29.04.2022 – The time has come: For Russia, the beginning of the end of the Ukraine war has begun. Because just like in the Second World War, the USA has now passed the Lend-Lease Act. Only for the second time in its history. Thus, the victory of Ukraine is only a matter of time. And all stock market players have to ask themselves whether this will lead to a celebration of joy. Or to an escalation by Russia and a crash.

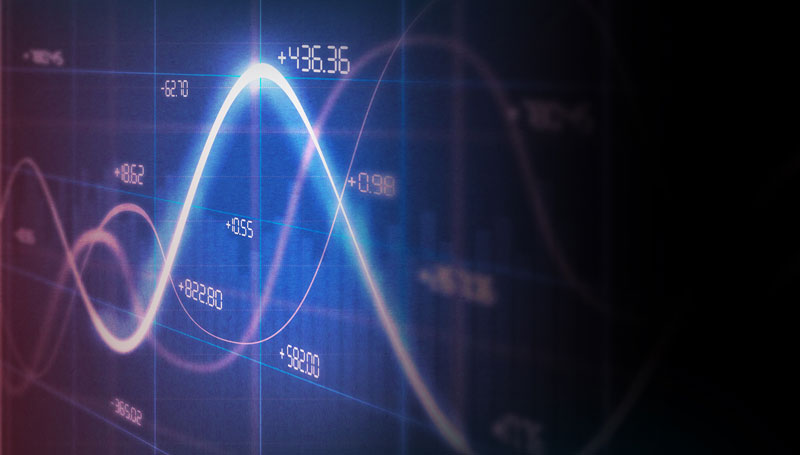

Pure coincidence or the first shock reaction? Russia stopped its attacks in eastern Ukraine during the night. In the days before, Moscow’s threats of nuclear war had piled up. Either way, the U.S. House of Representatives passed the Ukraine Democracy Lend-Lease Act of 2022 after the Senate. A real game changer, also for the stock market. Up or down? The only thing that is clear is that the nervousness will persist. You can see, for example, in the daily chart of the Dow Jones that investors have been looking for a clear direction for weeks.

Source: Bernstein Bank GmbH

Since the quality media here have hardly registered the political event so far, here is a brief historical background that investors and traders need to know. Britain had long been at war alone with the Soviets on the European continent during World War II. The foreign exchange reserves had been depleted, the kingdom had had to buy weapons on the principle of cash and carry. So just like everywhere else in the economy: put money on the table, take tanks.

The turning point in the Second World War

On February 18, 1941, however, the U.S. Congress passed the Lend Lease Act, officially called An Act to Promote the Defense of the United States. With it, the British – and the Soviets, too – could take weapons on credit. Fight now, pay later. Moscow, for example, paid in raw materials after victory. From February 1941 onward, at any rate, the flow of U.S. weapons for the anti-Hitler coalition swelled ceaselessly.

War on credit

So it could be again. For the Ukraine Democracy Lend-Lease Act of 2022 (S. 3522), now passed by the House, frees the White House from some bureaucratic and funding shackles on arms exports. Now there is no longer a need to debate budgets and the purpose and value of weapons forever. Depending on the situation on the front lines, deliveries can be made. Whether and how Kiev pays for vast amounts of material will be clarified sometime later. This could also involve the free transfer of bases for the Americans in Ukraine, who knows.

The warthogs are lurking

In any case, things are now getting tricky for the Kremlin. For the U.S. has some weapons up its sleeve that could soon blow the Russian army to smithereens. For example, the Fairchild Republic A-10 Thunderbolt II aircraft designed for ground combat. Better known as the “Wart Hog.” The National Review pointed out that the U.S. Air Force has more than 350 Wart Hogs in its inventory that it wants to get rid of anyway because of obsolescence, hard-to-get spare parts and the supposedly modern air defenses of China and Russia.

Brrrrrrrt

The jet is a The Hog is a hell of a machine, built especially to fight the Soviet tank masses. The main weapon of the Hog is the GAU-8/A Avenger 30×173 mm machine gun. Its typical brrrrrt buzz has made GI’s all over the world cheer in dicey situations. The jet had long been seen as obsolete because of the end of the Cold War and the conversion of many armies to helicopters. Now, however, it could make a comeback against the sometimes nicely lined up Russian tank columns.

Kreml under pressure

Which brings us back to the stock market. For the siloviki – i.e. the representatives of a powerful state – around Vladimir Putin, the Ukraine law is the beginning of the end of the invasion. The question is whether Russia will now pull back. Or whether Moscow will escalate. The Kremlin has certainly realized that the country is now seen by the West on a par with Nazi Germany – negotiations pointless. Russia has always reserved the option of using nuclear weapons not only in the event of an attack against its own country. But also if its own military goals are not achieved. So: keep an eye on the real-time news right now. We have reached a strategic fork in the road that also affects the financial market. Bernstein Bank wishes you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7