24.10.2019 – Special Report. The curtain falls for Mario Draghi today, Thursday, as the head of the European Central Bank chairs his final Council meeting. The Italian seemed to be at the end of his rope – the economy simply won’t start. And in view of the zero interest rate policy, the central bank has hardly any chance of countering a recession. The chances are increasing that what has been denied so far will happen after all – helicopter money for everyone. We shed light on the consequences for the financial market.

The zero interest rate does not work

This is the world Mario Draghi left us in close alliance with the Federal Reserve: The billions in central bank money just don’t help. The inflation rate in the Eurozone has recently fallen to 0.8 percent. The target of close to 2.0 percent is a long way off. At the same time, the latest economic indicators signal a significant economic slowdown in the euro zone. Industry is already in recession. But the key interest rate is already at zero, and the penalty rate for banks that park money with the European Central Bank has been lowered to 0.5 percent. The flood of money is simply not reaching the real economy.

Now the ECB wants to buy bonds worth 20 billion euros per month again from November, the end of the programme is open. The stock market is pleased with the liquidity. But the bubble on the bond market is now taking on alarming proportions. The ECB is in deep dispute: several national central bank heads have distanced themselves from the agreed measures. Unfortunately, the phenomenon is global. Although trillions of dollars, euros and yen have been pumped into the system since the collapse of Bear Stearns and Lehmen Brothers in 2008, growth is weakening.

Negative Example Quantitative Easing

There is a growing fear that Europe will flourish what America is currently doing. The Fed must increasingly play the Lender of Last Resort. Why the banks are currently distrusting each other is completely unclear. Assumptions range from a cash drain in the wake of Brexit to collapsing synthetic corporate bonds – we had already pointed out the repo crisis and the danger posed by collateralised loan obligations in special reports.

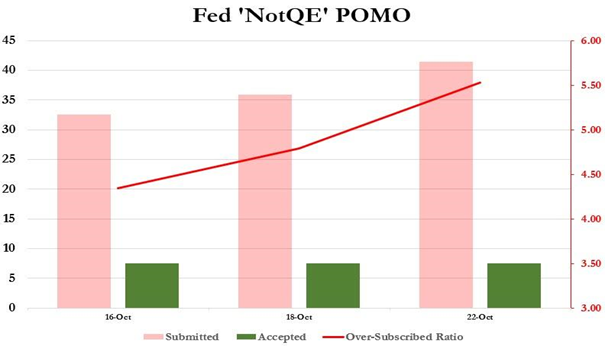

However, on Monday the New York Fed announced that its POMO (Permanent Open Market Operations) auction for Treasury Bills worth $7.5 billion was 5.5 times oversubscribed. Requests for fresh liquidity amounted to 41.472 billion dollars. This was the third auction in which demand far outstripped supply. The Fed is now pumping an additional $60 billion a month into the market via T-Bills. The US monetary authorities still do not want to talk about a new quantitative easing IV – but the market does.

Bank panic: DAX and Dow short – Gold and Yen long

This is a sidestep for all traders: we are perhaps in the middle of a banking crisis that has not yet been made public. Any visible sign of a disaster like the one in 2008 that is now on the surface can plunge Wall Street into panic – and the DAX into it at the same time. In this case, as so often, investors are likely to flee to safe havens – especially gold and the yen.

A new idea has to be born

And now back to the possible countermeasures of the central banks. How will they save the market if the banks overturn again, which is not well received by the voters? One possibility would be for the masters of money to expand their buying universe. A purchase program of 20 billion bonds by the ECB, for example, is considered by many augurs to be too small. Which would speak in favour of long trades in bonds in particular. But government bonds are gradually becoming scarce in Europe. So how about corporate bonds?

Draghi refersto MMT

And that brings us back to Mario Draghi’s legacy. According to Bloomberg, he told the European Parliament on September 23rd that the ECB should devote itself to new ideas like the MMT – the Modern Monetary Theory. However, the elements of modern monetary policy have not yet been tested. The MMT is a flow of post-Keynesianism according to which government budget deficits should not be too low. A state can never go bankrupt, so the MMT rejects austerity policy. Interestingly, Draghi also referred to an essay by three distinguished colleagues.

Blackrock discusses QE for the people

In August, three prominent experts judged: “Monetary policy is exhausted and fiscal policy alone is no longer enough,” said Philipp Hildebrand, former head of the Swiss National Bank, in August. Stanley Fischer, former member of the Federal Reserve and the Bank of Israel, and Jean Boivin, former Deputy Governor of the Bank of Canada, were also co-authors. The trio wrote in an article for the current employer Blackrock that the central banks must give money directly into the hands of the public and the private sector, Bloomberg reported.

Helicopter money or not?

So the idea of Helicopter Money reappears. Draghi himself was always ambivalent here. At the press conference in Frankfurt on 12 September of this year, he denied that the ECB Council had discussed helicopter money – that was not an option. However, the non-governmental organisation Positive Money Europe claims that Draghi had described the procedure as possible to EU parliamentarians in the previous months. And the “Wirtschaftswoche” had already reported in March 2016 that Draghi had said in front of journalists that the Central Bank Council had not thought about or discussed this – but he had also spoken of a “very interesting concept”.

The concept was invented by Nobel Prize winner Milton Friedman in 1969. The idea became famous through former Fed chief Ben Bernanke – he explained that in the event of deflation he would throw money from the helicopter if necessary. Since then he has been known as “Helicopter Ben”. The project could be implemented in this way: The state either grants a tax refund; or the central bank transfers money directly to the accounts of the citizens.

DAX and Dow long – Gold, Silver, Oil long

And that would have consequences for the financial market: many consumers would probably use the money gift immediately for shopping or a holiday. This would bring fresh sales to the companies and would result in rising share prices. Of course, smart traders and craftsmen would immediately increase prices for their services, cars or clothing. De facto the money supply would increase and the new air money would boost inflation as hoped. Which would demand gold and silver, real estate, of course. Also, more paper money would not seek arbitrarily reproducible raw materials such as oil.

So: material assets would be trumps. After the rise in wages and prices, everything would settle back in the new, higher equilibrium. And probably at some point a speculation bubble would burst – probably with new financial products, real estate or incredibly hip start-up companies that nobody needs.

Our conclusion: If we are actually threatened by a new crash in the financial market, anything is possible. As absurd as the idea of a gift of money sounds for everyone – it could become the ultimate ratio for the central banks. The Bernstein Bank is keeping an eye on the issue for you.

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.