28.05.2020 – Special Report. Wall Street is working its way forward, the DAX is keeping pace. So everything is fine on the stock market. If it wasn’t the issue of China. Specifically, Hong Kong. Even more concrete: The recent slide in the offshore yuan. In fact, a new trade conflict between China and the USA is looming. And Chinese stocks could get caught between the two fronts. And the stock markets in the West could be caught in the middle. Investors should keep a close eye on this issue.

The offshore yuan dives

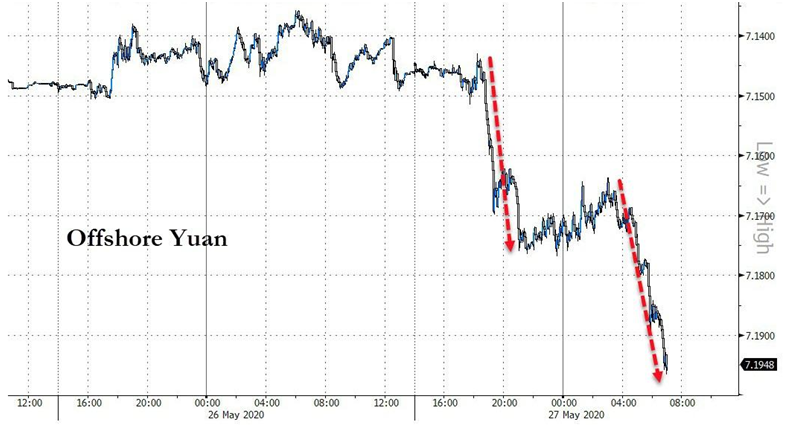

Obviously, a lot is going on behind the scenes. The offshore yuan has just plunged to unpleasant depths – we are at a twelve-year low. Who has sold here and why? In fact, the crash may be the result of a capital flight from China. For Beijing is likely to incorporate Hong Kong quite openly in the near future and end the special status of the former British crown colony. In any case, the announcement to extend national security laws to Hong Kong also has consequences for the financial market.

Hong Kong’s status as a financial centre under threat

President Donald Trump announced measures against China, but did not give details. White House spokeswoman Kayleigh McEnany said the president was “angry” with China’s actions. The question was how Hong Kong could remain a financial centre if Beijing put its controversial Hong Kong plans into practice.

Specifically, a counter-reaction of the administration could look like this: Firstly, Trump could impose punitive tariffs on Chinese products under the U.S. Hong Kong Policy Act of 1992 and restrict access to sensitive technologies. Other means would be export controls and investment restrictions plus entry bans on communist officials. The nuclear option would be to block Chinese banks’ access to the dollar clearing system.

Impending delisting in the USA

Last week, the US Senate passed a bill to limit or even stop the listing of Chinese companies on the Nasdaq. The bill has just been introduced in the House of Representatives. It could cause Chinese shares to disappear from the US stock exchange – unless their annual reports are audited by US regulators.

From the rain into the eaves

Nervousness is now growing among Chinese companies. Two of China’s most valuable megacaps listed on the US stock exchange now want to secure access to capital with a second IPO in Hong Kong. The company in question is NetEase, an online games provider. And JD.com, which operates an e-commerce website. According to the “Wall Street Journal”, the examination for listing on the Hong Kong Stock Exchange has just begun. The success of the two secondary listings should therefore point the way for Chinese shares. It is possible that Chinese companies banned from the US stock exchange could escape the wrath of the Americans – but they could also run straight into the clutches of the Chinese supervisory authorities.

Trade War Revisited

Not a nice choice, then – so better get out of the Chinese market and out of Chinese assets. Which would explain the crash of the offshore yuan. And with that we would have the next problem: Such a cheap renminbi should soon bring the hawks in Washington back on the scene. Because a weak yuan makes Chinese exports cheaper, for America the 7.00 was always the red line. By the way, 7.20 was the low point in the trade dispute.

A clear line in the USA

To all this is added the anger in America over Corona. China has most likely lied to the world about Covid-19 and covered up the origins of the virus. Trump never tires of branding China as responsible for Corona during the election campaign – and the Americans think the same.

And that would be the consequences for traders and investors: In a new trade war with Hong Kong variant, first the Hang Seng might get into turbulences. Finally the CSI-300. And then Wall Street. The Yuan should find itself on the short side anyway. That is, if Beijing strikes back and the situation escalates. The Bernstein-Bank keeps an eye on the topic for you – and wishes you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.