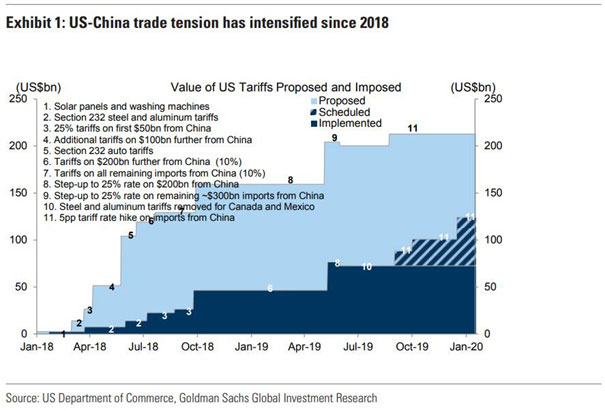

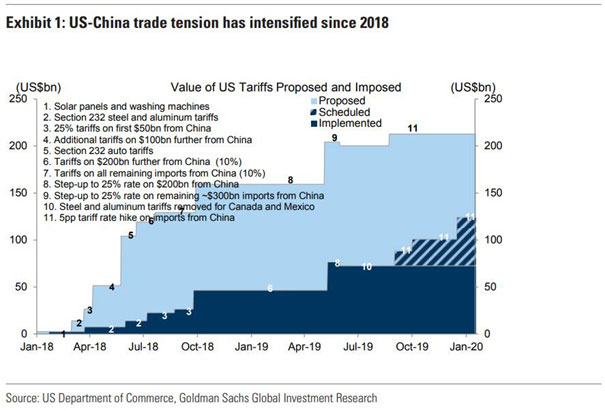

14.10.2019 – Special Report. Great pleasure on Wall Street, in Frankfurt and on the Asian stock exchanges: China and the USA have agreed on a minimum consensus in the customs dispute. So far so good – first of all the escalation spiral has stopped. But a closer look at the problems postponed into the future by Friday’s lean deal shows that new turbulences are inevitable.

First skepticism after the rally for hope

How were Wall Street and the German Stock Exchange cheering on Friday. Asia also made gains on Monday. But the first disillusionment set in on the Frankfurt floor at the beginning of the week. And for good reason. For now, after the smoke has gone from the bonfire, it becomes clear that nothing is actually clear.

That’s Phase 1.

First of all, the partial agreement of Friday still has to be signed. “Phase 1” of a major agreement includes intellectual property protection, financial services and monetary issues, US President Donald Trump said on Friday at a meeting with Chinese Vice Prime Minister and chief negotiator Liu He at the White House. If this partial deal really happens, this would be the biggest step in the two countries’ trade dispute over the past 15 months.

Sanctions spiral stopped for now

The most important thing from Friday’s deal: the increase in US punitive customs from 25 to 30 percent for Chinese imports worth 250 billion US dollars, which was actually planned for tomorrow, has been suspended. This will put a stop to the spiral of action and reaction. And the sentiment now seems to be improving again.

No real concession from Beijing

In return for the canceled sanctions, China undertook to purchase 40 to 50 billion dollars from American farmers, mainly pork and soybeans, which are used as animal feed. But this is not a real willingness to compromise. Rather, the Chinese farmers must now urgently push the breeding of piglets with increased fattening, because in the People’s Republic the swine fever rages and meat prices explode. So China acted out of self-interest. Moreover, according to Trump, Beijing did not keep to agro-purchases it had already promised months ago.

Vague details and unanswered questions

All details of the partial deal are otherwise quite vague, Goldman Sachs commented. All we know, too, is that US financial services providers should now have easier access to the Chinese market, probably without a domestic joint venture partner. But it is hard to believe that Beijing will stop manipulating the yuan downwards or copying foreign technology in reverse engineering. This is the Chinese business model that has brought prosperity to the country. By the way, the partial agreement does not deal with the Chinese telecommunications group Huawei either.

First showdown in mid-November

Trump also stressed on Friday that it would take three to five weeks until the now highly acclaimed partial agreement was signed. This is likely to be the outcome of the APEC summit in Santiago de Chile in mid-November. In about a month’s time it will be particularly exciting on Wall Street, in the DAX, on the dollar and on US government bonds.

Tension guaranteed until the end of the year

And the debate only becomes really interesting at the crucial points of industrial espionage, subsidies and industrial policy, i.e. preference for domestic companies, for example in the case of Chinese government orders. These really hard nuts – they are also part of the Chinese modus operandi and are actually non-negotiable for Beijing – must be clarified in a second and possibly third phase.

This also brings the mid-December date into focus. In addition to the already existing customs and the return of the postponed duties, the USA is keeping another threat in its hands: in mid-December, 15 percent punitive customs are to be levied on consumer goods from China worth around 160 billion US dollars.

Goldman Sachs noted that in view of the complex issues in Phase 2, a solution can be expected by the next customs round, if at all shortly before the deadline of 15 December. Especially as the next meeting of the Federal Open Market Committee is scheduled for 10 and 11 December. In view of the Christmas holidays, it was also possible to postpone the next customs increase at the beginning of 2020.

Short: New disappointments

Our conclusion: The lean “Skinny Deal” on Friday gives new hope for a recovery of the world economy. But this hope is only the opium on which the world’s stock markets are climbing – Hopium, as some US financial media aptly commented. The rush quickly fades away and the withdrawal symptoms set in. This short phase could now be imminent. In addition, a complete failure of the negotiations and an open trade war are still possible at any time. If you trade CFDs, these would be the Wall Street, DAX, or Dollar Short candidates. The safe havens would then be US Treasuries, Gold or the Yen.

Long: USA or China are buckling

It would be possible, of course, that Trump, because of the presidential election, that a rising stock exchange is more important than a genuine, comprehensive customs deal, which he had already promised before. Or China might collapse because the economy is hit hard by the existing customs. Then equities in global trade and the dollar should move up. Mirrored would be US bonds gold or the Yen sales candidates.

Only the volatility seems certain

However, since Donald Trump’s possible tweet tirades or the Chinese’s broken promises are both directional and timing challenges, a vola trade might be more appropriate. Because the only thing that seems to be guaranteed is fluctuating prices until mid-December. Which might make VDAX or VIX interesting candidates.

Bernstein-Bank wishes you successful investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.