19.11.2020 – Special Report. After the positive Corona news from Pfizer, Biontech and Moderna, the joy in the market can hardly be stopped. All the more interesting is the bearish interjection from Masa Son, the CEO of Softbank. At the DealBook Online Summit of the “New York Times” he warned of an imminent “disaster”. The giant white whale Softbank had recently eaten up even high-tech shares.

Fear of the domino effect

The software boss played the cassandra: in the coming months, world markets could collapse due to a second, intensified corona wave. According to Son, even with successful vaccines, this could bring “some major company” to its knees and trigger a domino effect running around the world. It would have to be a single bank – just like in the Lehman crisis. In any case, he himself was prepared for the “worst-case scenario”, explained Son. In this context, the blog ZeroHedge pointed out that the Nasdaq futures have been on hold for almost four months. High-tech stocks are always the forerunners in the euphoria.

Feeding frenzy at Big Tech

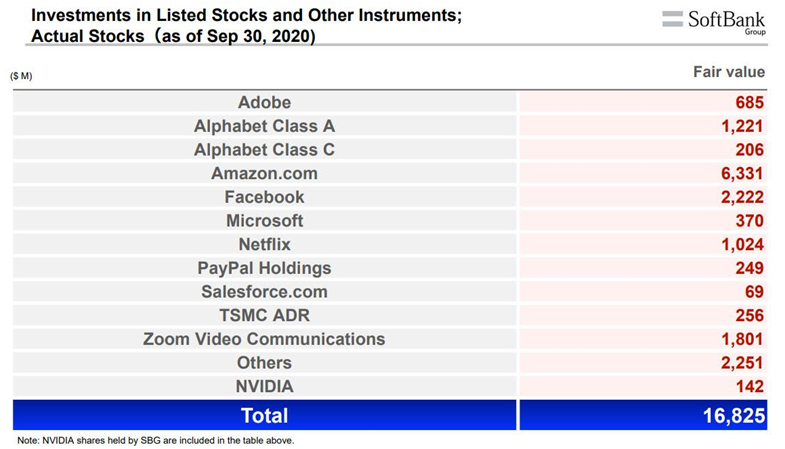

Perhaps Son was particularly pessimistic because his company had been hunting high-tech stocks as a “white whale” in the summer, and had pretty much spoiled his stomach. For example, the investment vehicle Northstar had bought US high-tech stocks worth $17 billion by the end of September. Of these, 6.3 billion were bought by Amazon, 2.2 billion by Facebook, 1.8 billion by Zoom and 1.4 billion by Alphabet. Since then the conglomerate has been sitting on a minus of 3.7 billion dollars.

And with this concentration on tech stocks, we have a potentially explosive mix with the current (monetary) political and medical situation. The porftolio of the soft bank also allows cross-links to the overall market.

Bet on Biden

From a political point of view, the Softbank investment was a bet on the victory of Joe Biden. After all, the high-tech companies in Silicon Valley gave the Democrats massive support. As “Breitbart News” reported, citing the media company Advertising Analytics, a lobby group called “Future Forward” donated a whopping $100 million to the Democrats’ TV spots in the final spurt of the election. According to the report, Facebook co-founder Dustin Moskovitz contributed around 22 million. Former Google CEO Eric Schmidt donated 2.5 million dollars, as the “New York Times” also reported. Crypto trader Sam Bankman-Fried donated 5 million dollars, former Twitter CEO Evan Williams 2.5 million dollars, Netflix boss Reed Hastings 1 million. If Donald Trump finally overturns the election in court, Big Tech is threatened with trouble from this side. Because the Republicans will take revenge.

Vaccination kills special corona sales

The vaccine also makes things dangerous for Big Tech. Almost all of the companies Softbank has bought into are beneficiaries of the lockdown – increased online trading, social contacts almost exclusively via social media, no more cinema or concerts but movies at home, web conferences instead of live meetings, more digitalisation in companies and so on. If a vaccination normalises the situation, the profits of the crisis winners will no longer bubble up as strongly as before.

The return of the fear of interest

And finally, there is the threat of the interest rate side for the high tech sector. If the Federal Reserve comes to the conclusion that the real economy is stabilising, it could reduce quantitative easing or even raise interest rates. And growth stocks always react particularly sensitively to interest rate hikes.

Our conclusion is that the market could soon turn to the other side of the coin when it comes to the corona breakthrough. And then the mood could turn quickly. Especially since the American Association of Individual Investors has just noted that the bull ratio – the ratio of bull to bear on Wall Street – has just risen to an incredible 69 percent. If two thirds of the players are bullish – who should still buy?

From a chart technical point of view the view on the Nasdaq Composite remains: It has recently ripped a gap between around 11,200 and 11,400 that wants to be closed. And if all of this happens, the S&P 500 is also threatened with bad luck if it does: only five FAAMG shares (Facebook, Apple, Amazon, Microsoft, Google – Mother Alphabet) account for around a fifth of the total market capitalisation of the S&P.

The Bernstein Bank is keeping an eye on the matter for you – and wishes you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.