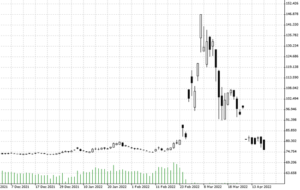

19.04.2022 – The Russian Central Bank has managed to stabilize the ruble – the currency is trading at its pre-Ukraine invasion level. However, it is unclear how long this feat will last. In any case, the central bank has now warned of the consequences of the war with unusual frankness. We explain what this could mean for traders and investors.

Almost simultaneously with the start of the Russian large-scale offensive in eastern Ukraine and parallel to the euphemistic statements of President Vladimir Putin that the Western economic “blitzkrieg” has been ineffective, the Russian central bank warned of harsh consequences. The situation is obviously serious: We suspect that the ruble will soon become a real short investment again.

Source: Bernstein Bank GmbH

For we are hearing unusually open and honest words from Moscow: The head of the Russian central bank, Elvira Nabiullina, made it clear yesterday, Easter Monday, that the sanctions imposed by the West are having an effect. In an address to the Duma, she stressed that the period during which Russia could live off its reserves would be limited.

Burned reserves

By way of background, Russia cannot use about half of its $640 billion in foreign exchange reserves because they are frozen in the West. The question is how many dollars and euros have already been burned as Moscow sold foreign currency to prop up the ruble. According to Bloomberg, Russia currently holds mostly yuan and gold. Presumably, Beijing will continue to step in with swaps for a while: China sells Russia dollars for yuan – making the Chinese currency interesting on the long side. Moscow then sells these Chinese dollars and uses them to buy rubles to stabilize the domestic currency. But even these reserves are finite.

The head of the central bank did not give the all-clear for inflation: The target of 4 percent inflation will probably not be reached until 2024. Inflation is currently at 17.5 percent, the highest level in more than two decades. So far, Western sanctions have only affected the financial market. This is now changing – the Russian real economy is suffering, Nabiullina added.

Blow to the economy

Fittingly, a warning arrived from Moscow Mayor Sergei Sobyanin: “According to our estimates, about 200,000 people are at risk of losing their jobs,” he said on his website Monday. To cushion the impact of unemployment, he said, authorities last week approved an aid program worth the equivalent of 38 million euros. So it’s going to be expensive.

And the toughest stage of all sanctions – a total boycott of coal, gas and oil by the West – has not even been reached yet. That could soon be the case if Russia escalates its barbaric war against civilians in Ukraine as well. Already, the World Bank has warned that the Russian economy will shrink by 11.2 percent this year. Although the interest rate hike has stabilized the ruble, it has stifled the economy by making new loans more expensive. In response to the sanctions, the Russian central bank initially more than doubled its key interest rate to 20 percent, but then lowered it again to 17 percent.

There is little to be said for the ruble

Moscow will probably have to print new rubles, which is likely to sink it again. Undoubtedly, the economic boycott that has begun in the West will also further weaken the ruble from a real economic perspective: Companies closing their local branches previously had to exchange dollars or euros for rubles to pay their Russian employees or keep their factories running. Now almost all Westerners are gone. This makes the ruble less in demand.

The conclusion from all this is that we do not see any supportive bullish factors for the ruble at the moment. These are likely to occur only when trade relations normalize after the war ends. Or, miraculously, new players emerge to supply fresh dollars to Moscow. If neither occurs, it is only a matter of time before the ruble plumbs new lows. Bernstein Bank wishes you good luck with your trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7