12.01.2020 – Special Report. Carnage among cyber currencies: The price of Bitcoin plummeted by double digits on Monday. A warning from England was to blame. And a major investor threw in the towel. Previously, investors had increasingly bet on cyber currencies: After the Senate election in Georgia and the promised inflationary orgies of the coming US administration, the crypto market has exceeded the $1 trillion mark for the first time.

Selloff because of FCA warning

It can happen that fast: Last week, the crypto market had reached around 1.1 trillion dollars. To date, it has lost around 200 million dollars in value. Bitcoin slipped from around 40,000 to around 32,000 dollars. One of the reasons is the surprising strength of the dollar for the market.

In addition, a warning from the British Financial Conduct Authority (FCA) sent cryptos south: investors should be prepared to lose everything. A press release stated: “Investing in cryptoassets, or investments and lending linked to them, generally involves taking very high risks with investors’ money.” In addition, “The Times” reported that some banks refused to execute transfers from crypto exchanges. Incidentally, the major trading venue Coinbase was unavailable for the second time in three days, which caused some nervousness in the market.

Guggenheim shoots down the Cryptos

Finally, Scott Minerd of Guggenheim took aim at e-currencies. He tweeted: “Bitcoin’s parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded. Time to take some money off the table.” The man knows what he is talking about, he had set the $40,000 as a target in December.

The mother of all bubbles

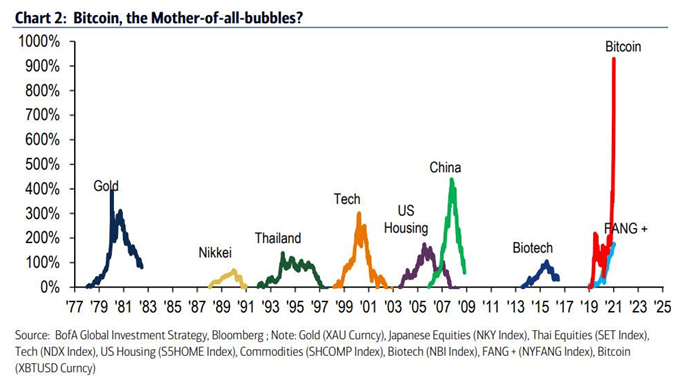

A few days ago, Bank of America also called Bitcoin “the mother of all bubbles”. Analyst Michael Hartnett stated: “violent inflationary price action past two months, bitcoin is up 180%, with the cryptocurrency market now more than $1tn as Bitcoin past 2 years blows-the-doors-off prior bubbles.”

Hartnett’s conclusion: the bursting of the bubble remains the biggest bull risk. And just as an aside, he also warned of the growing polarisation in the US electorate, just as we did in our recent Special Reports. Here are his words: “decade-long backdrop of maximum liquidity and technological disruption has caused maximum inequality & massive social and electoral polarization…value of US financial assets (Wall Street) now 6X size of GDP.”

Devaluation of the dollar

So much for the bears. Is it going up again? Who knows. The bulls also have some arguments on their side. Above all, the expected inflation had previously boosted the virtual currencies. Investors fear the devaluation of their savings: “The more that people perceive that their assets, particularly their liquid assets such as fiat currencies are eroding in value, the more they will look for alternatives,” said Geoffrey Morphy, president of the Canadian crypto-miner Bitfarms Ltd.

Indirect BTC investment

Virtual space is also safe if the banks collapse. For now. But there is a problem: as you know, we have been warning for some time that Beijing and the rest of the world could eliminate BTC and co. as unloved troublemakers in monetary policy. Simply by banning them, as Ripple recently experienced.

The first smart investment banks are therefore taking a diversion. Morgan Stanley, for example, almost quintupled its shareholding in MicroStrategy to over 10 percent in the fourth quarter. The software company had invested around 250 million dollars in BTC in the summer and has thus become a kind of BTC fund. Morgan Stanley is thus on the safe side in terms of an exit: direct investors will be stuck in Bitcoin if a ban comes. On the other hand, investors will get out of stocks like MicroStrategy.

Caution contraindicators

On Sunday, the Economist, which is of course much more professional in economic terms, pointed out that BTC should continue to rise if portfolio managers step in more – at least the e-currency will have bottomed out. It looks like some investors took advantage of this to cash in in the short term after the news was blown out into the world. Our conclusion: the only thing that is clear is that there is never a dull moment in cryptos. We are curious and will keep an eye on the matter for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.