22.09.2020 – Special Report. The major indices on Wall Street have just dropped below the 50-day line. Maybe this is just a bear trap. But maybe the worst is yet to come for the bulls. Because a broker now sees the beginning of the worst week of the stock market year. Other factors also call for caution.

Multiple expiration date

Russ Visch of the Bank of Montreal recently encouraged the bears and scared the bulls: “we are in the worst calendar month of the year for equities both here and in the U.S. and it’s not even close. In addition, the week following the September quadruple witching has also been one of the most consistently negative weeks of the year with the S&P 500 closing lower nearly 80% of the time over the past 30 years.”

That’s quite a quota: In almost 80 percent of the cases the stock market made losses in the past 30 years after the quadruple expiration date. In fact, futures and options on stock indices expired last Friday, as did stock options and futures on individual stocks. This coven only takes place four times a year.

These are the important levels

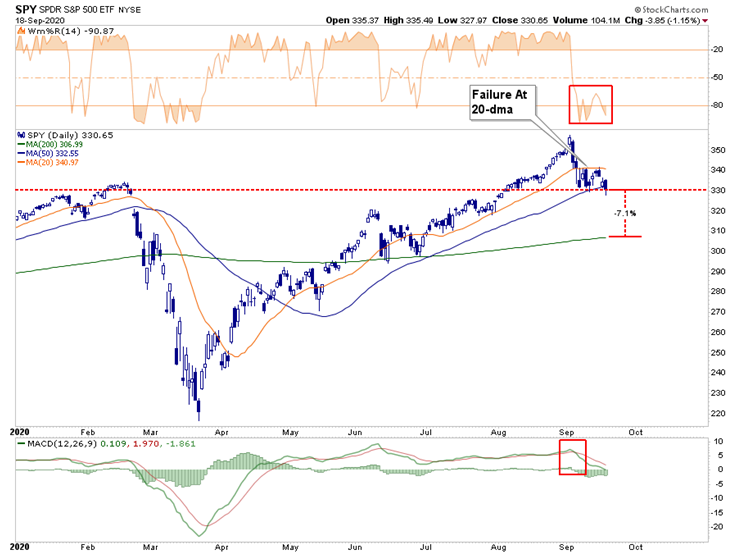

Visch said in early trading on Friday that the momentum was still negative. Should the S&P 500 close below the mid-September low at 3,310, this would open the door for a test of support at 3,233. In fact, the SPX closed at 3,319 and looked to the Nasdaq in the same vein: if support at 10,850 does not hold, a slide to 9,838 is possible. And here the composite fell to 10,793, with only a few mega-caps responsible for the sell-off. And the situation is not bad yet: “the market is letting some “steam” out of the areas that need it the most”. And further: “so far nothing about this pullback has us concerned about the broader, bullish backdrop.”

Morgan Stanley advises caution

Meanwhile, Andrew Sheets, Chief Global Strategist at Morgan Stanley, cited other factors that will continue to have an impact beyond this week, suggesting challenges in September and easier market engagement. In the US, the next stimulus programme, CARES 2.0, is not expected to be adopted until the end of the month. The first presidential debate on 29 September will be the most important milestone before the elections. As far as Corona is concerned, the end of the summer and the possible reopening of schools and universities threaten to increase the number of cases. In addition, the chance of a no deal on Brexit is increasing.

And then there is politics: in view of the death of Ruth Bader Ginsburg, judge in the Supreme Court, Morgan Stanley’s overall verdict was: “holding lighter exposure is prudent, and that investors will get a better opportunity in the near future to be more aggressive. We have just covered the issue in our own special report – if the Supreme Court seat is not filled for the election, the Supreme Court is threatened with a 4:4 stalemate. And then there is no quick decision on possible election challenges, which are as certain as the Amen in the Church because of the postal vote. Then the decision of a lower court will remain, which in many states will probably be a lengthy recount. The absolute disaster for politics, business and Wall Street.

Pre-Election-Correction

Lance Roberts of RealInvestmentadvice.com also frowned at politics. But only a little. The break of the 50-day line in the SPX is now pushing the 200-day line into focus. We had also announced this to you some time ago. However, according to Roberts, the market is already quite oversold, so that a “bounce” in the next few days is very likely. A small correction on the stock market in September and October before a presidential election is also normal.

The professionals have sold

There is also another interesting warning signal. As Bloomberg explained, the ultra-rich have recently sold many stocks into weak hands. Which would also explain the ongoing setback. In the week leading up to 11 September, insiders sold $473 million worth of shares and bought only $9.5 million. Heinz Hermann Thiele of Knorr-Bremse AG, for example, had sold shares for around 1.2 billion dollars. Mitchell and Steven Rales of the Fortive Corporation collected around 1 billion dollars.

We believe that the stock market will probably not pick up speed again until the strong hands reach out. And that could only happen after the risk factors mentioned above have been clarified. Especially since investors are now no longer betting on the Federal Reserve – their verdict last week was disappointing. The Fed announced a sudden halt in the purchase of corporate bonds and index funds. Furthermore, the US Federal Reserve does not intend to raise key interest rates any more in the next three years. The stock market players wanted more, many had bet on negative interest rates and even more cheap money for Wall Street. But shortly before the US elections, the Fed’s position seems too delicate. The Bernstein Bank wishes successful trades – we will keep an eye on the situation for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.