27.04.2020 – Special Report. A new price massacre is looming on the oil market: In mid-May, the oil tanks in the USA are full, and the situation on the globe is no different. But in America a wave of bankruptcies of oil companies is underway, many boreholes are closed. Some of them will probably stay closed forever. The market shakeout could be the basis for a new beginning. Especially since OPEC+ is now cutting back on production. This could push the oil price up again strongly within a few months.

Pipelines as a last resort

The American oil companies are throwing their last troops into the fray. In an unusual move, pipeline giant Energy Transfer asked the Texas Railroad Commission for permission to use its pipes as a tank. This could be used to store 2 million barrels, as reported by Oilprice.com with reference to Argus Media. Earlier this month, Enterprise Products Partners had already asked the U.S. Federal Energy Regulatory Commission to allow it to use its northbound Seaway pipeline as a storage facility, according to Reuters. We wonder: How much oil can be stored in pipelines in the USA? 10 million barrels? 20?

Global Oil Flood

We also ask ourselves: How much oil fits into pipelines in Russia or the Persian Gulf? How much on tankers, in oil tanks and on trains? Dozens of bulging oil tankers are anchored off the coast of California and Texas, hundreds off Singapore. Meanwhile, the U.S. Department of Energy is helping the oil producers, and the Ministry is negotiating with nine producers to store 23 million barrels in the Strategic Petroleum Reserve (SPR), the gigantic salt domes on the coasts of Texas and Louisiana.

Endgame mid May

Meanwhile, in the Gulf of Mexico, refineries are reducing capacity due to falling demand. According to Goldman Sachs, in about three weeks there will be nowhere left to store oil. “We are moving into the endgame,” was the verdict of Torbjorn Tornqvist, head of the commodity trading giant Gunvor Group. “Early-to-mid May could be the peak. We are weeks, not months, away from it.”

Tension in June contract

Interestingly enough, trading in the June Future for West Texas Intermediate expires on 19 May.

We are curious to see if we are facing another price massacre. At the end of April, the May contract had plummeted to minus 40 dollars. For June, a drastic improvement in demand and inventory capacities must be seen as soon as possible. Perhaps the crash in the May contract had also marked the low.

The market shakeout is underway

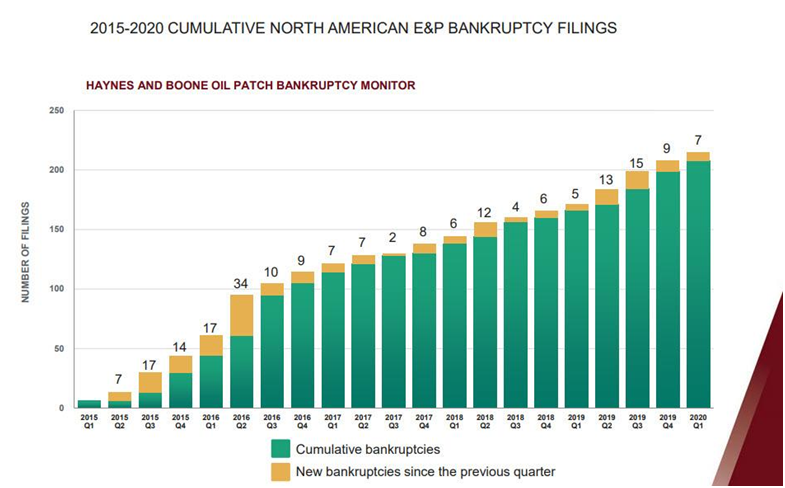

What is clear is that only an end to the oversupply will resolve the crisis. And in the US, the eradication of companies is in full swing. Diamond Offshore Drilling from Houston has just filed for bankruptcy; the company, always considered a jewel among oil producers, is sitting on debts of 2.6 billion dollars. Since deep-sea drilling is particularly expensive, the company needs an oil price of 30 dollars per barrel to operate profitably. Diamond Offshore is only one of about 200 North American oil companies that have been turned over since the beginning of 2015, according to the law firm Haynes & Boone.

US oil sources could dry up forever

Meanwhile, Baker Hughes reported that only 378 US wells produced oil last Friday. In the high of 2014 it had been around 1,600. An interesting development, because it is enormously expensive to seal a well. Moreover, especially in the USA, there is a danger that oil wells that have been developed with fracking and cross drilling can no longer be salvaged, as they will silt up at the end of production and become saturated as soon as the pumping in of water and thus the pressure in the fractured rock subsides.

Global turnaround

The same picture is evident all over the world – from Chad to Brazil and Vietnam, emissions are being capped. And on 1 May, the OPEC+ production cut of 9.7 million barrels or 23 percent of output will come into effect. If we now process all this information, we get the impression that we are facing a massive turnaround in oil prices. Production is falling drastically, and some US states, China and several countries in Europe are gradually easing corona restrictions. As a result, demand for gasoline and kerosene should slowly increase again. However, new tensions in the Persian Gulf could also drive up prices. Ergo, new opportunities could arise on the long side.

The Bernstein Bank wishes successful trades!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.