05.07.2019 – Daily report. The stock market is waiting for the latest figures on the US labour market. And the return of Wall Street – American trading had remained closed the day before because of “Independence Day”. Data from German industry is also disappointing. The DAX, for example, is stagnating on Friday noon.

Frankfurt moving sideways

No progress on the German stock market. The DAX recently held steady at 12,610 points with a minus of 0.2 percent. On Thursday, the leading index set a new record for the year at 12,659 points, its highest level since August 2018. A quick glance at the chart analysis: the DAX should not close below the 12,519 mark. This opens a gap – and price gaps are normally closed.

German industry not running smoothly

Finally, a damper for investors: German industry suffered a slump in orders in May. The Federal Statistical Office announced on Friday that a total of 2.2 percent fewer orders had been received than in the previous month. Economists had expected much less. It is therefore clear that German industry is in recession. Which some brokers quickly reinterpreted as an argument for a continued loose monetary policy of the European Central Bank.

Bond yields plummet

This confirmed the scepticism of many investors. Accordingly, a lot of capital flowed into the market for European government bonds in search of a safe haven. At minus 0.403 percent, the yield on the ten-year German government bond on Friday was again below the current ECB deposit rate and only slightly above its record low of Thursday. The French 10-year bond had just reached the yield mark of minus 0.12 percent, Belgian 10-year-olds recently recorded negative interest rates for the first time ever, and the Italian 10-year government bond slipped to a 14-month low of 1.67 percent. The comparatively high yield on Italo bonds is, by the way, the reason why it is precisely the crisis-ridden commercial banks that still stock up on such riskier securities.

Asia is holding back

In view of the lack of impetus from Wall Street, investors in Asia had also held back and turnover was quite thin. In Tokyo, the Nikkei 225 climbed by a moderate 0.2 percent to 21,746.38 points. The Hang Seng lost 0.1 percent to 28,775 points.

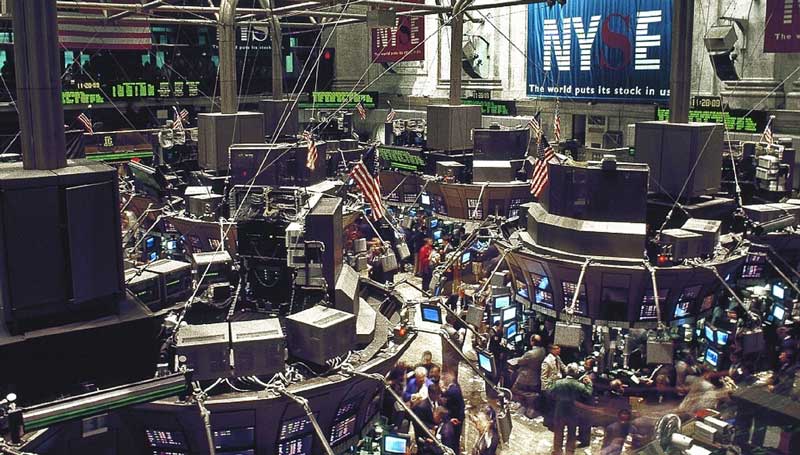

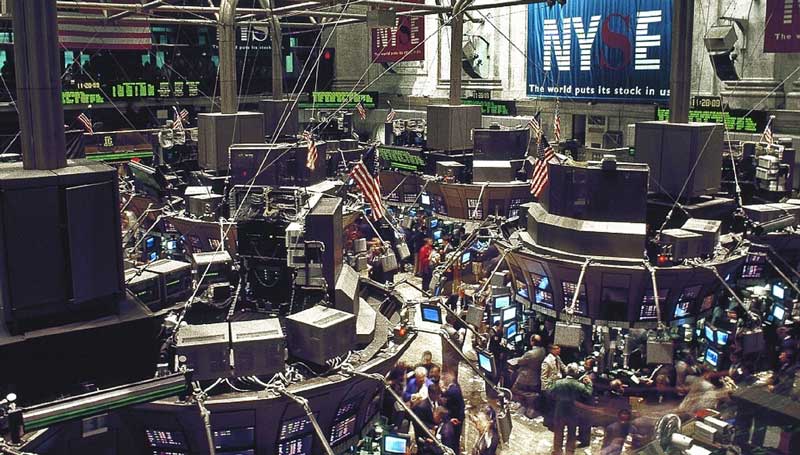

New records in New York

On Wednesday, the U.S. indices had set new records with interest rate fantasies spurred on. Three of the most important indicators stormed the price peak: the Dow Jones Industrial as well as the S&P 500 and the Nasdaq 100. The Dow closed in the shortened trading session before Independence Day 0.7 percent higher on the final record of 26,966 points. The S&P 500 rose by 0.8 percent to 2,996 points. The Nasdaq 100 gained 0.7 percent to 7,858 points.

This is what the day brings

This is what the day brings

This afternoon is the economic high point of the Börsenwoche: The official US labour market report for the month of June will be announced at 2.30 pm. Should the report turn out to be too positive, this should let the air out of investors’ hopes for interest rates. Conversely, if the employment and wages figures were to disappoint moderately, this could fuel expectations of falling key interest rates in the USA and drive stock prices higher.

Otherwise, the calendar is only sparely filled. The Bernstein Bank wishes all CFD traders and investors successful investments in online stock trading!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.