08.02.2023 – Sometimes it’s hard to be a chronicler. Especially when it comes to the Federal Reserve. Yesterday, Jerome Powell, the head of the Federal Reserve, was not expected to give a clear statement during an appearance before the Economic Club of Washington. From the cautious statements and the verbiage of analysts all over the world, however, this picture emerges: The tightening is not over, interest rates could continue to rise. However, things did not turn out as badly as some expected.

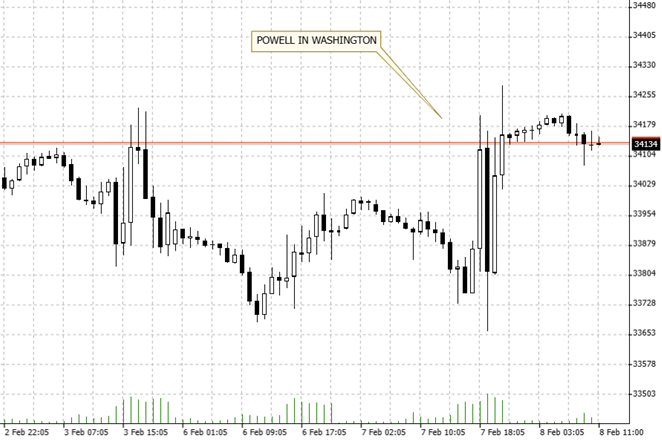

Once again, the market puzzled after word from the central bank. The financial service “Newsquawk” commented that Powell delivered news for both hawks and doves. Thus, he said that the disinflationary process has begun. However, only in the goods sector, which represents just 25 percent of the economy. In addition, he said, the Fed would have to do more if the jobs data indicated overheating or if inflation did not disappear. We add: Still, relief spread that Powell did not drastically correct his soft words of a week ago. Here in the picture the Dow Jones in the hourly chart – at last the hope of the bulls prevailed.

Source: Bernstein Bank GmbH

With regard to Friday’s U.S. labor market report, Powell admitted that he had not expected such a robust situation. In the Q&A session, Powell literally said: “We didn’t expect it to be this strong. (…) It kind of shows you why we think this is a process that will take a significant period of time.” And: the shortage of labor is probably not just temporary, but structural. The unemployment rate in January fell to 3.4 percent – the lowest level since May 1969.

Higher interest rates with a strong jobs market

So the Fed still has a significant path to lower inflation ahead, Powell further explained. He also said the central bank has no plans to abandon its 2 percent inflation target.

Michael Feroli, chief economist at JPMorgan, commented that Powell basically said the same thing he said after the rate decision about a week ago. Disinflation has begun, but the road is still long and more rate hikes are probably needed. Michael Gapen, chief economist at Bank of America, speculated that a continued strong labor market could mean that the federal funds rate could well rise above the rate the market currently expects, which is 5.0 to 5.25 percent. Key interest rates in the U.S. currently range from 4.5 to 4.75 percent. We add: However, many market players believe it won’t get much higher. And that much is already priced in.

It all depends on the data

Powell, by the way, pointed out that he also receives new data only one day before publication. We think: The market should therefore not hope that the Fed will pre-emptively announce what will happen in the long term. In other words, surprises are always possible. The only thing that is clear is that the Fed will react to the incoming economic figures. Powell literally said: “We’re going to react to the data. (…) So if we continue to get, for example, strong labor-market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than has been priced in.” Ergo, it is essential for traders and investors to keep an eye on real-time news. Bernstein Bank wishes you good luck!

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7