23.06.2023 – Looking at monetary policy helps enormously in trading. The Bank of England (BOE) has just confirmed this truism once again: It has raised interest rates surprisingly sharply because of the harsh inflation. Thus, the gap to zero-interest currencies such as the yen continues to grow.

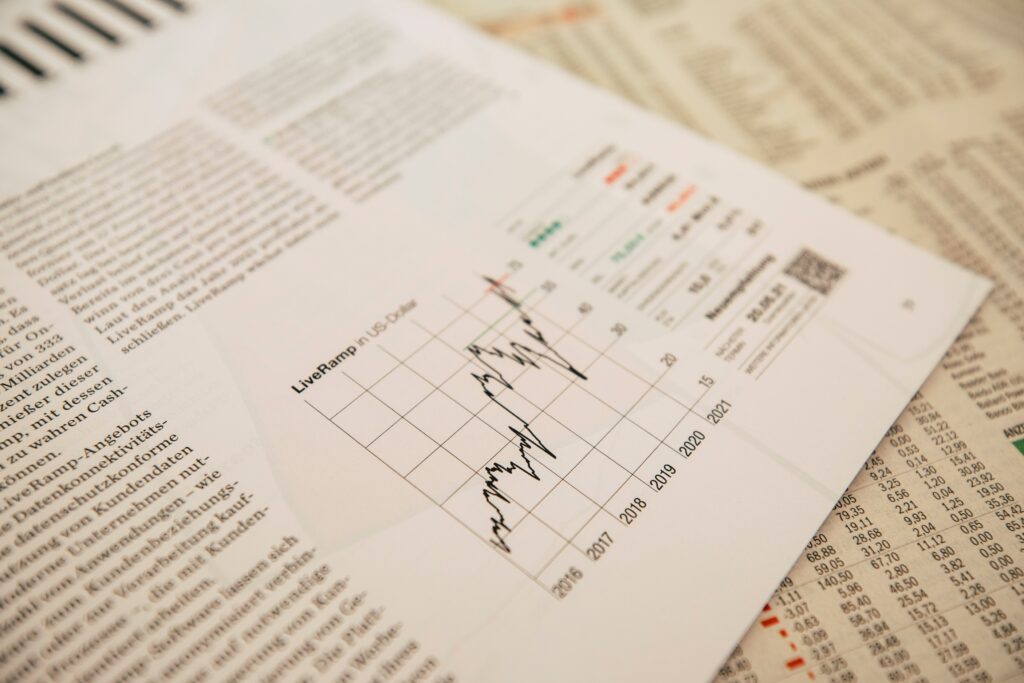

Last week, we had already pointed out the Bank of Japan’s departure from monetary policy. And now this special path has slipped back into consciousness. For the Bank of England raised its key interest rate yesterday, which increases the attractiveness of sterling against the yen. An end to the uptrend does not seem to be in sight at the moment, here is the daily chart of GBPJPY.

Source: Bernstein Bank GmbH

On the details, the BOE raised the interest rate by 0.5 percentage points to 5.0 percent. The market had expected the 13th consecutive hike, although not by this amount. The Monetary Policy Committee voted 7-2, citing inflationary pressures in the UK.

Inflation four times as high as desired

And there may be more to come: In his letter to Chancellor of the Exchequer Jeremy Hunt, BOE Governor Andrew Bailey wrote: “Bringing inflation down is our absolute priority. (…) If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.” The market is now assuming a key interest rate of 6 percent, which would be the highest in more than two decades.

This is because the central bank’s inflation target is 2 percent, but consumer price inflation had been 8.7 percent in May. The core inflation rate marked a 31-year high of 7.1. Sterling should therefore continue to strengthen against the yen. At least until the Nippon raises interest rates. Or until Britain lowers interest rates again. So far, however, the mark sees an easing in September 2024 at the earliest.

Home builders under pressure

For a turnaround in GBYJPY, watch for signals from London of stagflation. This is because the British have a problem in the real estate market: Unlike in Germany, most mortgages have variable interest rates that are based on the prime rate. As a result, many homeowners are currently running out of money in their household coffers, which is likely to choke off domestic consumption.

The high level of government debt could also cause a U-turn in monetary policy: at the end of May, the United Kingdom marked a debt ratio of more than 100 percent of gross domestic product (GDP) for the first time in 62 years, the statistics office announced. The debt level amounted to 2.6 trillion pounds, or about 3 trillion euros. We are curious to see what happens next and will keep you posted!

_______________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7