06.01.2023 – Sometimes things turn out quite differently than expected. Perhaps also this year on the financial market. Two professionals at the investment firm Blackstone have their thoughts on the matter.

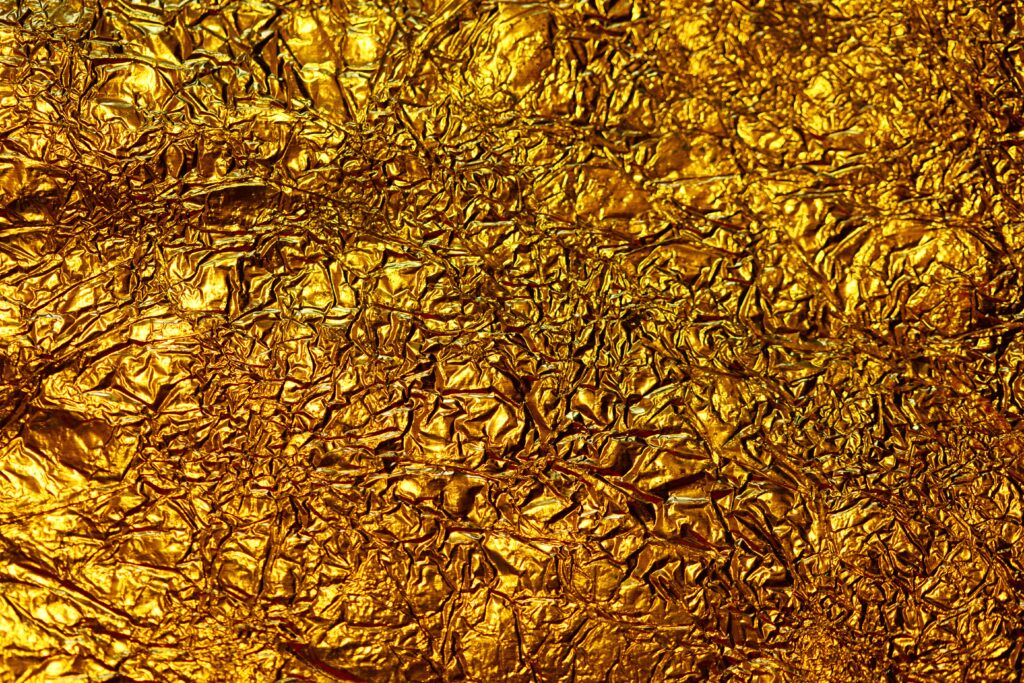

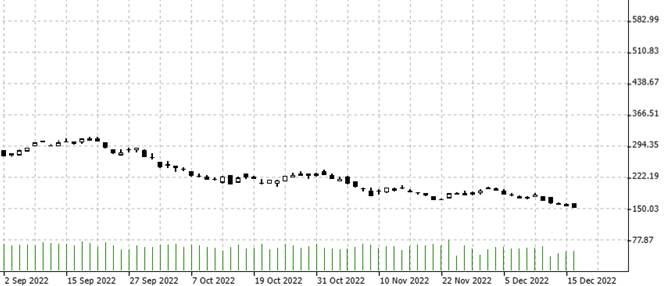

We looked at the predictions of Byron R. Wien, who is the Vice Chairman and Chief Investment Strategist in Private Wealth Solutions at Blackstone. If he’s right, we think the Nasdaq 100 will be in focus again this year, here’s the daily chart.

Source: Bernstein Bank GmbH

Wien started the forecasting tradition in 1986 at Morgan Stanley, when he was chief U.S. investment strategist there. He joined Blackstone in 2009 and has been joined by Joe Zidle on Ten Surprises since 2018. To the extent that Blackstone experts did not comment on the market implications, we said.

1. Several candidates are running for president in both U.S. parties. We think: no impact on the stock market. Unless an extremely radical candidate wins, which is unlikely.

2. the Federal Reserve says goodbye to a “pivot”. In other words: the expected turnaround in interest rates does not come. Real interest rates turn positive again. Impact on the stock market according to our opinion: Bearish. This would be a nasty surprise, especially for high-tech stocks.

The Fed overdoes the tightening and pulls the economy into a mild recession. Result: See point 2).

4. despite all this, the market gets used to the surprise and puts aside the fear. Turning point in the middle of the year – comparable to 2009, says Vienna. We see this as a consequence for investors: Catch-up in beaten-down stocks, especially growth stocks.

5 Modern Monetary Theory is discredited. Our verdict: Too unspecific for a market assessment. What is probably meant is that there is no new government money in crises.

6 The Fed remains more hawkish than other central banks, the dollar holds firmer than other currencies, such as the yen and the euro. As a result, according to Vienna, opportunity for investors with dollar holdings to invest in Japanese and European assets.

7. China is working hard to reach its growth target of 5.5 percent and even harder to repair trade relations with the West. With positive consequences for assets and commodities.

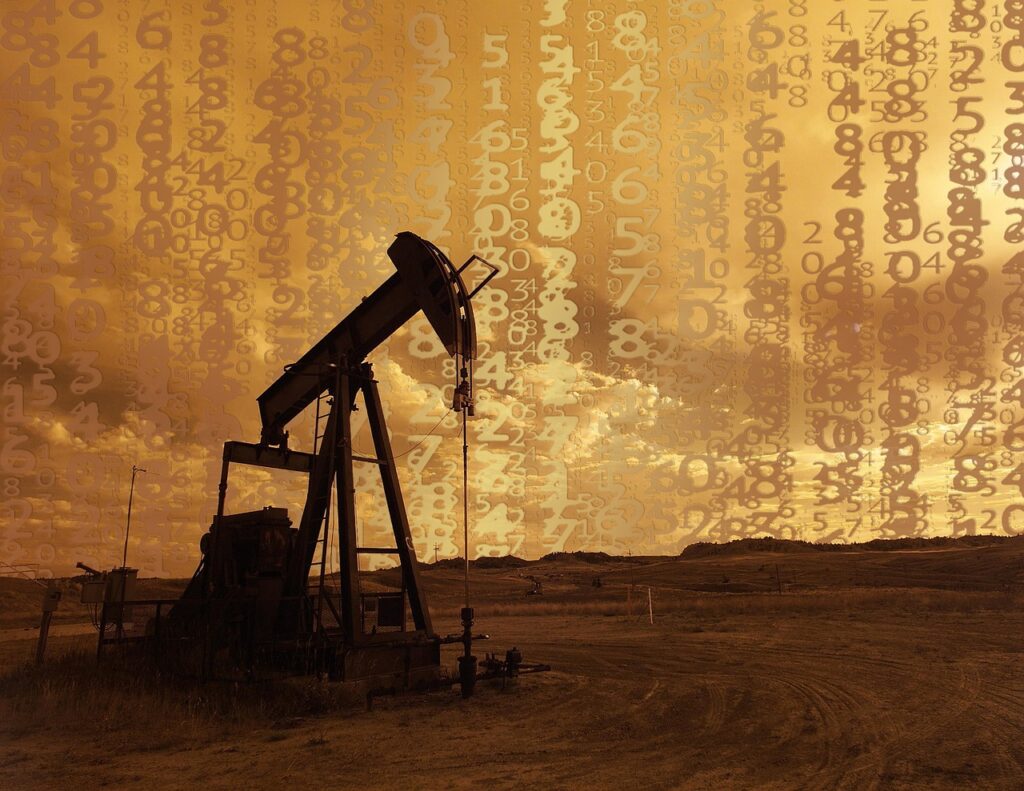

8. the USA becomes not only the largest oil producer, but also the most benevolent supplier. Result according to Blackstone: oil prices fall first in response to a global recession. But also because of increased fracking and higher production in Middle East and Venezuela. West Texas Intermediate slips to $50 a barrel – but could recover to $100 after 2023 as global economy picks up.

9. war in Ukraine rages on through first half of 2023 until attrition forces both sides to negotiate and divide territories. Our 50 Cents: Bullish, breathing a sigh of relief on the stock markets.

10. Elon Musk cleans up Twitter and turns it around by the end of the year. We think: Possible relisting with a potential stock market superstar.

The look back

In fact, their hit rate last year was rather positive. The pros were correct in announcing that rising interest rates were slowing down the S&P 500. And that inflation was stubbornly hanging on. As a result, the U.S. bond market would react with rising yields. Likewise, the augurs had correctly predicted that the world would shrug off the Corona panic. And that most countries would return to nuclear power. 5 correct.

Both were wrong in predicting that China would clean up its broken real estate market. The same applies to the prediction of a 20 percent gold rally. Nor did the radical, top-down turnaround in the USA toward ecologically and ethically correct business practices materialize. 3 Misguided forecasts.

Vienna was partly right in predicting that oil would rise above 100 dollars. Global demand concerns torpedoed this development. The prediction that China would establish itself as an aggressive power in the lithium market was also only partly correct – the People’s Republic is the dominant producer, but so far it has not used its market power for boycotts. 2 times undecided.

So you see, even highly paid professionals are not always right. But often – which you should keep in mind for your trades and investments. Whether long or short – Bernstein Bank wishes you good luck!

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7