29.05.2023 – The election in Turkey is over. The old President Recep Tayyip Erdogan is also the new one. Investors flee, the lira marks a new all-time low. Now it is only a matter of time before things get really interesting again: The central bank will have to intervene.

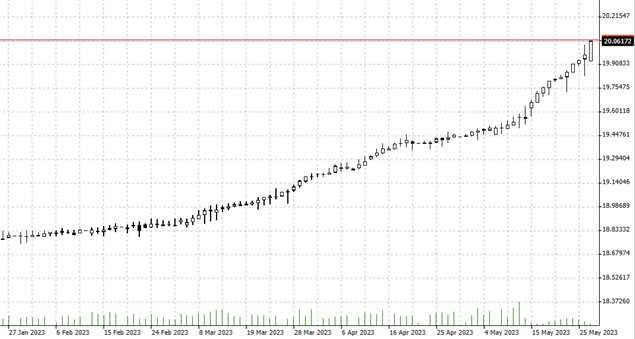

A daily chart like the launch pad of a rocket in the past: USDTRY has broken through the sound barrier of 20. A few days ago, there was already a small foretaste of the coming forex battle: After a short flash crash, the central bank intervened, as reported by the financial blog “ZeroHedge”. Nevertheless, the magic mark of 20 has fallen.

Source: Bernstein Bank GmbH

According to “Zero Hedge”, the trigger for the recent turbulence was Clemens Grafe, forex strategist at Goldman Sachs. His analysis unfolded its effect on the lira since last Monday. The expert had reported this about the Turkish Central Bank: “net foreign assets fell by US$3.2bn to negative US$14.8bn”. He further warned, “given the slowdown in the rise of TRY deposits and this week’s decline, we think TRY liquidity in the system is becoming more limited.” The essence: capital flight from Turkey before the runoff election. And the central bank’s ammunition is dwindling.

Bloomberg, looking at volatility, reported as early as the first round of the election that the market was preparing for the lira to crash to 24. According to Bloomberg Economics, Turkey’s central bank shelled out $177 billion to support the lira between December 2021 and April. Before the election, foreign investors would have held only about $24 billion in Turkish assets. A decade earlier, there had been $150 billion in bonds and equities.

On and on with Erdoganomics

And now the same song. “Unless there is another fist-pumping surprise, Erdogan’s rule, along with the unorthodox policies described as the Turkish economic model, will probably continue,” explained Commerzbank analyst Tatha Ghose in an interview with “Tagesschau.” All economists see interest rate hikes as an effective means of fighting inflation. Only Erdogan does not. The central bank just left the key interest rate unchanged at 8.5 percent. And that with an official inflation rate of still 44 percent.

Prepare for intervention

We suspect: The new government is likely to make an example of the lira again soon, in order to mow down lira shorts. Officially, it is always said that only evil speculators are responsible for the currency’s decline. There is probably still money for intervention. In a recent interview with CNN Turkey, Erdogan said: “Our economy and the banking and financial system are quite strong. Meanwhile, some Gulf countries have put money into our system – even if it is only for a short time.” After the May 28 runoff election, he said, he would thank the donors. Erdogan did not name any countries or sums. What is known is that Turkey has concluded swap deals with the United Arab Emirates, China, Qatar and South Korea worth about $28 billion in recent years.

The bottom line is that the lira offers tremendous short-term opportunities for savvy traders. It is not impossible that the central bank times just multiply the interest rate for the overnight loan to eliminate shorts. Which should strengthen the lira in the short term. In the long term, however, we see little hope for the currency – but let’s be surprised. Whether long or short – Bernstein Bank wishes successful trades and investments!

___________________________________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7