Gold 1853,085

|

EURUSD 1,1655

|

DJIA 26561,50

|

OIL.WTI 39,43

|

DAX 12539,60

|

|---|

The closer the US elections, the more difficult the situation in the financial markets. This election should be the most controversial election in the modern history of the United States, and investors are very concerned about it.

EUR/USD

An interesting situation is emerging in the US Federal Reserve. At different times, the members of the reserve system begin to contradict each other and even to refute statements made by colleagues. Of course, everyone has their own opinion, but not in a structure where the action plan must be shared. Some Fed members believe that the economic recovery has been weak and uneven. It is now clear that the US Federal Reserve will act on the circumstances and may even raise the rate if necessary. There is no specific plan.

Congress has not yet agreed on financial assistance measures for companies. The labour market has been sending signals for a long time that this assistance is absolutely necessary. In this uncertain climate, the hand of the investor will always be next to the “sell” button.

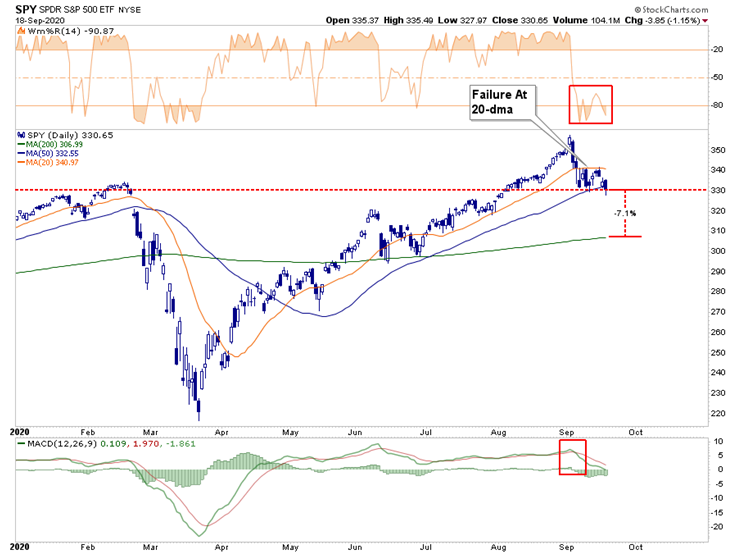

It is likely that stock indices have reached some saturation point and are not going to try to make new highs. Today we are waiting for data on initial state unemployment claims. If they turn out to be at previous levels, we can expect the indices to decline further. On Wednesday, the DAX closed with an increase of 0.39% and the S&P500 falls by 0.8% to 3280.

Euro

On Wednesday, the EUR/USD pair broke through the lower bound of the eight-week trading range of 1.1700. So far the price is very close to this level and the recovery is not ruled out. The situation in Europe is not easier than in the USA. However, the poor state of affairs in the US is on the contrary strengthening the dollar. This can now be clearly seen. We have recently discussed that the ECB has no desire to strengthen the Euro, but there are virtually no options to put it down. Therefore, the current exchange rate situation is more than satisfactory to it.

Oil

WTI oil prices on Wednesday are still under pressure. Although there was an increase during the day to $40 per barrel, there are still quite a few factors on which further developments will depend. The first factor is the coronavirus and the probability of a lockdown, which will inevitably affect the price. The second factor is the resumption of oil supplies from Libya after eight months of civil war. The third factor is the rising US dollar, which is putting pressure on the price. The US oil reserve figures are worse than predicted, which is another reason for sellers.

What awaits us today?

10.00 IFO Business Climate Index in Germany for September

14.30 Number of initial applications for unemployment benefit in the USA

16.00 Sale of new housing in the USA for August

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.