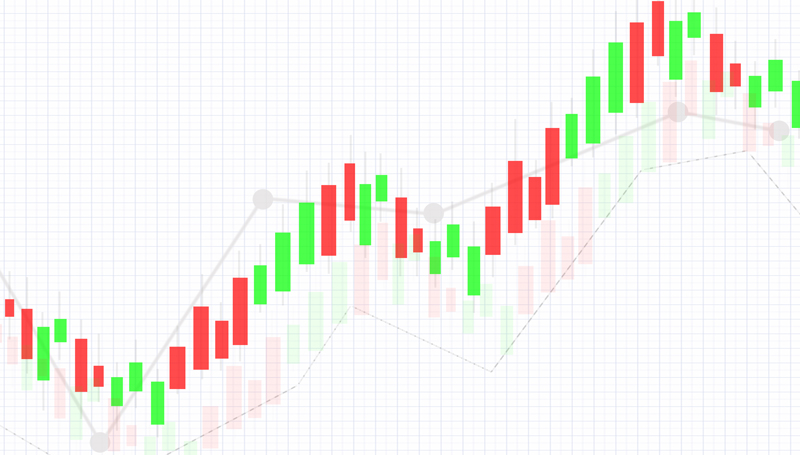

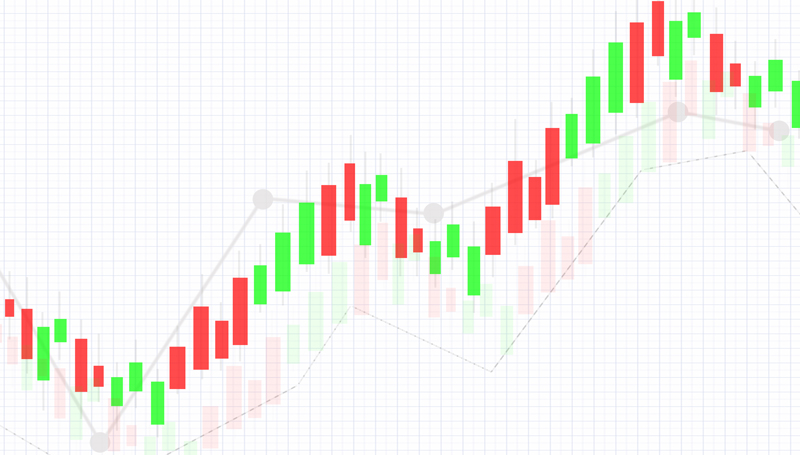

24.10.2019 – Daily Report. Has the year-end rally now begun? In early trading, the DAX has already reached a new high for the year. The price drivers are strong figures from Daimler. And the hope that the era of cheap money will continue in Europe, which many brokers are now certain of. The departure of Mario Draghi from the top of the ECB will probably not change this.

DAX and Euro want to go up

No interfering fires of any kind from the long-time burners Brexit, Customs dispute China-USA and Impeachment Donald Trump. Instead, strong figures from Daimler and moderate profits on Wall Street – as well as the prospect of sustained low interest rates in Euroland. The logical consequence: big names are getting involved, the leading German index is already pulling back to a new annual high. In the morning, the DAX reached 12,913 points and recently held up at 12,848 points with a plus of 0.4 percent. Only yesterday, after a hesitant start, the DAX reached an annual high of 12,819 points. Now the 13,000 points are actually within reach. The euro also rose according to the French purchasing managers’ index and climbed to 1.1163 US dollars.

Whatever it takes

Topic of the day will be the last meeting of ECB President Mario Draghi. The Italian will go down in history for his words that he will save the euro whatever it takes from summer 2012. At that time he actually saved the eurozone by keeping investors away from South country government bonds. And by flooding the market with zero interest and cheap money, he pushed share prices up. However, the question arises as to how the European Central Bank will intervene in the event of a recession and how commercial banks should earn any money at all in view of the ECB’s penalty interest rates – and the central bank seems to be at loggerheads as never before. The large monetary support package adopted in September met with fierce criticism from the Governing Council of the ECB.

However, the key interest rate, which has been at a record low of 0.0 percent since March 2016, will probably not be touched today. Traders will keep an eye on the euro, German government bonds and the DAX from 1.45 p.m. onwards.

Nikkei also at year high

Meanwhile, investors in Asia acted without a clear trend. The CSI-300 closed unchanged at 3,871 points. Supported by price gains in Japanese semiconductor stocks, the Nikkei rose by 0.6 percent to 22,751 points. This is the highest level for about a year.

Moderate growth in New York

The New York Stock Exchange also stocked up yesterday. The Dow Jones recorded a plus of 0.2 percent to 26,833 points at the closing bell. The S&P 500 rose by 0.3 percent to 3,004 positions. And the Nasdaq Composite rose by 0.2 percent to 8,119 points. The Dow was supported by moderate price gains from Boeing and Caterpillar after both groups had presented quarterly figures that were interpreted as bottoming out.

Fed pushes the market forward

There remains a brief explanation for the mysterious final spurt on Wall Street yesterday for many brokers. As so often, the famous financial blog ZeroHedge provided an explanation: At 3.15 p.m. American time, the New York Federal Reserve announced that it would drastically increase liquidity from today and beyond 14 November. In concrete terms, the availability of overnight repos is to rise from 75 to 120 billion dollars, while the Term Repo commission is to rise from 35 to 45 billion dollars. ZeroHedge suspects a panic at the Fed, which probably fears cash bottlenecks in the course of Brexit.

New power for the Turkish lira

And finally, a look at the lira – it has recently appreciated again against the euro and the dollar. Which is related to the end of US sanctions in the wake of the ceasefire. The very readable “Neue Züricher Zeitung” stated that Syria’s Kurds thanked US President Donald Trump for the end of the Turkish attack.

This is what the day brings

The diary today brings some interesting events, you will find the overview as always here: Market Mover

First of all, the ECB’s interest rate decision is due at 13.45 hrs. The last press conference with Mario Draghi will follow at 14.30 hrs. The question of whether and to what extent the central bank will continue to open the money floodgates will be exciting.

At 2.30 p.m., orders for durable goods will also arrive in the USA in September.

At the same time, the first weekly applications for unemployment benefits will be registered.

The Markit Purchasing Managers’ Index for Industry and Services will also be announced at 15.45 hrs.

New US construction sales for September are also due at 16:00.

Intel and Visa are among the companies reporting quarterly figures.

Bernstein-Bank wishes successful trades!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.