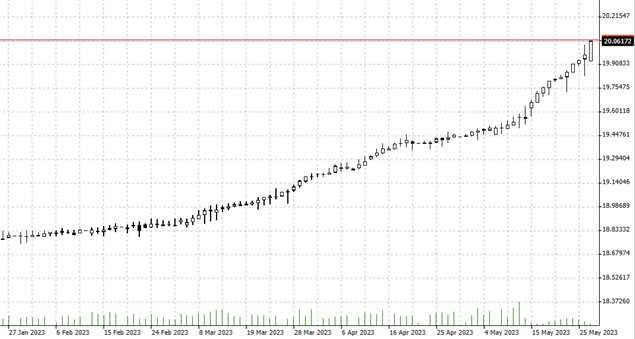

05.06.2023 – The dust is slowly settling at Nvidia. Recently, the company triggered a veritable stampede of bulls: the new mega-trend of artificial intelligence brought the chip and graphics card manufacturer a boom in orders. The stock shot up and set a new daily record on Wall Street with a gain of around 30 percent. Now investors are eagerly eyeing a gigantic price gap.

We brought this note here a long time ago: Mind the Gap. Anyone who rides the subway in London knows the famous announcement: watch out for the gap between the train and the platform. The gap in Nvidia’s daily chart is huge. It could well be that this Artificial Intelligence (AI) Gap will be closed at some point. Probably when some of the high hopes for AI dissipate into thin air.

Source: Bernstein Bank GmbH

For the time being, however, everything still looks rosy. The graphics card specialist exceeded the average expectations of analysts by around 50 percent with its sales forecast. Company CEO Jensen Huang spoke in a conference call of “incredible orders” for upgrading data centers. Nvidia chips and software are increasingly being used for artificial intelligence-based applications.

Smarty-pants from the web

We had already talked about the boom in ChatGPT and co. at this point. The current hype is somewhat reminiscent of the euphoria in the dotcom bubble. Just like the dotcom bubble, the AI boom could burst if a few nasty quirks aren’t fixed. For example, the various smart search engines sometimes spit out abstruse results. A few days ago, a lawyer in New York who had used the ChatGPT search engine made headlines. In his plea, he cited the cases “Petersen v. Iran Air” or “Martinez v. Delta Airlines” – which, however, simply do not exist.

We are also curious to see whether the predictions that entire occupational groups such as speakers, journalists, call center employees or even doctors and even lawyers will become obsolete will come true. Anyone who has taken a closer look at the texts and spoken pieces will understand that the results spat out seem strangely soulless and artificial. Sometimes the cool counselors have to correct themselves. Maybe that will change, maybe never.

Put on the AI?

Whatever the case, Nvidia has virtually become a lodestar for artificial intelligence from here on out. If the glitches pile up or regulation intervenes heavily, the stock could go supernova. Just imagine a doctor making a fatal misdiagnosis based on artificial intelligence. Or, AI continues to boom and competitors get in – pushing Nvidia aside. Then the big price gap magically beckons. Or else, Nvidia continues to zoom upwards as the ring leader. We are curious to see how the exciting topic of AI develops further – Bernstein Bank wishes successful trades and investments!

__________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7