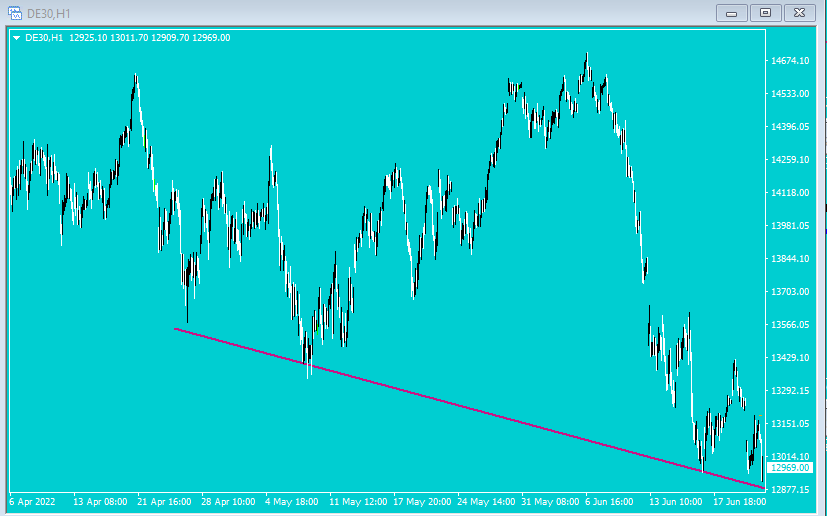

23.06.2022 – Now it’s getting exciting for the German stock market: An impending recession in the USA and the Ukraine war as well as a probable economic crisis in Europe are weighing on prices. The DAX is testing an important support zone.

On Tuesday, the DAX briefly dropped below 13,000 points to its lowest level since March. Yesterday, the German benchmark index had slipped to a three-month low. Société Générale commented that the index is currently sounding out the critical short-term support zone, which extends to 12,971 points. A daily close below this would confirm the overriding downward trend and make a timely reunion with the course low from March at 12,439 points likely. Most recently, the market tested this very zone.

Source: Bernstein Bank GmbH

This had happened: On the one hand, Jerome Powell caused nervousness yesterday with his speech before the Banking Committee of the U.S. Senate. He conceded that a recession as a result of higher interest rates was “certainly a possibility.” A so-called “soft landing” – that is, a resolution of the crisis without major damage – would be a challenge, he said.

Clueless on inflation

Then Powell caused raised eyebrows by acknowledging his own miscalculation: “Inflation has obviously surprised to the upside over the past year, and further surprises could be in store.” Powell thus confirmed his critics, who accuse him of saying that the Fed has acted too weakly too late. So we could still be in for a few more rate hikes as a pent-up demand. In addition, he explained that the Fed is powerless, for example, when oil prices rise. But wait a minute: Higher interest rates as poison for the stock market – and still no all-clear for inflation because of the dents in the supply chain? Stagflation!

Onward in Ukraine

Especially since the topics Corona and above all by Ukraine war remain for the stock exchange. Both events block the supply chains enormously and provide therefore for rising prices. While with Corona hope for improvement is announced, it looks different in the Ukraine. Russia just has to continue as before: block grain deliveries, throttle gas, bomb Ukraine. There are plenty of petrodollars from the West, and in the course of the grandiose German energy turnaround, with modern German nuclear power plants standing around uselessly switched off, it will take a few months to replace Russian oil and gas.

Appeasement in the West

Meanwhile, weapons from the West for Ukraine are only available in medical doses, because we don’t want to anger Vladimir Putin. The louder and more pseudo-decisively the heads of state and government of Germany, France or Italy act, the less heavy equipment Ukraine will receive. The current decision-makers in the Chancellery and the Ministry of Defense are a big gift for the Kremlin. Ergo, the pressure on the German economy and on the stock market will not let up from this side. Whether long or short – Bernstein Bank wishes you good luck with your trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7