02.06.2020 – Special Report. Instead of the feared bang, there was only one plop: the White House has imposed rather moderate sanctions on China. The stock market is celebrating. But what is not, can still be. Since Beijing has so far failed to meet its obligations under the customs agreement and is apparently counting on Donald Trump being voted out of office in the wake of the unrest, it is only a matter of time before the trade deal officially bursts. The grande finale of the trade war – or even a real war with China – could soon shake the stock market.

The trade deal is clinically dead

Highly interesting times in America and on Wall Street: Wall Street has so far let the riots in the USA roll off its back and has also ticked off China news from the commodity market with a shrug of the shoulders. Although Chinese buyers Cofco and Sinograin have been instructed by Beijing to partially cancel purchases of soya and pork in the USA. Instead, the companies are now buying in Brazil. A direct return to the rather soft American sanctions shortly before. And above all a Chinese declaration of war – the trade deal is probably dead. After all, China had committed itself to buying more American agricultural goods. Trump has not yet reacted.

Maximum escalation avoided

Previously, the US President had in principle left the trade deal with the Middle Kingdom intact – and he had only revoked special treatment for Hong Kong after Beijing extended its security laws to the former British crown colony. There are also restrictions on Chinese working and studying in the US. Trump has therefore – for the time being – refrained from any “nuclear option” against China, such as excluding Chinese banks from the dollar clearing system. As a result, the soft reaction of the Americans to the Chinese tricks on Monday led to several small rallies in the Asian markets.

Problems for the stock market postponed for the time being

Unfortunately, the danger of a new round in the trade dispute has not been finally averted. Garfield Reynolds, Bloomberg’s commentator on macroeconomics, said, “complexity is causing global investors to underprice the danger from U.S.-China confrontations over Hong Kong. “Far from being just a regional issue, the world’s two largest economies are sliding toward a more markets-negative showdown than anything we saw in the first three years of Donald Trump’s presidency.” So an ultimate showdown in bilateral trade may yet be to come.

And Goldman Sachs commented that if Trump decides that China has not met its obligations under the Phase 1 deal – which Beijing definitely has not – he could immediately raise some tariffs back to 15%. We think: Which could throw the stock market back into turmoil, as it has done every time we have had a negative comment on the trade dispute a few months ago.

The China trump is played before the election

We suspect that Trump will only pull this China bashing joker just before the election – he will once again rub all Americans in the face with the fact that the People’s Republic alone is responsible for the stalling of the US economy with its cover-ups in the Corona crisis and its breach of promise in the trade deal. And the US farmers in particular will be furious if China does not buy American products, as it once promised. The attack on China should benefit the Republicans. For the Democrats and their surrogates in the media – from CNN to the Washington Post or Twitter – are conspicuously holding back on criticism of Beijing.

Whom does the unrest hurt?

China currently seems to be very sure of its case – and is probably hoping for Trump to be voted out in November. The Chinese seem to be watching the riots throughout the country very closely. They are encouraged by the unbearable declarations of solidarity by the Democrats and the cultural chic in Hollywood for the antifa, sorry: Neo-Fa. If the Maoists are not mistaken: Outside the elites and universities, there is little support in the USA for the Red SA, which has captured the protests in many places. Especially not in the middle class – whoever has a house and a family is prepared to defend his property against the mob. A quick look at arms sales proves this. How socially just is it, moreover, when small self-employed people see their shop go up in flames? What does that have to do with police violence?

Anyone who thinks about it will also notice that the Riots rage above all in cities that have been ruled by democrats – sometimes for generations. Can’t or don’t they want to stop the plundering? Los Angeles, Minneapolis, Fayetteville, Atlanta, New York, Nashville, Seattle, Portland, Philadelphia, Chicago, Milwaukee, Salt Lake City, Washington DC, Detroit, Indianapolis, San Francisco, Kansas City, Houston, Charlotte, Cleveland, Pittsburgh, Denver, Dallas, Phoenix, Tampa, Baltimore, Oakland, Louisville. By the way, among them are the cities with the highest crime rates.

The consequences for the stock market

And here are the conclusions from all this for investors: If the unrest is quickly contained, Trump is likely to secure the applause of the silent majority. And the stock market.

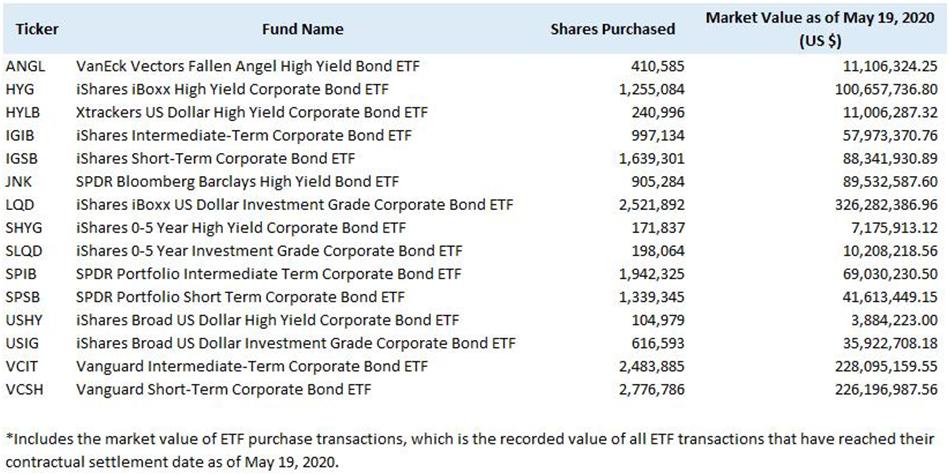

In addition, he could reserve the right to impose major sanctions on China until shortly before the election and let the stock market run to or above its old highs for the time being. In the event of a new conflict with China, however, stock prices are likely to drop in a frightened manner for the time being. If Trump does not react at all, Wall Street will be pleased that there will be no new trade war for the time being. The Federal Reserve’s air money is supporting the market. As we have just learned, the Fed has bought into a number of large index funds, which is supporting the stock market. The masses of bailout money are pushing prices up.

The danger of the second wave

However, there is a danger for the financial market: The unrest in the USA may have triggered a new wave of corona. Manolo Falco, the co-head of investment banking at Citigroup, had already warned in an interview with the “Financial Times” that the financial market was “way ahead of reality”. He instructed his corporate clients to collect as much money as possible before the true cost of the pandemic became apparent. Falco added, “as the second quarter comes along and we start seeing the pain, and the collateral effects of that, we think this is going to be much tougher than it looks.”

The next Black Swan

That leaves another bearis factor. What nobody in this country has on the radar screen could be the next Black Swan: A Red Chinese invasion of Taiwan. Beijing might be tempted to believe that the unrest in the US has weakened Trump to the point where he can no longer respond. In fact, Communist Secretary General and President Xi Jinping, at the recent National People’s Congress, called on the army to prepare for war. In addition, media reports plus photos showing the People’s Liberation Army in Zhurihe training to storm a 1:1 model of the Chinese presidential palace have recently been circulating. Needless to say, an invasion would send stock market prices worldwide down and oil prices up north.

The Bernstein-Bank keeps an eye on the matter for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.