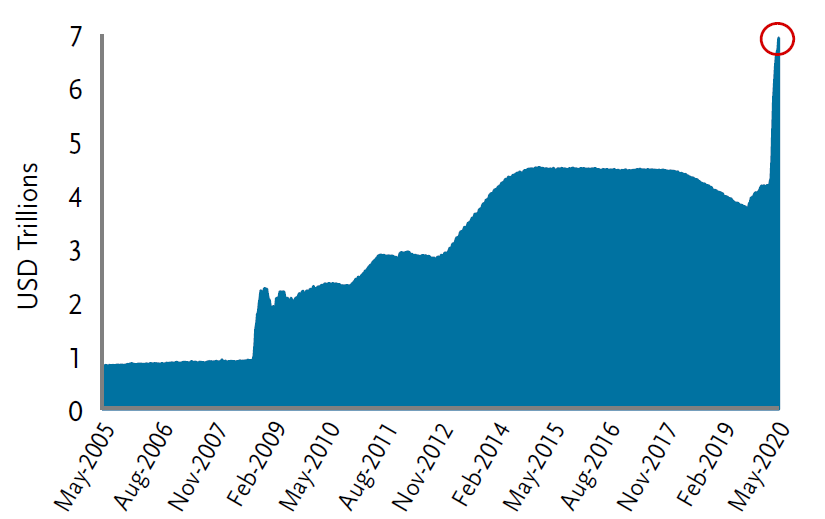

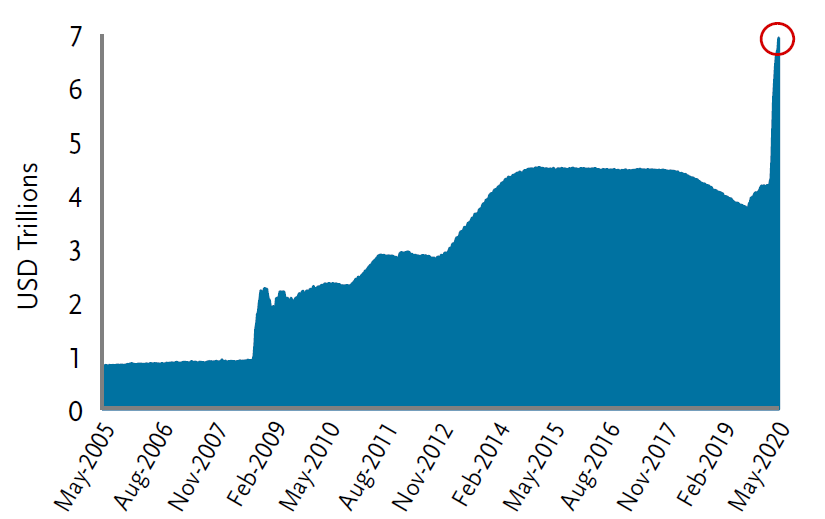

Another analyst also recently warned against a move away from the dollar – triggered by the gutting of intrinsic value in the course of the massive expansion of the money supply. Tad Rivelle is Chief Investment Officer at TCW Funds and MetWest Funds and manages around 180 billion dollars. And he stated that the Fed created billions out of nothing and massively expanded its balance sheet.

Source: Federal Reserve

This form of “Modern Monetary Theory”, with the almost unliminated flooding of money by issuing government securities that yield almost no interest, only works as long as the other side is willing to invest its assets in dollars instead of, for example, in commercial real estate or in currencies from emerging markets. This works as long as collective expectations are deflationary – then even a zero is attractive as an interest rate.

Beware of stagflation

But what happens later? Rivelle does not believe that dropping money from a helicopter will stabilize the economy on a broad basis. The shutdowns and the accompanying distortions in consumer preferences are likely to affect several sectors for a while: Restaurants, retail, energy, tourism, hospitals, aircraft construction, gyms and commercial real estate. The Fed has full control over the supply of greenbacks, but not over demand. All in all, the recovery from the Corona crisis will take an enormous amount of time – and the world after that will resemble the stagflation of the 1970s. In other words: a stagnating economy and rising inflation. If the dollar is not needed in an ailing economy and at the same time the money supply increases incredibly, people will turn away from a currency that offers less and less purchasing power.

The end is near

Egon von Greyerz from GoldSwitzerland.com also warned against an endgame. The dollar cycle, which has lasted for 50 years, had reached its end. During this time, the Greenback has lost 50 percent against the DM/Euro and 78 percent against the Swiss Franc. The US debt had increased from 400 billion dollars to 26 trillion since 1971. Unemployment in the US had reached almost 30 percent, according to the International Labour Organisation, almost 50 percent of workers in developing countries could lose their jobs. Thousands of companies are likely to topple over. There was no solution to a debt problem in a world that was collectively bankrupt, the report said. Almost all assets are likely to collapse, including stocks and real estate. First, the world will experience a hyperinflationary explosion, followed by a deflationary implosion. Accompanied by social unrest and probably wars.

Our conclusion: In fact, the arguments of the dollar opponents weigh heavily. But even bears can be mistaken. But the question is whether the US will emerge from recession faster than the rest of the world. Which should boost demand for the dollar against other currencies. Especially in the world’s largest economy, there is a huge backlog of demand – which means that the recovery on the stock markets would actually be an advance on the return to normality. Corona remains an important factor: if a vaccine or effective medicine is found, the global economy will quickly pick up strongly. With the tax revenues that would then bubble up, the mountain of debt could be paid off and the currency stabilized. The Bernstein-Bank keeps the matter in view for you and wishes you successful trades and investments.

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.