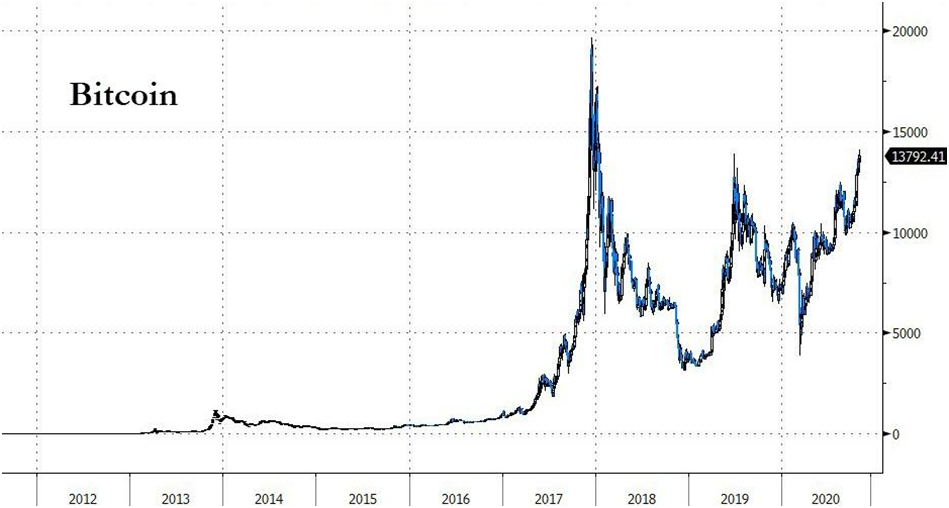

03.10.2020 – Special Report. Happy Birthday, Bitcoin: The e-currency has just celebrated its 12th birthday. And it has developed magnificently since then, with the price peak at just under 20,000 dollars. The past two months in particular have been good for BTC again: the price rose from under 8,000 to around 14,000 dollars at the weekend. Cyber money has some arguments on its side. Politics, for example. But also the gutting of the US dollar. And especially the age of the investors – young people are increasingly turning to cryptos.

Bitcoin in response to Lehman Brothers

Looking back: On 31 October 2008, a certain anonymous author with the pseudonym Satoshi Nakamoto – or perhaps it is a woman or a group, we don’t know – published a thesis paper entitled: Bitcoin: A Peer-to-Peer Electronic Cash System. In it, Nakamoto developed a plan that allowed “online payments to be sent directly from one party to another without going through a financial institution. And these financial institutions had just suffered severe damage to their image: Shortly before, the entire system had been shaken by the collapse of Lehman Brothers. Now scepticism is rising again.

Escape to a safe haven

Driven by the buzz around the US election, many investors have stocked up on crypto-currencies in recent weeks. People do not always trust banks, play it safe and make cash – Wall Street, on the other hand, presented one of the worst October ever before a presidential election. Riots are in the air. In times of crisis, hard assets are in demand: gold, silver, Bitcoin, weapons.

More and more air money

This is compounded by the continuing gutting of the US dollar. Infinite amounts of stimuli are already bubbling up to revive the US economy. Should Joe Biden become president, a prolonged lockdown with even greater government debt than at present is to be expected.

Incidentally, the Federal Reserve is already working on the introduction of a digital dollar, which will bypass the commercial banks as disruptive elements that park government money on their own balance sheets. The Bank of America judged, “the next frontier for central bank revolution is use of digital currencies as conduit for policies such as UBI (universal basic income), MMT (Modern Monetary Theory), student debt forgiveness, to induce sustained rise in inflation expectations. In other words: inflation has to go up, no matter what it costs – unconditional basic income, helicopter money, writing off university loans. The BoA Council: “own inflation assets.” Inflation protection through hard assets. Ergo, investors flee into alternative currencies. Bitcoin, for example.

Gold versus Bitcoin

With the older ones betting on gold and the younger ones on Bitcoin, as JPMorgan just reported. JPMorgan’s quantitative analyst Nick Panigirtzoglou recently pointed to this dichotomy in his report “Flows and Liquidity”: “the older cohorts prefer gold, while the younger cohorts prefer bitcoin as an “alternative” currency. Both gold and bitcoin ETFs have been experiencing strong inflows this year, as both cohorts see the case for an “alternative” currency. Earlier, Charles Schwab had already pointed out that Grayscale Bitcoin Trusts is the fifth largest holding company for future pension payments among the millennials, i.e. children born around the year 2000 or in the years before.

Push from PayPal

The JPMorgan expert also discussed PayPal’s decision to accept Bitcoin in its payment processing. His verdict: This “is another big step towards corporate support for bitcoin, which in our opinion would facilitate and enhance over time Millennials’ usage of bitcoin as an “alternative” currency. PayPal customers can also buy crypto currency directly from the shop. Ethereum (ETH), Bitcoin Cash (BCH) and Litecoin (LTC) are also accepted. PayPal is one of the largest payment processors worldwide with around 346 million active accounts.

JPM: doubling and tripling possible

JPMorgan stated that Bitcoin could increasingly compete with gold because of the upcoming cohorts of young investors in the investment universe. The current market capitalisation of BTC is around US$ 240 billion. This means that the market for Bitcoin would have to increase tenfold to match gold – in coins, bars or ETFs – as the gold market is 2.6 trillion in size. Even a moderate displacement of gold by Bitcoin would be bullish – it would mean “doubling or tripling the bitcoin price from here”.

Millenials are familiar with BTC

Our conclusion: It all sounds great – in fact, there are many arguments in favour of Cryptos. Young people are increasingly opting for electronic payments via apps – they are “digital natives” and are very familiar with smartphones, the Internet and the like. So the increasing digitalisation of business life and the advance of buyers also known as “Generation Y” or “Generation Me” is playing into BTC’s hands. After all, anyone who trusts in the e-wallet when buying sneakers no longer has any reservations about investing with BTC.

Nevertheless, the volatility of Bitcoin could argue against risk-averse investors going into the asset class – even young people are sometimes risk-averse. The question of all questions is also whether the world’s central banks will stand idly by and watch the rise of an uncontrolled parallel currency. That is the greatest danger for e-foreign currencies. The Bernstein Bank is keeping an eye on the matter for you – and wishes you good trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.