16.02.2020 – Special Report. BTC is scratching the price of 50,000 dollars. No wonder – three new bullish news items just hit for the e-devise. Apparently the dam is breaking and the posh world of old money is toying with the idea of investing. But at the same time, two bearish news items have also hit the cyber coin. We shed light on the current state of affairs.

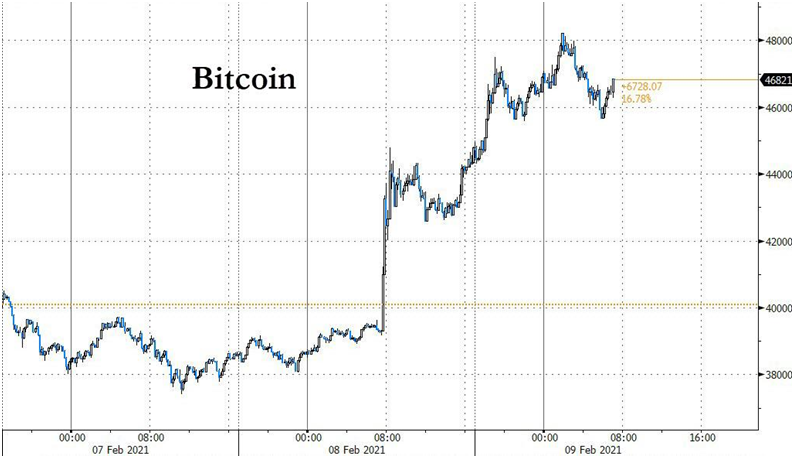

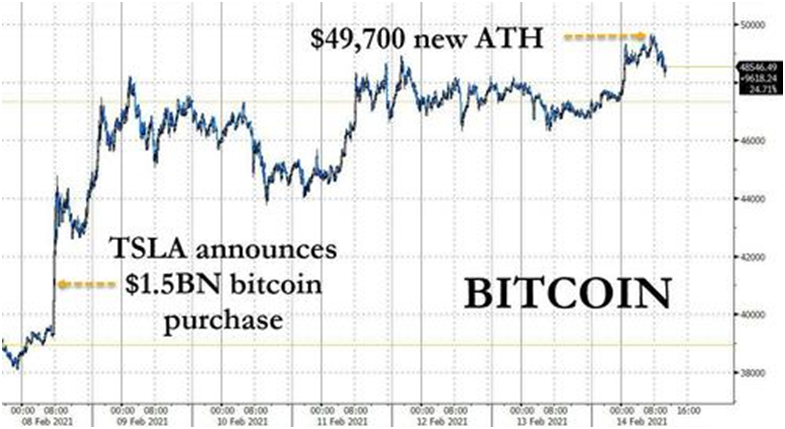

New all-time high

By the time you read these lines, it could be that time: BTC may have already surpassed the round mark of 50,000 dollars. In any case, the e-money just marked an all-time high before a small setback took place. What had happened? Quite simply, three respected Wall Street figures had spoken out in favour of BTC.

U-turn at JPMorgan

On Friday, JPMorgan – until now an enemy of cryptos – officially came out of the closet with the idea of investing. On CNBC, co-president Daniel Pinto said that there was no real demand yet. But: “If over time an asset class develops that is going to be used by different asset managers and investors, we will have to be involved.” If necessary, the investment bank will bow to demand. Four years ago, the head of JPMorgen, Jamie Dimon, had called bitcoin a fraud; he had also said in the meantime that “any trader trading bitcoin would be fired for being stupid. “

Morgan Stanley is also considering

In addition, Bloomberg reported on Saturday, citing well-informed sources, that Counterpoint Global was considering investing in Bitcoin. The investment firm is owned by Morgan Stanley and has $150 billion in assets under management.

Mellon commits to BTC

And last but not least, BTC received a very special accolade last Thursday: According to the Wall Street Journal, the Bank of New York Mellon announced that it would hold, transfer and issue Bitcoin and other cryptos for customers. Shocking: The oldest bank in the USA has declared its commitment to modernity.

Investors see a dam burst

In fact, some investors see a dam breaking because of these developments: “With each major announcement like the one BNY Mellon made, other institutions are spurred to more rapid adoption and deployment of digital assets,” s said Patrick Campos, Chief Strategy Officer at Securrency, in an interview with Bloomberg on Friday. The icebreaker, of course, was Elon Musk. Campos continued: “Tesla’s recent announcement will embolden other large corporates and institutions to accept crypto as not just a worthy asset class, but perhaps even an essential one. More important, is the corresponding build-out of institutional services to support these developments will trigger other digital assets-related developments within those institutions and in the larger ecosystem. ”

We are curious to see whether the herd will now start running. In any case, there is still room for improvement in the fine world of institutional investors: Only just under 3 percent of the market is currently in the hands of financial firms. When these illustrious investors buy, the supply will probably become much tighter, because such addresses usually hold their stocks for quite a long time. Currently, according to CoinTelegraph, only 24 firms hold around 461,000 BTC, which most recently corresponded to a market value of around 22 billion dollars.

Warning shot from India

Ultimately, the usual reference to politics remains as a counter-voice. They don’t like unregulated, uncontrollable e-currency – because taxes are lost through undeclared work, because monetary policy with its devaluation of currencies becomes powerless, because money from corruption and crime disappears into e-space.

A new report from India comes as little surprise: there are growing indications that the Indian parliament will soon pass a ban on crypto trading. Such speculation has been circulating since the end of January. With the planned law called “The Cryptocurrency and Regulation of Official Digital Currency Bill 2021”, the subcontinent would lead the way internationally. The Reserve Bank of India had already banned trading for about two years, but was thwarted by the Supreme Court in March 2020. If the example is followed in other countries, the price of BTC is likely to plummet because panicked traders will have to get out of the asset quickly.

Cyber crime is booming

And there is also a threat of trouble from another side: IT criminals are increasingly targeting investors and their wallets in view of the bull market. The crypto exchange KeepChange just announced an attack. According to the report, cyber thugs tried unsuccessfully to steal Bitcoin funds from users. However, the attackers did steal some data such as names, email addresses and other data.

So you see: The cyber battle between bulls and bears is in full swing. We are keeping an eye on this exciting affair for you – Bernstein Bank wishes you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.