22.03.2023 – It did it again, but only a little. The Federal Reserve has raised key interest rates by 25 basis points. And it did so despite the smoldering banking crisis. The market initially took it positively. But then U.S. Treasury Secretary Janet Yellen stepped up to the microphone in Congress. And gave the shares of small U.S. banks virtually free for the shooting.

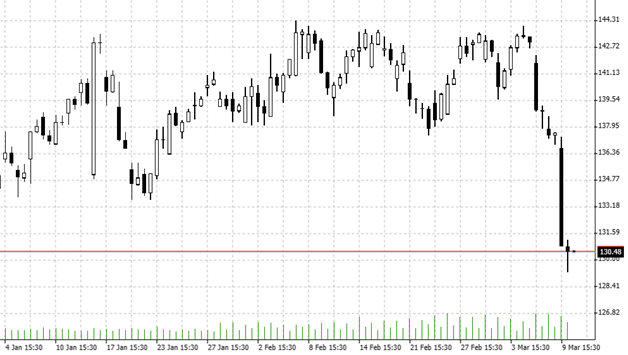

Yesterday, the Fed raised the federal funds rate by 25 basis points to 4.75 to 5.00 percent. So far, so expected. In addition, the earlier statement was cashed, according to which “ongoing increases in the target range will be appropriate.” However, the central bank said that “some additional policy firming may be appropriate. The market initially took it calmly, then it went south. You can see the reaction very nicely in the 30-minute chart of the S&P 500.

Source: Bernstein Bank GmbH

But this time it was not Jerome Powell who scared investors. It was Janet Yellen.

U.S. Treasury Secretary Cuts Rates

Mark Cudmore of the Bloomberg news agency commented that Yellen was “to blame for the stock slump”. He said stock prices dipped a minute after the policymaker began speaking. Specifically, the S&P 500 was up about 1 percent in the first 47 minutes after the Fed decision, he said. And the index was still up 0.6 percent in the first 17 minutes of Jerome Powell’s press conference, he said. But exactly from 2:47 p.m. Eastern time, Yellen had spoken before the U.S. Senate. And in the following 72 minutes, the SPX had slipped by about 2.5 percent.

No guarantee on bank accounts

Bloomberg colleague Mark Cranfield toed the same horn, saying Yellen had refused to provide a guarantee for savers’ deposits without working with parliamentarians. And that, he said, was an invitation to short bank stocks. Specifically, Cranfield judged, “to an aggressive trader this sounds like an invitation to keep shorting bank stocks — at least until the tone changes into broader support and is less focused on specific bank situations.” Cranfield warned that U.S. financial stocks are probably the most vulnerable assets right now.

Starting gun for the new bank run?

US star investor Bill Ackman was even more outspoken, saying that Yellen had de facto fired the starting gun for a new bank run in the small and mid-sized bank sector. Specifically, the head of hedge fund Pershing Square Capital Management tweeted: “This afternoon, @SecYellen walked back yesterday’s implicit support for small banks and depositors, while making it explicit that systemwide deposit guarantees were not being considered. (…) I would be surprised if deposit outflows don’t accelerate effectively immediately.” We add warningly: It is possible that Ackman has long been committed to the short side and now wants to conjure up a crisis.

But the financial blog ZeroHedge also put it bitterly: “the Treasury Secretary, with all the grace of a senile 76-year-old elephant in a China market, uttered the phrase ‘not considering broad increase in deposit insurance.'” Here’s an interesting footnote: JPMorgan estimates that $1.1 trillion in assets have already been withdrawn from customers of vulnerable banks. We’ll be curious to see if the new Big Short kicks in now. And whether the next bank will soon keel over. How good that you can also make money on the short side with CFD. Bernstein Bank wishes traders and investors good luck!

______________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7