25.04.2022 – The yen is weaker against the dollar than it has been for 20 years. This is the result of divergent monetary policies: While the U.S. is raising interest rates, Tokyo wants to continue to boost its economy, which has been battered by covid, through exports – and needs a cheap currency to do so. The development has consequences for other assets as well.

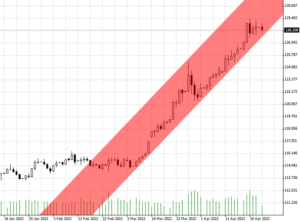

The yen’s plunge is indeed impressive. The financial blog “ZeroHedge” commented that the Bank of Japan is trapped. It is keeping the yield on ten-year government bonds at 0.25 percent, but this means it has to keep pumping trillions of yen into the market, thus weakening the currency. In contrast, the U.S. Federal Reserve has already initiated the interest rate turnaround. Ergo: dollar strong, yen weak. And this has intensified since the hawkish word reports from the Federal Reserve have been piling up. The steep trend in the daily chart means that investors have to take more and more yen in hand to buy a dollar.

Source: Bernstein Bank GmbH

For the “Wall Street Journal”, the development has a signal effect – this could indicate broader “market trouble”. This is because the weaker Japanese currency increases hedging costs for investors in Nippon who hold U.S. assets. Thus, we are likely to see a spillover from the foreign exchange market to Wall Street if large Japanese investors divest from U.S. stocks. Presumably, Friday’s sell-off was a foretaste of this development.

Tokyo wants to intervene

In any case, on Friday, Japanese television station TBS reported that Japan and the U.S. had discussed coordinated intervention to prevent another yen plunge. However, that would weaken the dollar and further fuel U.S. inflation. Reuters reported, citing a source in the Japanese government, that Japanese Finance Minister Shunichi Suzuki described the yen’s plunge as “sharp.” Speaking to reporters in Washington, D.C., the policymaker said he had agreed to communicate closely with U.S. counterpart Janet Yellen.

Washington balks

Apparently, however, the Japanese politician was unable to convince the U.S. Treasury secretary to intervene, commented Daisaku Ueno, chief foreign exchange strategist at Mitsubishi UFJ Morgan Stanley Securities. Specifically, “That’s why Suzuki had little to say about what Yellen told him. Given the U.S. battles with rapid inflation through monetary tightening, it’s unthinkable Washington will agree to Japan’s call for intervention.” Intervention is definitely problematic, commented Masahiro Ichikawa, Chief Market Strategist at Sumitomo Mitsui DS Asset Management.

The conclusion: Either the Japanese central bank abandons its 0.25 percent barrier for Japanese bonds. In which case Japan would have to raise interest rates just like Europe and the US. Or we do see intervention and experience a short squeeze. Or else the yen will fall into a bottomless pit. We’ll keep an eye on things for you – and wish you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7