01.08.2023 – Interesting times: Despite the interest rate hikes, the gold price is not too far from its all-time high. JP Morgan even sees a new price record for next year. Gold would therefore be an investment for patient investors. Which is also due to the chart technique.

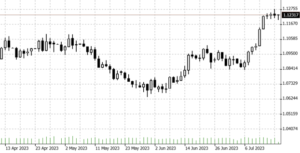

The resistance of gold is indeed amazing, here the monthly chart. Actually, the tightening in the world should affect the precious metal – because gold does not yield any return. Counterparts like government bonds or stocks with dividends, on the other hand, do. And a safe deposit box at the bank for the metal costs a fee on top of that. But the still high inflation speaks for gold. And the danger of recession. So that it goes further upward, the yellow metal must first break the resistance from three summits.

Source: Bernstein Bank GmbH

If the breakout comes, it will be because many investors still see gold as insurance in a recession. Greg Shearer, for example, executive director of global commodity analysis at JPMorgan. He expects gold to reach $2,175 per ounce by the fourth quarter of 2024.

Interest rate cut in case of recession

The expert believes in an end to interest rate hikes by the Federal Reserve after the July meeting just ended and even rate cuts by the middle of next year. According to JPMorgan, there is even more upside potential if the U.S. economy does slip into recession. In that case, the Fed would just have to cut rates again.

In fact, there are some signs that point to an economic crisis. For example, the Index of Leading Economic Indicators has already slid 15 times in a row – the longest stretch since 2007/2008. Now the Fed is pulling the “easy money” out of the economy – but the situation with debt and bad investments is far more dramatic than in the financial crisis of 2008, says Shearer.

The analyst concludes that gold and silver are “late cycle diversifiers and something that will perform as we look to the next sort of 12, 18 months.” In the second half of the year, the gold price will average $2,012 per ounce, he says. The expert believes there will be strong buying by institutional and retail collectors.

Central banks are buying

At the same time, diversification among central banks away from the dollar continued. Central bank reserves, for example, would have increased by 228 tons in the first quarter – 38 percent higher than the previous record for a first quarter set in 2013. The lobby group World Gold Council also believes that just under a quarter of the world’s central banks plan to diversify their reserves toward gold over the next 12 months.

We add: However, there is also the opposite trend. For example, in the weeks leading up to the presidential election in May, the Turkish central bank threw massive amounts of gold onto the market to support the lira, as Handelsblatt has learned from industry circles. Accordingly, Turkey may have dumped more than a hundred tons of precious metal between March and mid-May.

The Bottom Line: Watch the real-time news for signals of recession and hints of new interest rate cuts. If central banks then buy, gold should make a new run to the upside. Bernstein Bank wishes successful trades and investments!

_______________________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7