28.03.2022 – Rarely have traders and investors been as perplexed as they are now. Has the financial market ticked off the Ukraine war? What about the Federal Reserve and the threat of recession? We let a bear have his say once again – who draws an interesting historical parallel to the Yom Kippur War.

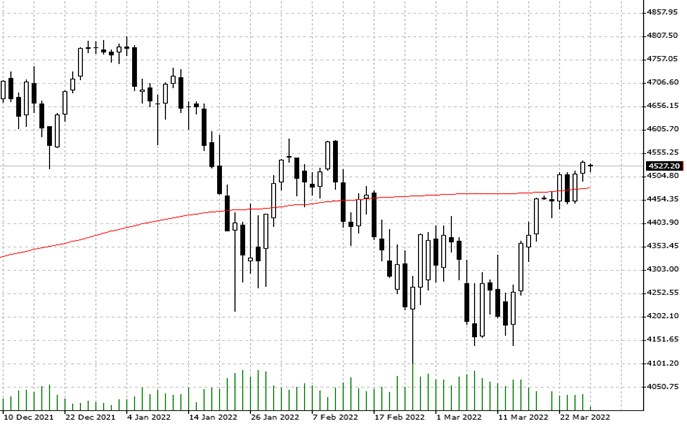

Mark Dittli, editor-in-chief of “The Market NZZ” sheds light on the events for the “Neue Züricher Zeitung” – and is pessimistic. It is quite possible that the S&P 500 will come close to its all-time high of 4800 points, which it reached on 4 January. But the situation is deceptive, this is only a bear market rally. In our picture the SPX in the daily chart with the 200-day line.

Source: Bernstein Bank GmbH

Dittli has two explanations for the upward movement that has been going on since 8 March. On the one hand, a lot of money has flowed from American government bonds into the stock market. In fact, the bond market has really crashed. Since the beginning of March, the yield on ten-year Treasury notes has risen by 76 basis points to 2.49 per cent. The yield on two-year Treasuries shot up by almost 100 basis points to 2.3 per cent. All in all, this is the third worst loss for US bonds in the past hundred years. On the other hand, cover buying had boosted equities. By the way, Goldman Sachs has also just stated a big bear market squeeze and predicted sales on Wall Street because of the upcoming tax deadline in mid-April.

Supply shock like in the Yom Kippur War

This brings us to a look at the history books. Just as in the 1973 Yom Kippur War, the Ukraine war is triggering a supply shock on the energy markets, writes the NZZ. The oil shock at that time also hit the US economy at a time when it was already struggling with rising inflationary pressure and the Federal Reserve had begun to tighten monetary policy. Dittli says: “The effects of the Arab oil embargo drove the US inflation rate to 12% by the end of 1974 and the fed funds rate to almost 13%. As early as December 1973, the US economy fell into a recession that would last until March 1975.” All this sent the S&P 500 down 44 per cent in one year. Remarkable in this context, he said, was a recent study by the Federal Reserve Bank of Dallas comparing today’s energy price shock with the 1970s.

Too much too late

The Fed has just started the cycle of interest rate hikes – but Fed Chairman Jerome Powell has hesitated far too long and now has to turn the monetary policy wheel hard and fight inflation. The financial markets are facing a liquidity withdrawal in the coming months the likes of which they have not seen in decades. A successful soft landing is unlikely. In the almost sixty years since 1965, the Fed has carried out eleven interest rate hike cycles. Eight of these have led to a recession. Only three times – in 1965, 1983 and 1994 – had a “soft landing” been achieved.

Dittli repeated his recommendation to use recovery rallies on the stock markets for sales and to build up the cash position in the portfolio. As always, we advise to keep dissenting voices in mind and to follow the real-time news closely. Bernstein Bank keeps an eye on the situation for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7