Gold 1853,925

|

EURUSD 1,1477

|

DJIA 36023,50

|

OIL.WTI 81,555

|

DAX 16052,55

|

|---|

The year-on-year increase in the US consumer price index reached a 31-year high in October. Against this background, the dollar index rose, recovering losses from the previous three trading sessions. What are the prospects for the US currency in light of the lingering price pressure?

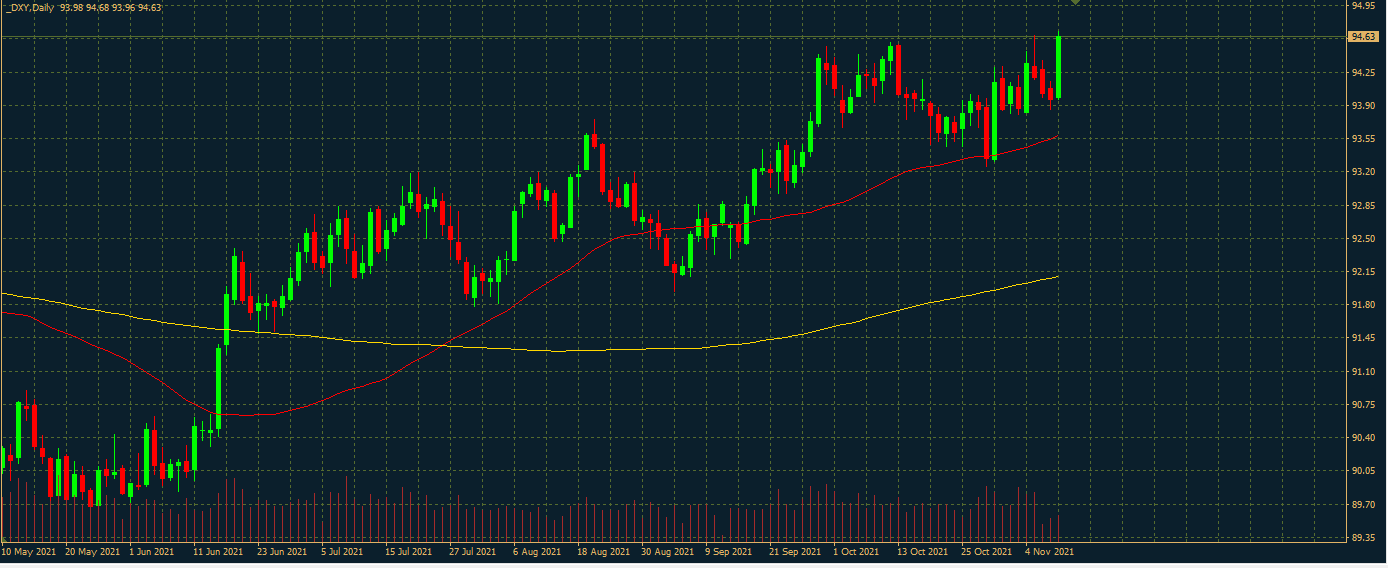

DXY

The monthly increase in consumer prices in October was 0.9%. Year-on-year inflation rose by 6.2%. The Fed’s reassurance that price pressures are about to ease is becoming less and less credible.

Why are prices soaring and why can’t they recover to the expected 2-2.5% as quickly as the central bank would like?

Firstly, because of higher energy and food prices. The former, including petrol prices, are rising because of supply concerns as OPEC+ is in no hurry to expand production yet.

Second, supply chains are still broken and will not recover quickly because of the pandemic. This is the scourge that affects exports and imports everywhere, causing a cascade of consequences. Here, as an illustration, it is appropriate to recall the semiconductor shortage that is affecting the automotive and electronics industries, leading to reduced supply and higher prices.

Thirdly, rising wages contribute to inflation. Employers are facing staff shortages and are raising wages to retain employees. And these costs are passed on to the consumer, raising the price.

This whole picture calls into question the short-term nature of high inflation. This tangle of interconnections cannot be quickly untangled. There is hope that somehow the Fed can help, namely by tightening monetary policy.

At the meeting on 3 November, the US central bank expectedly announced the start of the rollback of quantitative easing. As for the rate hike, Fed Chairman Jerome Powell said that he would be cautious.

The unabated rise in inflation will probably push the FOMC members to speed up. Especially since the labour market situation appears to be improving according to the latest report. This was cited as the main obstacle to a decisive tightening of monetary policy.

Most likely it was the expectation of more decisive action from the Fed that pushed the dollar index to the November highs near 94.6 today. This boundary has not been crossed since September. However, if the price not only penetrates it but also moves higher in the near future, the next target for the USDX will be near 95.6.

01.30 Australian jobs change

08:00 UK Q3 GDP

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.