01.04.2022 – Loud winners in these troubled times. On the one hand, Moscow has successfully stabilised the rouble. On the other, Russia has occupied the Donbass as planned and also the south of Ukraine. However, Kiev is defending itself heroically, the Ukrainian army is advancing successfully. We suspect that the really tough battle is just beginning – with consequences for the financial market.

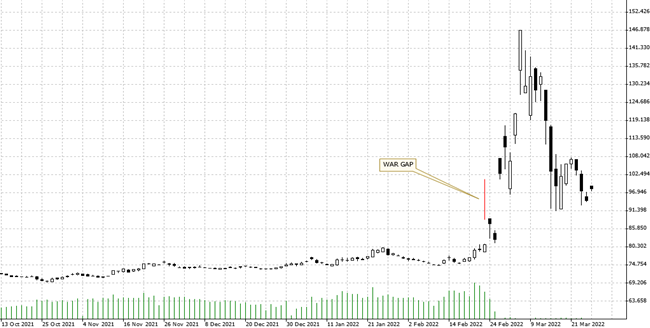

Success for the Russian central bank: The rouble has almost returned to its level before the Russian attack on Ukraine. The USDRUB exchange rate gap at the beginning of the war has almost completely closed again. It is always impressive how reliable the basics of chart analysis are. The back and forth over gas supplies in roubles or euros and dollars will probably continue to determine the fortunes of the Russian currency.

Source: Bernstein Bank GmbH

But all traders and investors need to be extra careful from now on and keep a closer eye on the real-time news. The Russian army is regrouping and the next few weeks are likely to be particularly bloody.

Key date 09 May

For on 09 May Victory Day rises in Russia – a monumental holiday with enormous significance for Russians. By this День Победы (Djen Pabjedi), things must have gone for Vladimir Putin. Whoever witnessed the celebrations in Moscow or Saint-Petersburg is deeply impressed: always brilliant weather – allegedly the Russian air force rains down clouds with chemicals. Children hand balloons and flowers to ancient World War II veterans. Cossack bands, military parade, gratitude and pride.

And this time? If the Kremlin gets its way, then everything will continue as before. But if Vladimir Putin does not manage a victory in Ukraine and thousands of coffins and war veterans return, reporting on incompetence and corruption in the army, the mood in Russia will tip. And then it will be dangerous for Putin.

No danger from the masses

This is what the Moscow Times, for example, believes. The paper states that Putin can rely on 70 percent of the population. The majority of the people are nationalistic, apolitical, ill-informed, hate the West because of years of indoctrination, but have seldom or never been there, especially not in America, at best in Egypt or Turkey. There will be no revolution with these people, this mass follows the television.

Furthermore, there are about 20 per cent who profit from the system, work in internationally active Russian companies and perhaps even own a small flat abroad. There are already a few grumblings here. And in the top 1 to 2 per cent who have become rich in the power apparatus or as decision-makers among the oligarchs, who own a chalet abroad and bank accounts in Switzerland, there is even ferment. These Putin profiteers would have to watch their paradisiacal lives vanish into thin air: their accounts blocked, plus the risk that they and their families would turn into nuclear ash. This is not how they had imagined the deal with Putin. We add: Especially since Putin now also wants to take over their share of around 20 per cent of the gas business – if everything is to be run via Gazprombank or the Russian Central Bank, the oligarchs are left out in the cold.

Possible coup from the elite

Ergo, the “Moscow Times” believes that a coup against Putin will come from within this elite. As with the deposition of Nikita Khrushchev in 1964, the assassination of Tsar Pavel in 1801 and the strange death of Josef Stalin. We explain: intelligence chief Lavrenti Beria simply let Stalin die in 1953 after a stroke – he forbade access for days; Stalin’s personal doctors, who might have been able to save him, had already been arrested anyway in the course of an anti-Semitic purge. What an irony of history: Stalin had planned the deportation of all Soviet Jews to Siberia in the Birobidzhan oblast. Beria saw himself in power and literally celebrated Stalin’s death. Until he himself was eliminated.

So: history teaches that nothing is impossible. Both a brutal Russian victory in Ukraine. Or an escalation with an attack on Poland or the Baltic States. Or even a nuclear war. But also a quick end. And that will be the real day of victory: If Vladimir Putin is removed, the stock markets will explode. Precisely because hardly anyone believes in this option so far. Bernstein Bank is keeping an eye on the situation for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7