10.03.2023 – SVB Financial Group is in urgent need of money. The planned capital increase sent the share price down by around 60 percent. Now there is a risk of contagion: SVB is heavily involved in business with small and medium-sized tech and biotech companies in Silicon Valley. Is there a major crisis going on behind the scenes in these industries? And what about the other banks? The fear is growing. After all, Silvergate Capital, which specializes in cyber currencies, just died.

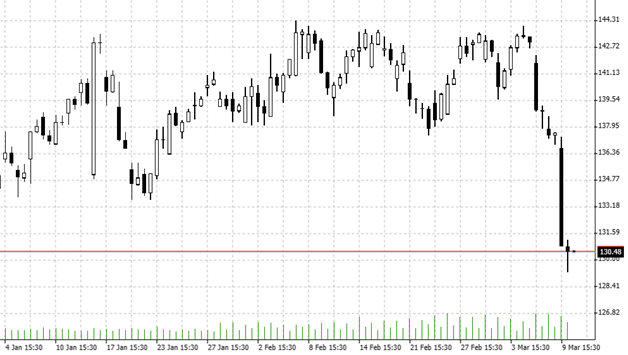

Goldman Sachs commented that hedge funds have launched a short attack on the financial sector. The sector slid the most in about three years yesterday, with the KBW Bank Index losing 7.7 percent, its biggest loss since June 2020. The indicator from investment bank Keefe, Bruyette and Woods measures the performance of 24 bank stocks. Bank of America, Wells Fargo or JPMorgan Chase, for example, lost heavily. You can see JPM’s stock here in the four-hour chart.

This was the trigger for the share price slide: SVB Financial reported a billion-dollar loss for the first quarter. The institution had to sell its $21.5 billion bond portfolio at a loss of $1.8 billion and now needs fresh money. SVB therefore wants a capital injection of $2.25 billion to survive the current cash burn. Group CEO Gregory Becker had to calm customers’ nerves on the phone. But industry giants from the venture capital scene, such as Peter Thiel’s Founders Fund, called for the company to withdraw its own money because of the risk of insolvency. Hedge fund manager Bill Ackman tweeted that Washington needed to think about a bailout to save investors’ money. That sounded a lot like the 2008 financial crisis….

Higher interest rates stop startups

As it stands, higher interest rates are having a drastic impact on the business of growth companies. The tech and biotech companies mentioned above, for example, are often not yet making a profit and are living on credit – as they tighten, they are facing higher borrowing costs, so they are apparently scaling back new borrowing. Which spoils business for banks, but also threatens the existence of high-tech companies; as well as a shakeout in the industries should entail plus layoffs – and for traders short opportunities on the Nasdaq.

And yet another piece of bad news from the financial sector caused jitters: the crisis in the market for digital currencies such as Bitcoin and Ether has finally wiped out Silvergate Capital. The crypto bank announced it would cease operations and initiate its own liquidation. Silvergate Capital’s securities slumped by about a fifth outside the major indices.

What is the Fed doing?

Bullish investors are hoping for easing on the interest rate front: figures just came in for weekly initial jobless claims, a short-term indicator of the jobs market; these had risen surprisingly sharply. This had triggered speculation that the Federal Reserve might not be quite so merciless in its fight against high inflation. Because higher interest rates stifle the economy.

Today is the labor market report for February, if you read these lines, then you may already know more. Analysts are again expecting significant job growth and an unemployment rate at its lowest level in more than 50 years. Wage trends are also likely to be closely watched. If the numbers come in as strong as forecast, the central bank should see no reason to hold back on further rate hikes. However, the Fed will take a close look at developments at the banks. We are curious and will keep you up to date – Bernstein Bank wishes good luck!

____________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7