20.05.2020 – Special Report. Gold’s little brother wants to know: Silver has shown an impressive catch-up in the past weeks. The journey is possibly far from over. Some believe that silver is cheaper than gold as it has not been for 3,000 years – and therefore still has some upside potential. We shed some light on the background.

Corona shock recessed silver

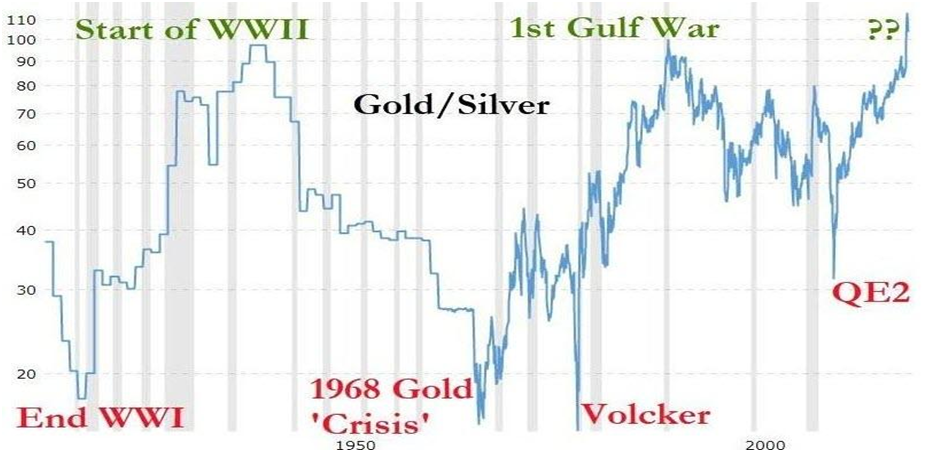

In the wake of the Corona crisis silver had dropped to an eleven year low in mid-March at $ 11.62 an ounce. Quite unlike the yellow precious metal, which had proved to be enormously robust as a hedge during the crisis. Ergo, according to the “Financial Times” (FT), in March the ratio of gold to silver in high rose to 125 times. A rather unusual decoupling. The gap is still enormously large, although silver recently made a small rally to $ 17.50 an ounce. A glance at the chart of SchiffGold.com illustrates the catch-up: gold now costs “only” 100 times as much as silver.

Cheap compared to gold

But historically, silver is still cheaper than gold at its lowest price in about 300 years – the FT referred to data from gold trader veteran Ross Norman dating back to 1697 for this review. And the blog SovereignMan looked even further back: writing tablets from Babylonia at the time of Nebuchadnezzar – around 1,200 B.C. – showed a ratio of 10 to 1, meaning that five shekels of silver cost half a shekel of gold.

But let’s stay in the modern age. SovereignMan argued that the typical exchange rate is 50 to 80 to 1, but silver has also been far more expensive in the recent past – in the 1920s and 1950s with a ratio below 20.

Way clear for a race to catch up

Now it should only be a matter of time before investors start to catch up. Analysts from Bank of America put the price target for silver for the next 12 months at $20. The FT quoted fund manager Grant Beasley of Highbury Capital in Toronto: According to the FT, over time more and more investors would jump on the rolling silver train, including, in the end, retail investors. They have already smelled a rat anyway: According to the lobby report World Silver Survey, silver coin sales rose by 13 percent to 97.9 million ounces by the end of 2019.

In the slipstream of gold

And if silver really does follow gold, then a buying frenzy could definitely be imminent: According to the World Gold Council, gold reserves in index funds rose seven times in the first quarter to a record 3,185 tons in March. Indeed, according to the website SchiffGold, silver has outperformed the yellow metal in a bull market. Investor Peter Schiff said literally: “If we’re going to go to a new high in gold, if gold is going to take out $1,900, which I believe it is, silver should outperform.

Rotating printing press

The general arguments of SchiffGold for silver are understandable: The Federal Reserve is printing trillions of dollars to support the economy with air money. Last week, the Fed’s balance sheet swollen by a further 212.8 billion dollars to an incredible 6.93 trillion dollars. The money supply had increased by 198.6 billion dollars. Ian Williams, Chairman of the Charteris Treasury Portfolio Managers Fund, also spoke to the FT, saying that silver is an inflation hedge just like gold. In fact, according to the paper, in a 440 per cent rally during the financial crisis in 2008, silver rose to $48.44 an ounce in 2011.

Buy investment funds

Moreover, according to SchiffGold, investment demand had already risen before Corona. Last year the silver holdings of professional investors jumped by 12 per cent to 186.1 million ounces – the largest increase since 2015. According to the FT, Exchange Traded Funds recently held the record level of 675 million ounces. At the same time, the output of the silver mines has continuously decreased in recent years, SchiffGold continued to judge. Last year production was down for the fourth time in a row, specifically minus 1.3 per cent to 836.5 million ounces.

Bulls factor Industry

According to SchiffGold, silver has historically been more volatile than gold, as half of the demand comes from industry. The white metal is used in the electrical industry because of its good conductivity, but also in photovoltaics and as a bacteria killer in the pharmaceutical industry. Important areas of application are specifically solar panels, infrastructure for 5G mobile networks or radar equipment for autonomous cars. In March, Samsung announced the development of a new lithium-ion battery, which had a thin layer of silver-carbon instead of graphite applied to the anode. With all these applications, we would have a bullish factor in the long term: if the industry picks up again after Corona, demand should also pick up.

Our conclusion: If you follow the arguments of the experts, you should go long with silver. And see the white metal as an alternative to gold. The Bernstein Bank wishes successful investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.