Gold 1798,505

|

EURUSD 1,1223

|

DJIA 35303,50

|

OIL.WTI 75,855

|

DAX 15920,45

|

|---|

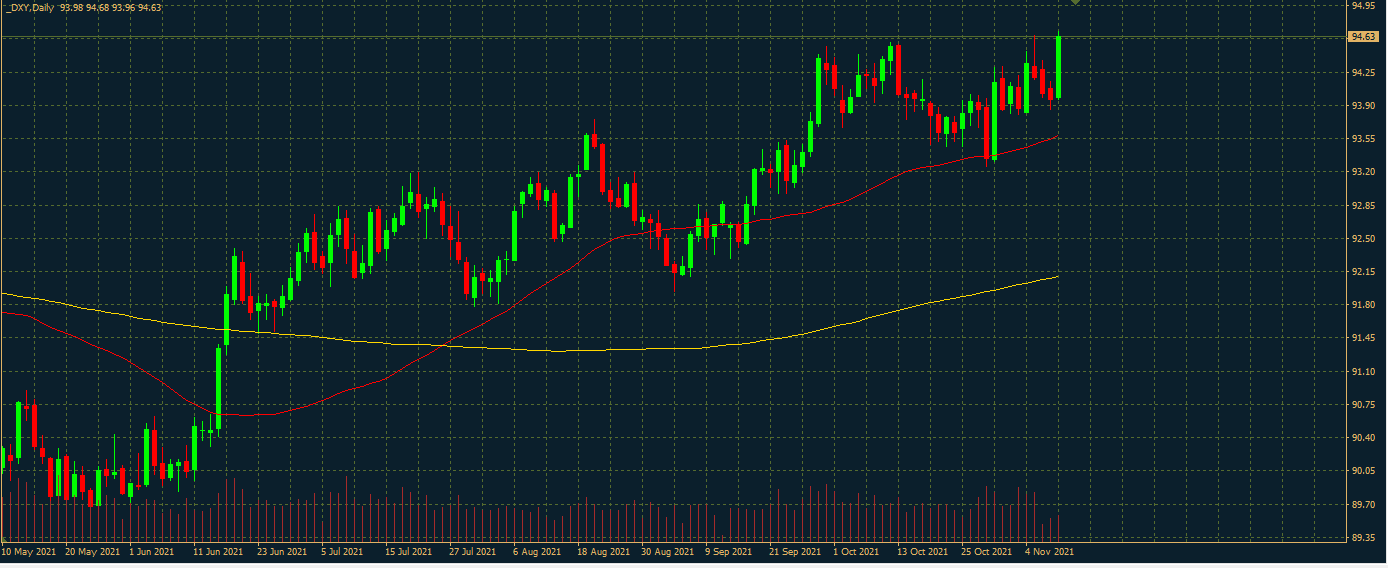

The US dollar rose against a basket of currencies for the fifth week in a row. Another technical target has been reached on the dollar index chart. What is happening on the fundamentals and will the US currency continue to strengthen?

DXY

Wednesday’s trading session was a very busy one for the dollar. On the eve of the long Thanksgiving weekend the US released unemployment claims, an update on Q3 GDP, personal consumption expenditure and FOMC minutes.

All in all, it was a good day! The first thing that shocked the market was the news that during the reporting week the number of jobless claims fell to a 52-year low. There were 199 thousand of applications against 270 thousand a week before and 260 thousand forecasted. And that’s after it exceeded 6 million at the start of the pandemic. As you can see, the labour market is doing quite well.

The GDP data was slightly above the initial estimate, showing a 2.1% growth in the third quarter against the expected 2.2%.

But the most interesting thing was the FOMC minutes. It was clear from the document that the central bankers are prepared to go ahead with an earlier unwinding of quantitative easing. They are also prepared to start raising rates earlier if inflation accelerates and the economic recovery is robust enough.

And what do we see? Economic reports this month are encouraging, inflation is not. The Fed is ready to accelerate. So a rate hike is on the way! In 2022 the market expects three rounds of hikes.

Expectations of an earlier monetary policy tightening were confirmed yesterday. And news of Jerome Powell’s term extension as Fed head gave confidence that the central bank will continue on its intended course.

As a result, the dollar index reached a strong mirror resistance level at 96.90. Technically, the fate of American currency now will depend on the possibility of breakdown and fixing above this boundary.

If we see a true breakdown, the next target for growth will be in the region of 99.00. And it is quite achievable, if expectations of a hawkish position of FRS will remain in the market.

An alternative scenario would be a local correction – a pullback to 95.00, but for now it looks unlikely.

01.30 Australian retail sales for October

09.00 Address by ECB President Christine Lagarde

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.