12.05.2020 – Special Report. The Corona crisis is choking the economy worldwide. The Federal Reserve and other central banks are pumping massive amounts of money into the economy. But the real economy staggers from recession to stagflation. The result: a massively pumped-up money supply pours over fewer goods. This threatens Weimar conditions. We will shed light on what this means for investors.

The legend relies on BTC

The loudest warning came last week from investor legend Paul Tudor Jones (PTJ). He founded his hedge fund Tudor Investment Corporation in 1980 and now uses Bitcoin. Which, together with the Halving, gave BTC a boost. PTJ explained that more and more people are coming to appreciate the value of the e-foreign currency, while at the same time confidence in central banks around the world is eroding.

Great Monetary Inflation

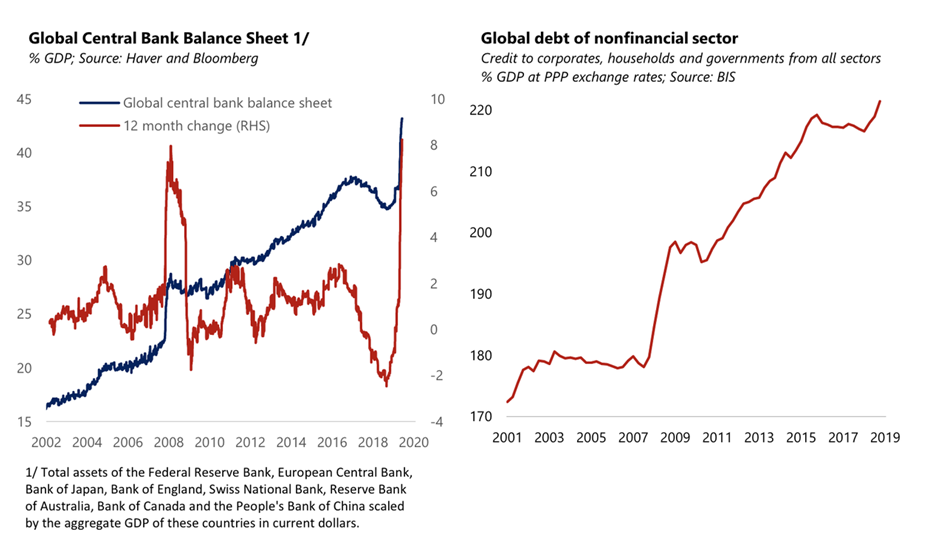

PTJ has listed some good arguments: For example, since February 2020, 3.9 trillion dollars or 6.6 percent of the gross domestic product in the USA have been magically created through quantitative easing. The world is witnessing Great Monetary Inflation – an unprecedented expansion of the money supply. Since February, the Fed’s balance sheet has grown by 60 percent, and by the end of the year it will probably double. And it is not only the USA that is pumping more and more money into the economy: the Bank of Canada has already tripled its balance sheet, and that of the Federal Reserve of Australia has increased by 43 percent. All in all, the debt on the globe is growing massively.

Stagflation ahead

According to the PTJ, there have been only two phases in which M2 monetary growth has exceeded real output over a five-year period: the 1970’s/80’s and the 1940’s. Note from our side: In the first phase, the oil shock stalled productivity and inflation climbed at double-digit rates. In the other, the Second World War was the reason for the decline in production. And this is where the Corona crisis sets in as a massive external shock. The coming decade will resemble the 1970s and bring an era of stagflation, PTJ warned. In other words: high inflation and at best stagnation in the real economy.

The hedge fund manager also argued that the flare-up of the US-China crisis will tear apart global supply chains and ultimately spill over into the prices of goods – wiping out two decades of disinflation triggered by globalization. In other words: If cheap products from China are replaced by US products, prices will rise.

Bitcoin as inflation protection

Because of the global flood of money, PTJ had taken a closer look at the cyber currency for the first time. Bitcoin are deflationary due to their design – the amount is capped at 21 million. And then there is portability – BTCs can be carried on a smartphone. Another argument for BTC is the upcoming digitalization, which has been accelerated by Covid-19.

In short: Bitcoin is a great tool to defend against global monetary inflation. BTC inventor Satoshi Nakamoto had planned the same in one of his early statements: “the root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Gold, Bonds, Stocks

PTJ considers US government bonds and the Nasdaq 100 to be among the top assets in the global inflation race, and gold remains an attractive hedge against Great Monetary Inflation. With the money supply excesses of the 80s as a basis for comparison, the gold price could rise to 6,700 dollars.

The Everything Bubble

And on Saturday the blog ZeroHedge published an interesting essay by a former economist from JPMorgan – but the author wanted to remain anonymous. Under the less confident title “The everything bubble” the author first looked back on the previous financial crisis: Since 2009, the ultra-loose monetary policy coupled with an increasing macroeconomic supply had led to deflationary tendencies and higher asset prices. In addition, investors were chasing yields at ever higher risk. The result: all-time highs in almost all asset classes before the current bear market began. Monetary policy had learned nothing from this. The question now is how to support systemically important banks, reduce unemployment and prevent riots.

Hyper-Inflation a la Weimar

The only remaining means of the central banks is to print more and more money and create new debts. Then there would soon be an inflation like in the Weimar Republic. This is because global output is stagnating or falling; overall economic demand is falling. And the money supply would rise massively, which would initially support asset prices. Soon, however, energy companies, the retail sector and banks are also likely to experience massive bankruptcies. So even more printed money. So it is only a matter of time before inflation gets out of control.

New selloff at the door

The latest stock market recovery since March is a short-term affair, he said. Nothing has improved – only the emergency liquidity of the central banks. The conclusion of Anonymus: “Expect a new selloff by year end – re-testing the lows of March – because perfidiously the Fed does not yet own enough corporate debt/equity to control asset prices!

The unfortunately not very concrete advice to investors: „Look for uncorrelated asset classes or inflation resistant assets. There is a chance central banks will own a good part of cross-sector corporate debt/equity when the dust settles, and inflation starts to go through the roof. “

In other words: a new crisis with a wave of bankruptcies, sell-off on the stock market, another rescue with central bank money, and inflation to take off. The protection: inflation-resistant assets, corporate bonds and those shares that the central banks could soon buy.

The Bernstein Bank wishes successful trades!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.