If you are a trader who is looking for information about different financial instruments and ways to expand trading skills, we have compiled a comprehensive CFD guide. This topic is quite useful for a beginner who wants to learn more about the basics of trading and CFDs. However, this information will also be interesting for an experienced CFD trader who is eager to systematize his knowledge about online investments and once again review some of the stock trading fundamental principles.

In fact, CFDs are defined as contracts for difference. For trading with CFDs, a trader needs to purchase and distribute CFDs. The latter are economical derivatives allowing a trader to deal on markets, including Forex, commodities, stocks or indices, but with no need to physically purchase or sell them as a physical underlying. This type of trade stands out from share sale, since it does not let a trader have any basic assets nor the rights of a shareholder. Nevertheless, it provides a trader with the possibility of purchasing and distributing an asset and winning or losing the real difference between transaction’s entry and exit cost.

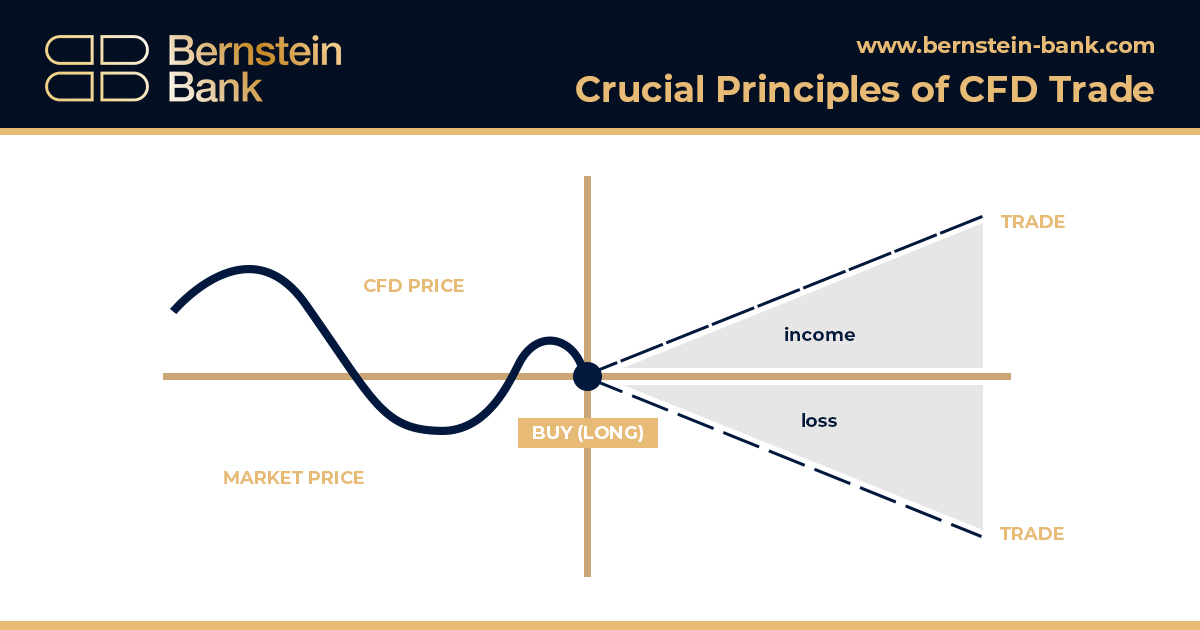

Among crucial characteristics of CFD distribution, one can mention the fact that any trader can earn from pricing swings in both directions (towards loss or income) in accordance with the accuracy of his forecasts.

Let us examine CFD crucial points by explaining the following terms:

- Long and short CFD trade sales

- Margin

- Hedging

- Leveraged trade

CFD Trade: Long and Short Positions

CFD trading enables a trader to profit by falling or increasing prices. A contract for difference’s position is not only useful to replicate a conventional investment, but it can also generate profits when the cost of basic assets declines in value. Such process is described as ‘going short’, which is just the opposite of ‘going long’.

Once a trader thinks the Google price is going to decrease, he is able to sell the respective CFD stock. Again, this is a cost delta between entry and exit prices, but a trader can secure profits if the stock pricing falls and incur losses if it goes up. No matter whether a trader goes short or long, his negative or positive earnings are only realized after the deal has been closed.

Leveraged CFD trades make it possible to achieve a higher position cost than in traditional trading. Let us say, a trader wants to take a Google position of 300 shares. For a conventional investment, a full stock price would be payable. At the same time, CFDs require to deposit just 20% as a margin.

In leveraged trading, a trader agrees to swap the price variation of a higher equivalent value of the basic asset with no obligation of depositing the full expense right from the start. Nevertheless, the revenue and expense rate is figured on the basis of the total position size, in this case – 300 Google shares. Therefore, both revenues and expenses can be multiplied enormously in comparison with trader’s original investments and that expenses can exceed the entry margin. That is why it is essential to consider leverage effect and undertake to act affordably.

- CFD Margin Functioning: Very often leveraged trade is named ‘margin trade’, because the deposits needed to take and support a position – ‘margin’ – mean just the split of the full extent of trade.Margin is divided into two types:

- margin required as an individual margin to take a position.

- aggregated margin required in case trading comes about to lose the margin and does not cover any additional capital on trader’s account.

In the event of adverse development of a leveraged position, a trader can receive a margin call from his dealer requiring him to carry out a margin payment on his account. If a trader does not raise enough funds, a broker can close the position and all damages suffered will be realized.

CFDs’ Modus Operandi

There exist four crucial factors of CFD trading: trading sizes, holding duration, spreads and gains/losses. Let us focus on them.

1. Spreads, commissions, swaps: CFD prices are divided into 2 types: purchase price (Bid) and selling price (Ask). Selling price is generally a bit less than the market cost, whereas purchase price is still slightly higher than this one. The variance between these 2 prices is defined as ‘spread’.

The smaller the trader’s spread, the sooner he becomes positive on his CFD deals. As far as contract for difference is concerned, there are CFD trade accounts that have no commission for entry and exit of the transactions. In this scenario, only spread counts in these CFD transactions daylong.

In case trader’s CFD position remains open from one day to another, a swap fee intervenes to keep it open during the night.

Exceptions to the afore-mentioned operation are CFDs that are not settled over spread. Alternately, purchasing and selling prices is in line with the cost of basic assets, and the fee for opening a CFD equity position is commissioned. Commissions to speculate on stock prices through contracts for difference are close the to the costs of trading physical stocks.

2. Trade size: Contracts for difference are sold in the form of lots, standardized contracts. The total amount of CFD is formed the basis of the basic asset and often matches the size at which it is traded in the current pipeline.

Gold is traded on commodities exchange, for example, to 100 troy ounces per lot. Accordingly, a golden CFD is also traded for 100 troy ounces per contract. For equity CFDs, one contract equals one share.

3. Holding period: It is noteworthy that the majority of CFD trades are free from fixed expiration dates. A trade gets closed by locating it in the opposite direction to the one chosen for the opening. If a trader buys 100 silver contracts, he must sell 100 silver contracts to close the position.

If a trader leaves a CFD position open on the expiry of a trading day (around 23.00), he will – beside a few exceptions – pay overnight financing costs. This fee affects the cost of funds that were finally borrowed to take the leveraged position.

4. Profit and loss: P&L CFD Long Position

P or L = Amount of contracts * Rate of each contract * (exit price – entry price)

P&L CFD Short Position

P or L CFD = Amount of contracts * Rate of each contract * (entry price – exit price)

To make a complete computation of the loss or gain of a transaction, it is necessary to remove any charges, commissions or stop loss fees that have been applied.